Calculating the true value of Zeek Rewards members

At the time of publication of this article, Zeek Rewards claim on their website that in order to get paid, upon joining Zeek Rewards here’s what you need to do:

At the time of publication of this article, Zeek Rewards claim on their website that in order to get paid, upon joining Zeek Rewards here’s what you need to do:

Here’s How to Get Started:

-Choose your affiliate level

-Enroll a few friends as free customers

-Enroll a few friends as free affiliates

-Sell a few e-commerce suites

-Join the Customer Co-op

-Drive Traffic to Zeekler.com and Earn 20% and one point on every dollar your Zeekler.com customers spend on bids

Or

-Purchase some sample bids to give away to free customers

-Drive traffic by placing ONE FREE AD every day

There’s a strong implication here that upon completion of the above tasks, Zeek Rewards will then qualify you to participate in their daily profit share which in turn pays out a 90 day ROI on any retail bid purchases your customers make, or any VIP (sample) bids you purchase yourself and then give away to customers.

Along with this, much emphasis is made by Zeek Rewards that the daily requirement to place an ad and the acquisition of customers is primarily what their members are getting paid for. That is, with Zeek Rewards being ‘zeekler.com’s paid advertising division‘, that ‘driving traffic’ to Zeekler is what is important and the true value of Zeek Rewards’ members to the company.

Indeed, much has been made of this with Zeek Rewards members consistently referring to this advertising (via the giving away of sample bids and advertising) as being key to the success of both Zeekler and their Zeek Rewards commissions.

But how much value does this really provide to Zeek Rewards and perhaps more importantly, how would you measure this for the sake of comparison and establishing the true worth of Zeek Rewards members?

A good place to start would be the Zeek Rewards compensation plan.

The only main attraction of the Zeek Rewards business opportunity is participation in the daily profit share. In a nutshell, via various acquisition methods Zeek Rewards members acquire VIP points and then earn a 90 day dollar share based on the value of these points.

These points expire over a 90 day rolling period and need to be continually replaced with new points, otherwise overall point balances go into decline.

The money that makes up the profit share allegedly comes from a number of sources but primarily Zeek Rewards claim that it’s pegged to the success of Zeekler, which is why the profit share revolves around the promotion of Zeekler.

So lets start by analysing the relationship between Zeekler and the listed suggestions from Zeek Rewards to new members.

-Choose your affiliate level

Prior to some changes made earlier this year by Zeek Rewards, the level an affiliate joined Zeek Rewards primarily mattered because it dictated how many sample bids they could give away to each customer they acquired.

Following the changes all paid affiliate levels were standardised to being able to give away 1000 points to each customer. In effect, for the bulk of Zeek Rewards members this meant that the only difference in affiliate levels was how much money they were handing over the company each month.

For the sake of analysis, we’ll count membership subscriptions as money going into Zeek Rewards via members. And as far as Zeekler is concerned, a member’s affiliate level has no bearing on the site one way or another.

-Enroll a few friends as free customers

The enrolment of free customers in itself has no direct relationship with the daily profit share, but it does permit the purchase of retail bids by the recruited members, which in turn provides revenue in Zeekler and at the same time provide VIP points to the recruiting Zeek Rewards member.

As far as the profit share goes, we can boil down the contribution to the profit share as money going into Zeek Rewards via customers and Zeek Rewards members.

The customer monetary contribution is in the purchase of retail bids, and the member contribution is via the purchase of sample bids, which are then given away.

In both instances no actual product is being purchased, but rather real money is being converted into a virtual currency (Zeekler bids).

Furthermore, note that whether this virtual currency is actually used in Zeekler is irrelevant, VIP points are issued based on the purchase of bids, rather than whether or not they are used in Zeekler. This is true regardless of whether the bids are given away or directly purchased by customers.

In summation, as far as the Zeek Rewards compensation plan goes and member’s commissions are paid out, the purchase of bids here is what is of value to Zeek Rewards.

The participation and use of bids in Zeekler is irrelevant and not a direct contributing factor.

-Enroll a few friends as free affiliates

As far as the profit share is concerned, free affiliates eventually need to upgrade to paid affiliate status if they wish to continue earning in the profit share, so as above, the same considerations apply as with paid affiliates (acquiring customers and membership fees).

There are additional commissions earnt when recruited members make purchases (10% on level 1 and 5% on level 2), but again this is counted as money going into Zeek Rewards via members.

-Sell a few e-commerce suites

If you ask most Zeek Rewards members about ‘e-commerce suites’ you’ll in all probability get a blank stare response.

As far the profit share goes e-commerce suites are a non-factor and were just something Rex Ventures had lying around from previous business ventures that they’ve tacked onto Zeek Rewards.

-Join the Customer Co-op

Prior to changes made in April, the customer co-op was run by Zeek Rewards and equated to members paying the company for “customers” to dump bids onto. This was attractive in that it turned the requirement of attracting customers to dump bids into a passive activity, meaning you could just pay a small fee per customer ($2.50 or so) and that was it.

As VIP point balances grew so too did the number of customers required for purchase by Zeek Rewards members so no doubt this was a nice little money spinner for the company.

After April 2012 though the company stopped directly selling “customers” to members (conceeding that this was illegal), although they are still readily available for purchase from several third-party companies.

The bottom line is that now the fees for these paid-for customers is going to third-party companies, rather than Zeek Rewards (who they themselves were contracting out the acquisition of paid customers anyway), and as such this side of the business directly contributes nothing directly to the daily profit share.

-Drive Traffic to Zeekler.com and Earn 20% and one point on every dollar your Zeekler.com customers spend on bids

Placing emphasis on ‘driving traffic’ to Zeekler‘, the above task is disingenuous as it is the conversion of bids (either by the customer or affiliate) that drives the commissions, rather than any participation in Zeekler itself.

The use of bids is entirely optional as far as the profit share requirements goes. This is easily understandable when you consider that it is upon purchase of bids that Zeekler and Zeek Rewards see the money and are thus able to redistrubute it.

As far as the auctions go, the winner pays whatever they won the auction at, but this pales in comparison to the revenue generated via the sale of bids.

Although with Zeekler offering a cash substitute on all auctions, it is noted by members that this can serve as a small discount on the initial price paid for the bids if they win an auction with said purchased bids and choose the cash prize option (this counts for customers too).

The downside of this of course is that as a result, Zeekler is full of suspicious looking penny auctions that no sane retail customer would bother pariticipating in.

-Purchase some sample bids to give away to free customers

As above, the purchase is what contributes to the profit share, not the use of the sample bids once given away. Only Zeek Rewards members can purchase sample bids to give away so this equates to money going into Zeek Rewards by members themselves.

-Drive traffic by placing ONE FREE AD every day

This is the big one in that if you ask a Zeek Rewards member what they do, ‘advertising for Zeekler’ is usually the given reply.

Note that the actual requirement however is the publication of a free ad, and that the time required to do so is usually only a few minutes, if that.

Yet as the ‘paid advertising division’ of Zeekler, much importance and emphasis is placed on the fact that Zeek Rewards members are directly contributing to the success of Zeekler and Zeek Rewards via said advertisements.

At the end of the day however, inherently there is no direct contribution to the profit share via the placing of free ads on already saturated classified ad networks. Thus the value of such a requirement is highly questionable, if not non-existent entirely.

Putting it altogether

With Zeek Rewards supposedly being the ‘paid advertising division’ Zeekler, one would assume that this advertising by members would be of primary importance to Zeek Rewards.

Furthermore one would also assume that the advertising itself would contribute a significant amount to the commissions structure of Zeek Rewards.

Unfortunately, neither are the case.

When Zeek Rewards recently banned the nationals of six countries from joining and participating in the income opportunity, they also inadvertently quantified the exact dollar value of advertising that members do for Zeekler.

