Tranont jumps on crypto fraud bandwagon with TranontCoin

Merchant subscription services, nutritional supplements and… cryptocurrency?

Merchant subscription services, nutritional supplements and… cryptocurrency?

Tranont is the latest MLM company to jump on the crypto fraud bandwagon with TranontCoin.

Cryptocurrency in and of itself isn’t fraudulent but when paired with MLM is often the “product” itself. TranontCoin isn’t that, but does share the inherent fraudulent investment scheme model wrapped up in crypto jargon approach.

Before we get into that let’s back up a bit.

Tranont’s cryptocurrency offering was announced during a webinar held yesterday.

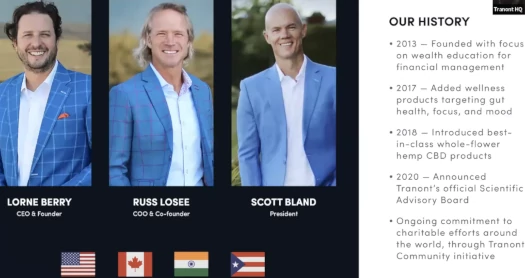

Tranont is a US-based MLM company headed up by Lorne Berry (CEO), Russ Losee (COO) and Scott Bland (President).

Evidently one or more of these men have fallen down the crypto bro rabbit-hole, and so we have TranontCoin.

Specifics of TranontCoin have yet to be made public, other than it has its own blockchain.

Lorne Berry has disclosed Tranont is working with an unnamed third-party, who “have some very, very successful ventures that they’ve done in the past”.

I’d be willing to bet disclosure of this third-party would turn up all sorts of nonsense, hence the secrecy.

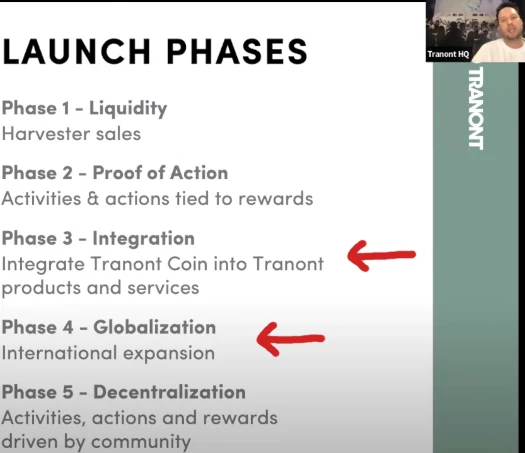

While the long-term goal appears to be full integration of TranontCoin into the company’s compensation plan…

…today we’re going to focus on the “first phase”; a daily returns investment scheme.

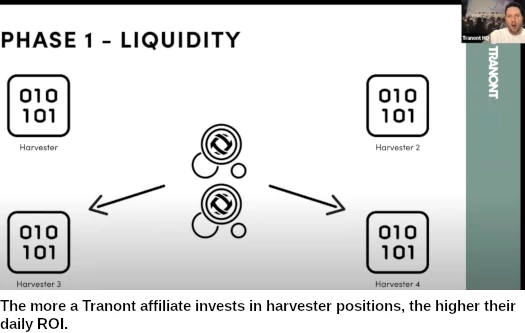

Tranont are selling “harvester” positions. These positions will see Tranont affiliates invest on the promise of a daily ROI.

Here’s how Tranont CEO Lorne Berry explained the scheme on the aforementioned overview webinar;

You’re able to purchase a harvester … and immediately once that harvester is purchased, it starts to actually compute and it starts to spit out rewards.

Now with those rewards, you can do a couple of things with them. You can go ahead, they will have a monetary value, you can go ahead and change those out. And you can change it into fiat.

How much Tranont’s harvester investment positions will cost isn’t disclosed.