As per a press release put out by CEO Paul Burks on the matter, he stated that despite many banned members having been with the company for a year or more diligently advertising daily for Zeekler, that Zeek Rewards would only be issuing refunds for

payments made since joining, including subscription payments, bid purchases and any other payments.

The true value of advertising for Zeekler that Zeek Rewards members are required to do daily?

In hard dollar terms, nothing.

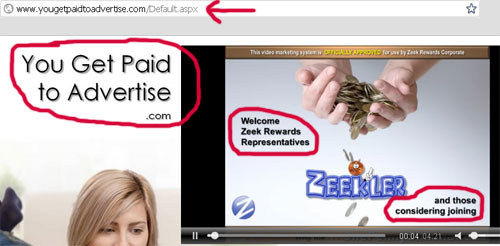

Kind of ironic when you consider one of the compliance friendly taglines of Zeek Rewards is ‘you get paid to advertise!’

In the case of issuing refunds to Zeek Rewards members and in effect quantifying just what value members provide to the company via their participation and membership, turns out that only money injected into Zeek Rewards via a member’s own purchases is of any value.

Banned members, through no fault of their own, were forced to forfeit any VIP point balances they had accrued or any outstanding balances (projected or otherwise) owed via participation in the daily profit share.

And thus the true value of these members to Zeek Rewards was reduced solely to the money these members had financially contributed towards Zeek Rewards themselves.

Advertising, promotion, signing up customers, encouraging recruited members and customers purchase bids… none of it warranted any form of financial compensation or restitution on behalf of Zeek Rewards when they cut ties with the affected members.

Whereas most MLM businesses compensate members based on sales of tangible products and services as a direct result of marketing or advertising the business itself (as this is where the value of members to the company in question is derived from), here is a company candidly reducing the value of members to the money they themselves put into the company.

By rights if the advertising and procurement of Zeekler customers meant anything financially to Zeek Rewards, then at a minimum banned members would be entitled to commissions paid out on the purchase of any bids made by their customers and recruited members, as well as some form of monetary compensation per the amount of advertising done by each individual members, paid out pro-rata based on their VIP point balance and withdrawals to date.

Instead, Zeek Rewards reduced their participation in the scheme to the money they themselves put into the company.

There is one other distinct business model that also harbors this trademark defining characteristic:

a fraudulent investment operation that pays returns to its investors from their own money or the money paid by subsequent investors, rather than from profit earned by the individual or organization running the operation.

The above is taken from the Wikipedia definition of a Ponzi scheme.

Looking at the bigger picture, it is worrying to consider that the long-term success of Zeek Rewards thus is pegged to the financial contribution of its members.

If these contributions are all that Zeek Rewards are willing to refund, it thus follows that these contributions are all that really matter when calculating the worth of their members and what they are actually paid for. That is, pumping money into Zeek Rewards themselves or encouraging others to do so.

Naturally this wouldn’t be such a problem if said money was being used to purchase actual goods or services. With the money being pumped into Zeek Rewards and Zeekler however simply being converted into a virtual currency (Zeekler bids), which is then in turn converted into another virtual currency for ROI payouts (VIP points), this is serious cause for concern.

Furthermore it entirely throws into the doubt the claim that money being contributed into Zeek Rewards is not an investment. Especially when you consider that neither Zeekler bids or VIP points hold any monetary value outside of the company itself.

When you throw in the fact that a 90 day ROI is offered on the points themselves… it then becomes even harder to ignore the obvious.

With Zeek Rewards offering members a rolling 90 day ROI based on their direct monetary contributions into the scheme (via the purchase of sample bids and re-investment of paid out returns), and reducing the value of their members to the money they themselves pump into the company, there’s clearly not all that much room for interpretation here.

Strip away the marketing jargon and compliance double speak… and at the heart of Zeek Rewards is the fundamental concept of the more money you put in or convince others to put in, the greater your return.

Why dont you put the positive related posts.You again have no idea what your talkin g about!

@ steveamenta

This isnt a court of law. They are guilty until proven innocent in my book. If they were legit it would not be hard to prove it…

@steveamenta — Oz was pointing out a flaw in Zeek’s business model. Why do Oz need to mention something “positive” along with it?

Perhaps you just don’t like the tone? If you can’t find any fault with the evidence or logic, then perhaps you just don’t like the information you see and it’s giving you a cognitive dissonance.

Nice job, Oz. You’ve basically clarified my own thoughts I had commented in the previous Zeekrewards topic.

They say they are not investment, but they want your money (buy bids, which gets you VIP points instead of bids)

They say they are not investment, but they give you ROI at usurious rates (over 1% DAILY)

They say they are not investment, but they are surely NOT paying you for work

They say they are not investment, but they are paying someone who had more points (i.e. more money in system for longer time) more than people with less points for same amount of “work”

Clearly, they are lying about being not an investment.

Here you are:

I quoted ONE of the major points from MLMhelpdesk, and made only short statements for the rest of the points. It’s meaningless to quote too much from other blogs, it’s better to make the information available through a link.

Note:

I made comments about ‘highly misleading’ for some of the info, like the 25:1 ratio and some statements about 3 million customers. For the income disclosure I’m not sure which ‘amounts’ they have used, only real payouts or if they have included VIP Points.

In addition to this, a few comments related to other articles here points out some additional sources of revenue, like some income from advertising and sale of marketing software to affiliates.

They say they are not investment, yet for the first 8 months in 2011 they advertised 125% ROI.

They say they are not investment, yet for the first 11 months in 2011 they allowed affiliates to share spreadsheets and use the words “interesting” and “compound” (and banned the use of the word “compound” claiming it was copyrighted by Albert Einstein and not allowed to be used).

It includes all payouts.

The way Zeek Rewards work is the daily profit share is paid out in cash. It sits in your backoffice as “cash available”. You choose either to cash it out, or reinvest. Any reinvestment amount above 0% is done automatically. Most people have automatic reinvestment set somewhere between 80% to 100%. Say you have 100% reinvestment, then you receive cash, and it is immediately used to purchase VIP points, which then is immediately given away to your free customers (sometimes there is a lag and the giving bids away runs a couple hours later).

So from ZR’s perspective, they are paying everyone a cash payout. It’s just that people will reinvest the cash and buy more bids for compound growth and to overcome the 90-day bid expiration. If you keep less than 80% reinvestment, you generally will not be able to keep a positive growing balance (depends on the average daily profit share and how many people you’ve sponsored, as you get 10% commission from level 1, and 5% commission from level 2 on all daily profit share).

Other misleading items:

The Alexa ratings ZR constantly touts is highly misleading. The reason the Alexa ratings are high is because of the daily requirement to post a link to your meaningless, spammy classified ad. Every affiliate, including free ones, will log in at least once a day to place the ads. So of course they will gain a much higher Alexa rating than other sites where the user/customer/affiliate is not required to log in daily. How often do MLM distributors login to their backoffice in other MLM’s? Maybe a couple times a week? But not every day.

ZR uses ZeekRewarsdNews in superfluous ways, such as the post today about “everyone fill out this survey if you attended the Red Carpet Event”. If you attended the Red Carpet Event, doesn’t ZR have your name and email? Why blast a blog post to every one when only a handful of people attended the event.

ZR has a “red carpet event” and advertises it to VIP’s, though anyone was invited if you knew about it, but the event is at a Holiday Inn Express. Isn’t “red carpet event” and “Holiday Inn Express” an oxymoron?

ZR spends at least 75% of the time on the 4 times a week opportunity calls to promote Zeekler, and imply that Penny Auctions are a new revolution in digital entertainment/shopping and is new to the US. Reality is that Penny Auctions are on the decline. ZR implies heavily on the calls that Zeekler generates vast amounts of revenue. ZR implies that placing daily ads has a causal effect on high revenue generation for Zeekler. Reality is that Zeekler generates very little revenue relative to ZR affiliate investments and is a terrible penny auction.

ZR markets its Free Store Club as being a viable income generator on its own and that you can buy goods whoelsale at a significant discount to retail. Reality is you can find the same cheap made-in-china items (exact same name and pictures) on Amazon Marketplace for about the same price, and you could make more commission being an Amazon affiliate than trying to promote what looks like a 10-year old shopping cart application that has no retail credibility.

ZR touted the compliance training and said it would launch on Jan 23, then delayed to Feb 1, now it’s been 3 months. Exactly how serious are they about compliance? Why announce something twice that you can’t deliver? Reality is feedback from affiliate leaders beta testing the compliance said it would drive away members who would start cashing out because it removes the passive investment allure to the program. So ZR and Grimes has to rework the program to be as less “intrusive” as possible. Who will sign up for an MLM knowing they have to take and pass a test or risk being deactivated (or whatever the punishment will be)?

ZR not telling you that their two top corporate officers Dawn Wright Olivares and Darryle Douglas are also distributors. Isn’t this a conflict of interest? They can make strategic decisions how that are beneficial to their own downlines but may harm others – for example, deciding on compliance requirements that focus on stability at the expense of growth. If they already have their large downlines they want to maintain the income stream for as long as possible. A new affiliate wanting to grow their investment like others before them now cannot because of numerous compliance restrictions. This would be fine if the decision was made solely in the best interests of the company, but with officers who are distributors, how can you trust that their decisions aren’t biased to their own income at risk?

Jimmy and others as your income may be going up as you say or your just rolling it over and promoting your income as it supposedly grows. Remember it does not count as income until you put it into your account or they actually pay you.

It does not count if you just roll it over. (Or does it) does it work as an investment and when you cash it out because you have not held it for a year and you must pay taxes on it? Have you asked that question. What does the IRS or the State say about it.

As Zeek Rewards state it is income so it must be reported correct. So if you were in before 2011 did you report all your income even though it is setting in your Zeek account?

Thanks for sharing this information so the State and the IRS may audit your account once they make a declaration if this is true income you must pay the taxes on it or if it setting in an account as a place holder for an investment so you do not have to pay taxes on it, Where are the securities License for the company?

Next why does it take 3 weeks to get paid? Why do you have to hold it for 90 days? Why is it about the same percentages every 90 days on your money. If it grows does not grow at different percentages?

So you tell me the growth is the same every month or every quarter when no business in History has ever done that since it is supposedly on Profits for the company. So you think there would be a spike in Dollars coming in to drastically increase the return (oops sorry investment term there, but how else am I suppose to say it) Or profit sharing percentages. Or would the number of new enrollees dilute the pool as lower the returns? Hmmmmm…..

Funny how no one can explain the commission structure or comp plan completely and no one can explain fully how the profit sharing really works. Wonder why you ask 90 percent of the distributors never bid on products?

Most bids are given away for free and ask any of them to share their back office with them and see now many buy bids after they got the free ones. Ask them how there ads supposedly pull the same avg of customers day after day? No one can explain it,.

Your in a Money game that is hiding behind a supposed successful marketing arm of Zeekler… Who may be in trouble for using its own bidding Robots to run the prices up! Oh by the way if the bids are truly free why can you only use them on junk and not the real products and why are most of the bids on Cash that goes into your zeek rewards accounts?

Blinded by the greed. Done by the end of the year if not end of the summer!

In a previous post i might of been a little naive that zeek rewards downfall be by too many members cashing out at once. I now wonder if the government regulators will end this scam by the same passive growth income zeek rewards is distributing by third parties giving away bids.

This seems even more red flag than the customer co-op they had before. What takes the authourities sooo long to make these type of culprits down to prevent alot of future headaches.

Thx for the information. It means the income disclosure is highly misleading, in not showing the investments, reinvestments and expenses related to the income.

@steveamenta

My point in posting the positive info was “Sure, no problem. But if you want ME to post it, you’ll also have to accept comments about misleading info. It’s better to post the information you want yourself.”

Anyone can add the information they consider to be ‘valuable’ or ‘useful’, but they can’t expect Oz to add the information for them if he consider the information to be misleading.

About the experts in the list:

If ZeekRewards have a flaw in their business model, making it become very similar to a Ponzi scheme, were these experts the right ones to call?

Most of them seems to have focused on solving minor problems within their own areas, and totally ignoring the most major problem. Changes they have made have pushed problems onto affiliates rather than solving them in many cases?

The work itself is OK, with some reservations. But I really wonder how people have analysed the problem, and which ‘think inside the box’-methods they have used? “If we describe the problem as XXX, then solution YYY should work”?

Everything in place, except for the most important = real retail customers paying for the bids with real money?

I don’t think you get it. Having all the top people in place covering all the legal stuff doesn’t help much, when there is a flaw in the business model.

A rapid growing number of real customers will help, paying for the bids in money without getting anything other in return than the thrill of the auctions. It will help, but it won’t solve the problem completely.

I can answer a feew of your questions, but Jimmy will give you a better answer.

The 14 days / 3 weeks question:

This is probably for better to be able to control the cash flow, so 14 days before they pay out can be a normal business decision. None of us have made any negative comments about this solution, except some people mean 14 days or more are too long delay.

It’s a bad sign if the 14 days now has become 3 weeks.

The 90 day question:

New affiliates invest money into bids.

Bids generate profit over 90 days before they retire, average 1.4-1.5 percent per day (125% to 135% per 90 days).

The profit becomes visible each day as “cash available”, and can be withdrawn as money or reinvested into bids. This can be done automatically through settings in your back office.

Most people will follow a plan, something like reinvesting 100 percent for some months, keeping the balance rapidly growing.

Then they start to follow another plan, withdrawing 20 percent as cash and reinvesting 80 percent. This will keep the balance stable or slowly growing.

When people realize it’s probably a Ponzi scheme, they will follow different plans. Some will continue following the 20/80 plan, while others will set withdrawal to 100 percent. Others will “excercise their faith in the company” and continue to invest more money.

all you people are doing is going back and forth about nonsense. the daily profit pool comes directly from the profits of the auction and other online shopping.it does not come from people putting money in as affiliats.

please read a reputable source like the mlm news journal or troy doolys message that came out sunday. the company is going to be a monster because they are doing things the right way.

oz said dubli was a scam to and couldnt stop talking about the same way he is slamming zeek.look back to his blogs from last year.look at dubli now. what happened oz?

could you please explain.its ok to be wrong. good debates are healthy.just admit when your wrong and you can take credit when your right.the leaders in the industry are praising zeek for its business model and the way it treats its customers and affiliates.

dr.keith lagos.is he a fraud to oz?try doing some genuine reporting.you come accross like the national enquirer.please do your homework!

And who buys bids for the auctions? Affiliates who want to build up their VIP points. The fact that one person can spend 1400 bids for a mere $100 cash should tell you the bids are merely window dressing and is used to move money from one member to the pool to the other members.

Such as suddenly banning members from six countries and offer bull**** explanations?

Then go away and join the other cultists on the ass kissing mlm sites.

This site is the ONLY one i have found that doesnt have a bunch of slobbering mlm junkies praising each other about how great thier program is.

The auctions don’t generate much profit, the sale of bids do (when people pay for the bids with money). Spending bids on an auction doesn’t generate profit in itself, other than raising the price and make the products become more costly.

The auctions will generate profit in a situation where people run empty on bids, and buy more bids to be able to continue their bidding. The bidding in itself doesn’t generate profit, and neither does giving bids away for free.

Affiliates reinvesting “cash available” doesn’t generate any profit either. Profit is generated from new money coming IN, while the “cash available” is already in the system. ZeekReward has probably made a major mistake, and calculated all buying of bids as revenue.

The online shopping:

How much did you sell for in your FSC-stores last month or last 3 months? Most people have answered “Nothing”, plus some “but I haven’t started to promote it yet” and something similar.

You will probably be the first one having a significant amount in revenue from these shops. It will make it much easier for us to calculate when someone has real revenue from these shops (other than what they have bought themselves there).

And so said anyone else, including Troy Dooly. It was basically an investment scam running from country to country, with false claims about successful auctions in Europe. We haven’t checked anything about it since spring 2010.

Reviews will usually be made from the business model they currently have, not from any possible changes in the future. We do not predict changes like that.

And I will still guess Dubli have some of the same problems they had in 2009/2010, with most of the money coming from investors rather than from external sources. But I don’t think they will like me to do an in-depth check about where their main focus are?

NOT TRUE. Zeek corporate itself has said it includes all profits, including affiliate purchase of bids (which are eligible for 90 day profit share).

The question isn’t so much what Zeek corporate has admitted to, but if the “formula” is fixed or does it change with the wind? Why yo ask?

Look at all the days that Zeekler or ZR had problems, downtime, payment processors not working, moving offices, holidays like Christmas, promos like Mustang and Superbowl BOGO, etc… yet the profit rate holds nice and steady.

Take a look at any other online business from retail to sports betting to poker rooms to casinos, they all have much larger variations.

It’s not possible Zeek’s profit rate can be so steady if they truly are taking 50% of daily profits (which is what they have said). I could see some type of money buffer if that was part of the formula, but they already said 50% of daily profits are paid out.

You can take it one more cynical step. If ZR is indeed paying out 50% of its profits daily, why is it such a small company with such poor IT, marketing (see how many ads in the Backoffice have spelling errors), terrible web server look and feel, terrible back office, terrible web application security.

If ZR was actually making 50% of the profits it was paying out daily, corporate would be ROLLING in the profits after costs. But Zeek corporate doesn’t act like an Apple or Google with lots of profits and poised for growth. They act like a miser scrimping along every last % of margin.

What other business does that? Ponzi’s. Ponzi’s have to keep administrative costs as low as possible because their margins are negative. They just need to extend the game as long as possible.

It’s funny that you mentioned him, and the Network Marketing Business Journal. I made some comments about this as part of another comment, but I choosed to delete them as “unfair” (because I only had seen things from one side).

My comments was about being able to identify the main problem, instead of focusing on the symptoms. Reviews and comments about Ponzi scheme is only a symptom for something, and in this case it’s about parts of the business model. We have been very specific in identifying which parts.

A qualified advisor will usually try to identify the real problem, and do some investigations on his own if needed. He will usually also address the real problem instead of the symptoms.

NMBJ published very positive information about ZeekRewards without addressing the real problem. They tried to ‘outweight’ some negative information by being extremely positive. They even included meaningless and misleading info just to make it become more positive.

In my opinion, they have possibly failed to identify the real problem. They have just delivered a ‘solution’ within their own area of expertise (publishing).

It doesn’t seem like they have analysed the methods either, just used a general ‘pump out as much positive information as you can’, a method called ‘overselling’ if they had tried to sell a product.

We don’t know the effect of this strategy yet, and I don’t even know which problem they tried to solve or the target audience. That’s why I choosed to delete the other comment, as being ‘unfair’ and ‘onesided’ in the viewpoints. I wouldn’t have brought it up either if it hadn’t been used as a point by others.

I’m still being unfair and onesided here, but at least I had a chance to admit it before someone else pointed it out.

If you add up all the payouts from the income disclosure….

Dist 399 avg $1,072.41 – $427,891.59

Man 288 avg $2,774.55 – $799,070.40

Exec 3090 avg $10,310.81 – $31,860,402.90

Sr Exec 819 avg 5,594.01 – $4,581,494.19

Non ranked 10722 avg $1,949.91 – $20,906,935.02

Total $58,575,794.10

You would think with almost $60million you could afford better IT, but I guess all them lawyers cost alot…

With them using a “$” in front of the number then it has to be the total for the checks written and not VIP points generated….but I could be wrong.

And this is just what they paid out.

Wouldnt it be safe to say they made more than $60million?

I was rereading some of the case files in the “Andy” Bowdoin Ad Surf Daily court case (I need better hobbies) and it reminded of something which might be relevant to Zeek. And if so, it explains the spam a link a day portion of the program.

American law has developed a number of legal “tests” to help determine if an offer constitutes some manner of “investment” and therefore could be regulated by our Securities and Exchange Commission. Perhaps the most famous being known as the Howie Test as was initially formed in the Supreme Court decision SEC v. W. J. Howey Co., 328 U.S. 293 (1946)

Wikipedia link:

http://en.wikipedia.org/wiki/Securities_and_Exchange_Commission_v._W._J._Howey_Co.

Here’s a link with a slightly longer explanation and it’s posted on the Bar Association website in North Carolina, home of Paul Burks and Zeek:

http://businesslaw.ncbar.org/newsletters/nbinov2010/security.aspx

In one of his court filings Andy (or his attorneys rather) argued that Ad Surf Daily could not be held to be an investment because the program required you to view websites on the advertising rotator.

They were claiming this this amount of effort negates the “profit arising primarily from the efforts of people other than the investor” fork of the Howie test. The motion to dismiss was denied by the judge in an very short order which basically rubber stamped the Prosecution’s motion posing the dismissal.

That opposing motion is worth a read:

https://sites.google.com/site/asdupdatesfiles/documents/23-main.pdf?attredirects=0&d=1

Particularly section 2 which starts on the page numbered nine. It shows quite clearly that if your opportunity offer fits into the legal definition of an “investment” then they couldn’t care less what you call it, it’s an investment. A few choice quotes:

And:

Paul and his compliance team could sew every Zeek affiliates lips shut and impound all the letter ‘I’s from each of their keyboards so none of them ever spoke or typed the word “investment” again in their lives and that wouldn’t change how the law will view the program.

After all, the legal definition of an investment contract is “anything that investors purchase with (1) an expectation of profits arising from (2) a common enterprise that (3) depends upon the efforts of others.’” SEC v. Banner Fund Intern., 211 F.3d 602, 614 (D.C. Cir. 2000).

Can anyone explain how all three of those things are not true of Zeek?

The real question is what is the total number of unpaid VIP points? What level of cash do they have on hand and coming in to meet any increasing levels of withdrawals?

Profits are only determined on revenue/assets – costs/liabilities. If revenue is increasing but liabilities are increasing faster, then the sustainability is dwindling.

If 30-40% of the active affiliates decided to cash out, how long would it be before the average 1.4% daily profit share will start declining? Once it starts declining, the trend of cashing out will only get worse until a tipping point is reached.

This is likely the real reason that the percentage is remaining so consistently at 1.4% over time. ZR has to do everything to maintain the illusion of stability because this whole scheme is dependent on affiliates believing it will still be functioning and paying out a healthy percentage 90 days from now, so they repurchase at 80-100% rather than cashing out.

Remember, the “plan” is for people to accumulate a bunch of points at 100% reinvestment, then switch to 80% reinvestment, 20% cash out. If everyone is really doing that, ZR is going negative on every single affiliate after they are in for 3 months or so, and has to offset this with FSC revenue (likely minimal), penny auction revenue (less minimal but still insufficient), membership dues (marginal), and new sales of bids to customers/affiliates (no real figures on the breakdown here).

Note that new sales of bids to new/old affiliates is only a temporary benefit, just like someone getting a new bigger loan to refinance paying off the existing loan. It buys time, but at the cost of added VIP point liability so the problem gets bigger as more time goes by.

This is the proverbial KTC (Kicking the Can Down the Road) plan.

Unless someone really believes that a majority ( ie > 50% ) of the “revenue” coming in is new retail customers ( ie NON-affiliate related ), then the system is doomed to fail at the point that confidence is lost in a sufficient number of affiliates so they quit “repurchasing”.

I would not be that impressed with $60 million payout so far. That is just how much money is changing hands – it doesn’t represent a balance sheet profit for ZR.

A company rolling in the dough at this point would have a much more professional IT effort, a much higher profile “Red Carpet” event, and less of the clueless bumbling going on with the leaders.

Also, the top people in the company would not be their own affiliates – they would be corporate executives outside of the affiliate pay plan with a high salary, perks related to corporate profitability.

It would have an air of professional success, not the smell of a small-time family business struggling to get off the ground, scrimping on expenses, nickel-and-diming stuff ( ie affiliates paying for compliance course ), giving off an image of incompetence to the public, and behaving unpredictably with no real long term vision or plan.

I have to agree with some others on here – this ZR thing is doomed to fail, probably within 6 months to a year if the regulators dont kill it sooner.

Uh what? ZR themselves have confirmed that some of the money comes from affiliates, they just refuse to state how much.

Wake up sleepy.

And three years ago… it was.

I’ve only seen a bit about them over at MLM Helpdesk, but from what I understand they trashed their scam business model that revolved around reverse auctions and appear to be relaunching themselves.

What does that tell you.

Delicious, delicious irony.

@gen3benz

Been a while since I looked at the ID, but from memory they only quoted US based affiliate income. So yeah, they took in more.

Exactly what I was thinking, considering Zeek tells us the $60 million is 50% of the profit, the rest goes to the company.

So it takes $60 million to pay 12 employees(including the crappy IT guys), hire some lawyers, and rent some office space?

This is one of the most elaborate Ponzi Schemes ever created. Two Points:

1. The try to make it seem ligit by asking it’s members to do “some work”–placing the one or two ad’s a day. Really? How are they checking the 100,000 or 200,000 internet ad’s the members are placing? Where are all these ad’s going? The fact is…it’s irrelevant. The ad placement is just a cover making it seem as though some work is involved.

2. If everyone today, instead of doing the 80/20 investment model, decided to cash in all of there money…I mean pull everything out of their accounts…Zeek would most likely tank overnight.

Actually, it wouldn’t. If at any time cashout requests exceed funds available an organized gang of cyber criminals will launch another DDOS attack shutting the site down and preventing them from processing the requests.

Or there will be some problem with one of the payment processors freezing their money. Or some strange glitch will hit the e-wallet system where you can only use it to fund your Zeek account but not to withdraw funds, their programers are working to correct the problem as we speak.

There are a hundred little lies they can tell to delay short term revenue shortfalls. The problem is that many of the people playing the Zeek game have played many games like it before. They recognize the excuses and will be quick to adjust their reinvestment ratios and get as much money out as they can.

And when enough of them do the short term revenue problem becomes permanent.

Commentary:

It seems more than a few Zeek defenders chose to trot out the list of consultants that Burks have hired for “compliance”, esp. Mr. Laggos.

Frankly, as M_Norway had pointed out before, they are only experts in their field of expertise, and their job is to SOLVE problems.

I doubt ANY OF THEM would tell Burks to his face, “Your business is a scam and you should shut the whole thing down before Treasury agents knock on your door.” It doesn’t help either party. They are there to earn their worth, and Burks needs the problem solved. So they are advising Burks to revise his business.

The question here then is… are the revisions fundamental (like the Dubli reboot), or merely cosmetic?

Does someone have a list of all the changes thus far? Because so far all I am seeing are merely COSMETIC changes, such as “ZeekRewards is NOT an investment, repeat after me.”

Are there any FUNDAMENTAL changes since the compliance review? That significantly affects how Zeekrewards operates?

My article is back up.

http://kschang.hubpages.com/hub/Analyzing-ZeekRewards-is-it-a-legal-and-viable-business-and-can-it-provide-long-term-income-for-you

Troy Dooly offered some insights he gained from the time he spent at Zeek’s “Red Carpet Event” on one of his friend’s Blog Talk Radio shows. He is by the way moving Zeek from his “High Risk” category to his “Start Up” category.

His direct commentary begins a bit before the 38 minute mark:

http://www.blogtalkradio.com/jimgillhouse/2012/04/20/this-week-on-aces-radio-live

Let me again say that I have personal affection for Mr. Dooly and sincerely believe his heart is in the right place. But I don’t believe that he’s looking at the bigger picture.

Forget about US Federal and state laws for a moment, just look at the laws of mathematics. Since we aren’t thinking about the law we can call things what they are, Paul Burks not only claims he can provide a higher return on (VIP Point) investment than Warren Buffett, he’s out returning Bernie Madoff as well. And by a wide margin.

it seems actually good that the top officers are also top distributors. if they have downlines in the thousands it means they are the ones with the most to lose if the whole thing blows up. so they better make it work or else …

as far as the distributor goes you must be smart to spread your efforts around .Only a fool would put 100% of his time and effort in a single MLM program

@Stewar — but it also means they have the most to gain. They probably have more VIP Profitpoints than any body else, and thus would be raking in the money in addition to whatever ZR pays them in salary and corporate profits.

Remember, people who join with little balance are encouraged NOT to pull any money out, whereas people who have PLENTY of VI points can take plenty of money out, perhaps THOUSANDS per week. (if they have like 500000 points, very possible for those top execs).

The real question is… are there enough REAL bidders (i.e. those who joined Zeekler but NOT ZeekRewards) to feed enough profit into the system to SUSTAIN 1.5% daily profit? I very much doubt it.

Sorry a little of topic. I would like everyones opinion on when a ponzi scheme fails alot of individuals are left holding the bag and wanting their funds returned and never get it back.

My question in zeek rewards is how big would of an affiliate have to be in points and amount converted into cash to be brought before the court to offset these funds. It would not be be difficult to trace these people in zeeks own back office files.

They top few are well over 500k points. The top 3 had 500k points in Nov.

Many “MLM leaders” are in the 100k to 300k range and they are getting a lot of their downline from other MLM’s to now join. After all, they have the ultimate evidence of success: their own paychecks and back office statements, even though it is against compliance rules to share them, everyone does.. it is the ultimate recruiting tool.

The problem is sustainability. If you are late to the ponzi, by the time you build up to 50k points (which seems to be the level where most people switch to 80/20), the people who came before you will be at 200k, and the ones before them at 500k, and the ones before them at 800k, and the ones who were at 500k in Nov are now at 1M (depends on how aggressive the were reinvesting for compound interest).

It’s just not imaginable that average Joe starting out at $1k to $10k investment TODAY can reach 100k points or 500k points, because by the time he increases his virtual points 10-20x (to reach his desire goal), the size of all virtual points will be so enormous Zeek cannot possibly keep up with the payouts.

I think after Zeek crashes, the fundamental relationship between BehidnMLM and Troy Dooly will change significantly, as despite Troy’s very diplomatic explanations, I think he thinks we’re all idiots for thinking Zeek could possibly be a ponzi. (If that’s his opinion, I wish he’d just say it without hedging. We state our opinions here quite clearly, we can handle an opposing opinion.)

You can already see some warning signs with the behavior of many of the “leaders”. Some of them are suggesting people join at Diamond level and buy in at the max $10K which maximizes money IN to ZeekRewards, thus facilitating the uplines ability to cash OUT of ZeekRewards with decent profit percentages.

You notice the compliance course is still nowhere to be found even 3+ months after it was first announced, and I have seen upline pushing “auto-ad submitting tools” and pushing Zcustomers as a replacement for the now illegal 5cc.

In other words, the “work” component is becoming less and less important, and the “investment component” is becoming more and more important. It is becoming very clear that the ad submission is really not about advertising at all, but merely a hoop to jump through to obtain the daily profit share percentage.

This is the inevitable result:

0. ZeekRewards can and will change the rules at any time. Thus, there is no guarantee that the profit percentage stays in a good range, that more and more “qualifiers” are not added to prevent paying it out to everyone, that more banning of affiliates occurs for lame reasons, etc.

1. Many late joiners will become bagholders that just bought in for $5K-$10K and will lose the majority of their “investment”. The later you join and the more you buy in for, the greater the risks of losing.

2. There is regulatory risk that the FTC or SEC becomes interested in shutting down Zeek, in which case there will be basically zero warning and the whole thing could die a death overnight.

3. People with huge point balances when ZR goes defunct or is shut down will be left with huge IRS tax liability for “earnings” that will not really exist as cash. That would not be a good situation and would be hard to escape easily.

I have study ZeekRewards and Zeekler. I bacame a Diamond and then became a free member. Today I told them to cancel my account. I did not refer my friends or family to this program, because my inmediate reaction and feeling after checking them out-is a Ponzi alright.

My lost $99, better than loosing my credibility. MLM lost my vote of confidence and this were my comments to Troy on his website.

“Shame on you Troy. You don’t have to be intelligent or an expert to see that Zeekler or any of their junk products does not sustain Zeekreward. Only their members.”

Issue #3 is not a problem. If you earned $100k in Zeek payments this year but used 100% of it to reinvest, you’ve also purchased $100k in bids. Your bid purchases are deductible expenses. Your tax liability is zero ($100k paid, $100k in expenses).

The issue Oz & I have been saying is there is an audit risk, however, because your schedule C filing will trigger anomaly detectors in the IRS when they see very high revenue and high cost, nearly a 1:1 ratio, and no history of similar business in the past from you.

Issue 1: net revenue

If you look at it at a TRUE “net revenue” from a participant/affiliate’s side, the revenue is “net negative” for the first 40-60 days or so. Then it makes a climb daily to net positive before day 90 and start going from there.

So you have a “window of vulnerability” where you actually have a ‘net loss’ until whatever you get back as “profit share” exceeds the money you put in.

Issue 2: are bids deductible as business expense

The idea that “bid purchases are deductible expenses” is questionable. While bids in themselves could be considered an business expense if you are really buying them to give away, it’s clear that affiliates are NOT considering them as business expense, but rather “pay to play”, as they don’t intent to use the bids as bids, but rather only as something to convert to VIP ProfitPoints.

Or in other words, you are REWARDED (remember, it’s called ZeekRewards) with VIP ProfitPoints, and what are your tax liabilities on THAT?

I just joined as a free member because an acquaintance of mine told me about it since I am currently looking for a job. Because i couldn’t understand how Zeek worked from either my acquaintance or the website, even after joining (and I somehow thought that would illuminate me), I found this article.

I also find it frustrating that most of the other google search results on Zeek Rewards have titles like, “Don’t Join Zeek Rewards! Warning!”, and then when I click on them, they proceed to advertise Zeek Rewards.

So, thanks for all the people engaging in this logical, honest, and objective discussion. It’s been more enlightening than anything available through Zeek Rewards.

That’s the whole idea. Yet we have people accuse us of “fearmongering”.

If we’re fearmongering, then they are joymongering. And there’s a lot more of them. 🙂

You will find the rest of the articles about ZeekRewards if you click on the company name – either right under the headline in the article, or in the list “Companies” in the menus to the right.

Jimmy has best understanding on how ZeekRewards works (among those who have been most active).

Articles about companies will usually start with a review in the first article, with factual and unbiased information as the central part. A few companies will get follow up articles, usually because of information that pops up later.

For ZeekRewards, we have changed focus from seeing it as MLM to see it as an investment scheme (Ponzi scheme), talking about the business model rather than laws. This shouldn’t be any problem as a free affiliate, and you have 60 days to evaluate it anyway.

I have been an affiliate for about a month now. I see many many red flags. I’ll touch on just a few here but I believe these few are enough to cause anyone with half a brain to not join or to get out (as I’m doing).

1. A major difference between Zeekler and Quibids, Skoreit, etc.., is the “buy it now” feature. If I want an iPad I can go to a store and buy it and pay the retail price. I can also go to Quibids, buy bids, take a chance on getting the iPad for cheap BUT if I lose the auction I can then apply what I spent in bids trying to win the iPad towards the retail cost of the iPad.

I was going to buy it at the retail store anyway…might as well have fun, see if I can get it cheap and if not, buy it retail like I was going to. You can even buy it after the auction closes. They will credit your bid costs towards the purchase price.

At Zeekler you lose all the money you spent on bids. One person wins the item.

In the “how it works” section of Zeekler they mention a “scoop it now” feature but I have been unable to find any auctions with this option. It’s possible I have just not been in the right auctions but I’ve looked quite a bit.

This is why I joined as an affiliate. I saw it as working like Quibids and it was just a matter of competing with them and other legit auction sites.

To facilitate what I consider is a deception; Zeekler has a link to their Shopping Daisy prominently displayed right next to the item being auctioned with a huge button reading “GET IT NOW”. At first glance you would think it is for the item but upon further examination you realize it is for the Shopping Daisy itself.

2. If I wanted to participate in the Zeekler auctions I could buy bids. Lets say I want to buy that iPad. I take $100 and buy my bids. I try to win the iPad. I blow though my bids (my $100!) and then I notice the winner of the auction has won it by using up 5789 bids!

They just spent 6 grand on a $700 item?! No, the bids are so diluted they have almost no value. I would not pay real money for bids that are diluted and that are completely lost as in item 1 above.

Who would? No one! And no one is! It is all affiliate money coming in that pays the daily reward.

3. The money I put in, lets say $1000, will take MONTHS and MONTHS to recoup using even the most conservative rebuying strategy. It is highly recommended to rebuy with 100% until a certain level is reached but lets say I want to get to a zero personal risk sooner than later.

I rebuy at 100% for 90 days then switch to the 80/20 plan. Taking into account the $99/month fee I would break even after eight months. If I started with $10k it would be around six months.

I’ve skipped some details for the sake of brevity (1.52%, other plans, etc.) but my point here is that $10k today doesn’t cost Zeekler one dime until at best six months down the road and most people plan to leave the rebuy at 100% much longer moving the breakeven out to a year or more.

When the end comes for the affiliate it will be akin to being on the Titanic watching the iceberg approach, turning the wheel hard over, and kissing your assets goodbye as you await your icy death. A few will make it to the lifeboats….

4. During the denial of service attacks the site was down for a fair amount of time. I told my upline to expect a reduced payout as there would be no profits from our operations.

The hair stood up on the back of my neck when we made our normal profit for the day! It wasn’t possible to make a profit with the site down. That was the day I knew something was wrong.

There is much more but I said a few items so there you go. I’ll be interested to see any honest replies from my fellow affiliates.

Bravo sir! You are using logic when analysing Zeek.

You should post this all on mlmhelpdesk and see what Troy has to say about these red flags…

The site was only down for a few hours on 3 different mornings that I recall. It did not inhibit the auction site to my understanding and it definately didnt inhibit the checks in the mail on the way to Zeek to fund the account. It only delayed the Upgrading or Joining into the system for the monthly dues…And on those days I do think the pay out was a tad less but yes hardly noticeable.

Next, everyone keeps missing the critical point that Zeek is Private and the statements made about the profit pool are always and have always been to my understanding “UP TO 50%” giving them a ton of flexibility to even out the daily spikes and crashes of true numbers.

People must treat this like a penny stock. Get in, place some ads, dont throw life savings at it, let it ride for a bit, start taking out money in small quanities and if you get into the black, congrats.

I definately dont see this going on for 3-5 years but quite frankly it could easily go 1-3 years which is enough to crush it on an original buy in amount no matter how high or low…

As they don’t release the length and scope of outage there’s no way to say either way.

Blasphemy!

Dont say the “S” word in front of the compliance gestapo.

Sounds like you are implying that zeek is an investment.

Except for the last investors that dropped $10k and it evaporates the next day. Maybe you just get deleted like the banned country affiliates.

What I find interesting is that no one mentions or even seems to acknowledge the sheer profits that the company is accumulating from the monthly subscriptions.

I’m unsure as to how many affiliates there are but if there are 250,000 Diamonds with a $100 subscription every month, that’s 250,000,000 for the company and yet in 2011 they only paid out 60 million and people are worried about the whole thing tanking?

Imagine the subscription money accumulating every month. The amount the company is paying out monthly to affiliates very likely doesn’t even amount to HALF of what they are getting in monthly subscriptions. Add to that the profits of the penny auction and it seems to me that they are not only in the green, they are swimming in profits.

Keeping people exciting about their “earnings” with the company not actually paying them anything until they decide to cash out their rewards, is what seems to lend great believability in the sustainability of the model.

It seems to me that most of the people in here presenting themselves as purely “discussing” or “wanting to understand” how this works have in fact completely made up their minds about that which they don’t really know. Using “logic” with straw men doesn’t amount to any wisdom.

Uh… those numbers came from where?

All levels can dump 1000 bids on a customer now so not much point being a diamond… unless you want to build a downline by recruiting. Most members just use ZR as a passive investment opportunity though so it’s a moot point.

And anyway, if you’re going to make the case that membership fees are going to keep the Ponzi rolling that alone is a fallacy.

If membership fees are making up even a significant portion of the daily revenue share then that only increases the validity of the Ponzi scheme claims. And certainly isn’t going to look good when the authorities come knocking.

Yes, much easier to just throw some random membership numbers you pulled out of your arse and claim the entire business model is sustainable.

They had 3090 US diamonds for all of 2011, that includes any that dropped out. Which would be 309,000 a month. A bit less then 250 mill

Dont know the worldwide count as zeek only posts the US income disclosure

@Oz,

You’re completely missing the point and then inserting your worthless “ponzi” rhetoric to boot.

In fact, using terms like “ponzi” are very self-serving and misleading unless we quantify what degree of ponzi makes it a true ponzi scheme in the way people understand it.

This is important because any business model in life has some form of ponzi because it depends on continually incoming revenue to keep going. You can’t go to a restaurant and say “I’d like to pay for some food but do not use any of the money I spend here to pay your employees”.

BTW, it was kind of dumb of you to ask me where I’m getting those numbers when obviously I said that I don’t know how many members are in zw. I was putting out a figure for the sake of argument.

I’ve heard that there are perhaps 500,000+ affiliates in ZW and so I was just throwing out a figure saying that if 250k affiliates are each spending 100 a month for a subscription that it would be fare more than what they are spending every month on paying affiliates.

Member’s money goes in, member’s money gets redistributed amongst members and members earn a return greather than the initial amount they put in. That’s Zeek Rewards at its simplest.

Peel back the bids and penny auctions and its still member’s money being recirculated as its primarily their money buying bids. Membership fees also meet this criteria in terms of reshuffling member’s money amongst members.

Irrelevant, restaurants don’t pay me a greater ROI over 90 days then the cost of my food. Please, the ‘every business is a ponzi’ arguments don’t cut it here and only reduce the credibility of those that use them.

Cool, so you just pulled some numbers outta your arse, decided that was justification enough to declare Zeek Rewards sustainable and ran with it.

Cheers.

First of all, you made up the numbers. The actual numbers are far less than this wild estimate. People can achieve ROI with a silver subscription, and there are far fewer Diamonds than Silvers or free affiliates.

Secondly, you have a math error by a factor of 10 even with your made up numbers – 250,000 * $100/month = $25 million/month NOT $250 million/month.

The real issue here is where is the “profit” coming from that is generating this ROI for affiliates? Zeekler holds maybe 200 auctions/day max. Quibids holds 10,000 auctions/day. Quibids is not even making near the amounts that you are claiming here. So Zeekler is making far, far less on its auctions.

Even if there is money coming in for bids, it is not pure profit as there is VIP point liability associated with the vast majority of bid purchases. This just produces liability into the future of more than the revenue generated now.

That is cash flow positive short term, but profit negative long term. Much like getting cash advances on your credit cards each month and spending the money. Cash is coming in, but the balance sheet is getting worse every month.

Since affiliates are basically shuffling money back and forth through bid purchases, and later cashouts, there is no actual long term sustainability. It is just a question of how long the money coming in is equal to or greater than the money being cashed out.

There is also a time limit as the compounding effect has to paid out of somewhere, and there is no revenue engine to drive growth to pay it.

If the company makes a ton of money “mostly” from subscriptions, instead of bid sales, that would prove it to be a Ponzi scheme that relies on new subscribers joining, and selling of bids to be incidental and almost irrelevant.

Your premise actually proves ZR to be illegal.

Interesting straw man, as you never actually defined what exactly *is* a Ponzi. You just keep claiming that Oz’s definition is wrong.

A Ponzi scheme basically means members are paid with their own money: there is no “external income” such as investment, services, sales of goods, etc. to increase the money.

A business provides service or goods, and takes in money. They make a “profit” by charging a price ABOVE cost. More money goes INTO the the business than comes back out.

A ponzi scheme takes your money, and gives it to some OTHER member, then takes some OTHER member’s money, and give it to you. There is little or no extra money going into the business, not enough to provide the “extra” money you get (more than you put in). So eventually, someone will be unable to take out what they put in, as the scheme is already running a net DEFICIT, by robbing Peter to pay Paul.

Your idea that the “membership dues are enough to provide the profit” is an interesting angle, but your numbers are completely wrong, and ultimately the logic holds no water.

Your numbers are off by a factor of 10 or 100 depending on the scenario you presented.

Logic-wise, consider this: the amount of affiliates and their membership dues CANNOT account for the profit share that has been observed for over a year.

Take the official 2011 IDS: total number of active members (rank or no rank) is 15318. Taking the averages and multiplying them by number of members revealed total payout to ZR members as 58.5 million.

If you take the 15318 to be 23.99% of all members, total ZR member count is about 63852. While we don’t know what the distribution of diamond/gold/silver is, let’s make an assumption of $35 being the average membership due (this accounts for majority of members being silver). So if you work the numbers, that turns out to be 26.8 million annually on membership dues.

Given that ZR claims to pay out HALF of the profit to members, their profit is like 118 million, vastly exceeding the membership dues we estimated.

Your logic holds no water.

Of course 250k Diamonds members is nowhere close to the actual number, but you’re missing the point here.

Just to play along… if there are 250,000 Diamonds, and the average Diamond has a 10,000 VIP point balance, then Zeek has to pay a daily, compounding profit share on 2,500,000,000 VIP points. At 1.5% that’s $37,500,000 per DAY.

How much is that per MONTH? Yup, that $250M in monthly revenue sure goes a long ways.

And don’t forget there are commissions paid out on the monthly subscription and the daily compounding, so you can trim about another 22% off the revenue and add 22% to liabilities.

22% is based on 10% for level 1, 5% for level 2, and the recursive rollup of the entire downline equates to about 22% (depends where you are in the forced matrix, I calculated 22% based on being in the exact center of fully filled matrix, which at 250k Diamonds would be quite deep).

And it would be plainly obvious at this point that the penny auctions generate nowhere close to a fraction of a fraction of a fraction of 1% of the monthly revenue, so this is a pure ponzi investment scheme at this point.

Want to try another hypothetical?

^^ update as others pointed out, $100 on 250k members is only $25M revenue per month (not $250M, I used the numbers analyzer provided in the quote snippet.)

If the average Diamond has accumulated 10,000 VIP points, then how does the $25 monthly revenue pay $37.5M in dailiy profit share?

Just doesn’t make sense. It’s an investment ponzi, clear and simple, not sure why Troy Dooly doesn’t see it.

I have been willing to explain it most of the times when anyone have asked about the definitions we use. These are NOT “Legal disclaimers”, they are only meant for clarifying some of the most commonly asked questions about some definitions.

The most typical questions have been about words like “illegal”, “Ponzi scheme” and other specific expressions.

And some definitions:

SPECIFIC FOR ZEEK REWARDS

@analyzer

I’ll guess you use slightly different definitions for “Ponzi schemes” and “investments”? The definitions used here relates to the investment parts of ZeekRewards, what ZR calls “purchase bids” and “profit sharing”.

I will usually use a slightly different definition, by including the word “primarily”. Most Ponzi schemes will have SOME sources of external revenue, mostly to make them look more legal and more like real investments.

Corrected that two paragraphs later.

Is there statistical information available to show how many people are bidding on the Penny Auction sites?

Surely this information would be available and can show how much people are actually spending on Zeekler. When we know this we will know whether Affiliate’s money is going towards profit share (?).

Nope, that is proprietary info. They dont have to and dont want to give out this info. If the company just showed its revenue from non-affiliate customers (and a few other bits of info) then this blog probably wouldn’t exist.

Either that or we would have proof (if the numbers weren’t BS) that this mlm is a scam.

No. With members admitting that they artificially created “bidders” (family members, friends, etc.) this number wouldn’t actually mean anything either. It is impossible from ZR’s POV to separate the “real” members buying bids from the “shill” members created by affiliates buying bids only to generate VIP Points.

The only way to tell is from behavior: real bidders behave logically (spend only a few bids on items), while shill bidders behave as if bids are worthless so anything goes, like spending 1400 bids on $100 cash at final price of 45.

If members want to “game” the system by putting in money as shill members it *could* almost be argued that it’s NOT ZR’s responsibility, except that they setup the game/system that way for people to play it, so they are responsible, and as many pointed out, Dawn, the VP, is one of the top members, and therefore, profiting from it (i.e. other people feeding money into the system). Remember, she has the most points, so she gets the biggest cut.

So they have NO incentive to crack down at all, or to prove they are not a Ponzi, as they may discover things that actually prove the other way.

One step further…$37,500,000 a day to pay for 250,000 spam ads on the internet. Those are some pricey ads…

When do the affiliates stop and think about this for a second and realize it has to end sometime?

The blog is called “Behind MLM”, not “Behind ZeekRewards”. 🙂

Anyway, Zeek’s strategy has always been “Don’t never ever mention those words!” (interest, compound, investment, Ponzi, etc.), and this habit has become so dominant that they are unable to do something when expressions like that are involved.

Another part of this strategy is “Try to ‘outweight’ the critics by releasing extremely positive information”. This strategy can partly be seen in the “250K Platinum members” and “250 millions per month” statements, they’re part of a so called “Compliance training”.

Dawn might be only one of the top 3, along with Daryl Douglas, but not #1. The likely top affiliate is Todd Disner based on back office reports shared in Dec before the crackdown non sharing spreadsheets, back office screen shots, and check flashing.

His numbers match the 2011 Income Disclosure Report very closely – so either Todd Disner is #1 or there are more than one distributor near the $700k revenue for 2011.

Note Todd Disner and Bruce Disner were big recruiters in ASD as well.

@Jimmy, I hope you realize your analysis is worthless because awarding points is not the same as costing the company actual money until people specifically cash it out, which they will only tend to do at 20% and even if they do that for a prolonged period their points will begin to go backwards.

Either way, referring to it as some kind of monetary loss for the company makes no sense.

People are NOT spending much money on Zeekler, they are spending BIDS (virtual currency). It won’t have much effect on the revenue and profit if somebody throws the bids away instead of using them. It won’t have much effect when someone spends 1000 bids or more to win a $150 cash auction, either.

Bids are not real money. The monetary transaction happens when the bids are BOUGHT, not when they are used in an auction. Spending bids in an auction is not a monetary transaction, so it won’t generate revenue either. Bids are worthless outside the auctions, and they don’t hold any monetary value inside the auctions, either. They hold the value of “the right to place one bid”, a non-monetary value.

A growing number of bids spent in the auctions will primarily reflect the growing balance of VIP Points among the affiliates. A growing number of customers will reflect a growing number of affiliates, who needs some “customers” to drop the bids onto in order to earn VIP Points. A commonly used method is to sign up family members and friends as “customers” when the balance starts to grow.

“MAIN REVENUE SOURCES?”

When I started checking the income sources in January 2012, the Penny Auctions and the FSC stores were claimed to be the main sources for revenue. In a case like that, people would spend most of their efforts trying to drive external customers to these two main revenue sources. Instead they were mostly trying to recruit new investors to their respective downlines. The few websites I checked were focused 95% on recruitment.

You will probably find a few affiliates actively trying to get external customers, but the majority of affiliates will only post “the daily ad”, the minimum of what’s required to earn any profit. They haven’t been encouraged to do more work, either. Recruitment pays far more than external customers.

“FRESH MONEY”

The only significant sources for “fresh money” I detected were investments from newly recruited affiliates, and some possible “additional investments” from affiliates in general (like when they have become greedy, and wants to earn more money faster).

Reinvestments are NOT “fresh money”, so I didn’t count them as “significant sources for revenue” either. From ZeekRewards’ viewpoint, the reinvestments are probably the most significant source for revenue. From my viewpoint, revenue derives from external customers rather than from investors, so affiliates circulating “old money” won’t generate any real revenue (and neither will “new money” from affiliates).

I will consider it to be a Ponzi scheme when a business needs new investments in order to pay out interests earned by old investors.

A growing number of affiliates investing and reinvesting is what ZeekRewards consider to be a “solution”, and what I will consider to be the main problem.

Clearly, you didn’t do the math. As explained before, as long as reinvestment * profitshare >= 1.1% your balance cannot go backwards.

For example: 80% reinvestment * 1.4% profitshare = 1.12% which is greater than 1.1%. So balance cannot go down.

It was YOU who gave him the number of diamond affiliates as an example?

250K Diamond affiliates with average $10,000 invested will mean 37.5 million daily points, or $7.5 million in daily withdrawals if they use an 80/20 plan, or $225 million in expenses per month (compared to the $25 million they will pay in member fees each month).

The numbers are 7 million per day and 210 million per month if you use 1.4% daily profit instead of 1.5%.

The numbers used in this example is largely exaggerated, but it was you who introduced the idea of 250,000 Diamond affiliates. The others have only played along with you, and not being very focused on the details.

When it comes to cashing out money, I’ll guess close to 100 percent of the affiliates have some ideas about cashing out sometimes in the future? They will either follow an 80/20 plan, 90/10 or any other plan for withdrawal. Very few will follow a 100% reinvestment plan forever.

“Awarding points is not the same as costing the company actual money” is only a delusion. It means the problem is delayed and will be visible in the near future, even if it’s not visible yet. And the longer it takes in time before the problem becomes visible, the bigger and more unsolvable the problem will be.

Interesting shift of position by Analyzer.

First the premise was “there are so many members, membership dues must be enough to pay for the ‘profit shares'”

When we explained that the math doesn’t work out, the premise shifted to ‘profit share can’t be that big because people don’t cash out all at once, but want to maintain their VIP point balance’. Well, that’s just reinvestment.

(also note the vagueness of both premises, leaving a ton of wiggle room)

Even if you combine the two premises together, the math still doesn’t work out, as the “investment” was already factored in (and analyzer doesn’t seem to see that). As M_Norway pointed out, it’s off by a factor of like 40.

Oh yeah, I meant this particular blog, not the whole site.

Fascinating.

The Disner’s weren’t only just big wheels in Ad Surf Daily but when Andy Bowdoin’s “offshore” version of ASD (Ad View Global) was tanking very soon after it’s launch rumors circulated that Todd might take over AVG and right the ship. His name held some currency in those circles.

I also found his name with a single digit affiliate number in a “failed to launch” autosurf program called Ad Pay Daily. The man like the ponzies.

Todd also, with the help of a former attorney friend of his named Dwight Owen Schweitzer held conference calls to raise money to fund a Pro Se lawsuit against the US Government and the accounting firm that handled ASD’s victim compensation program.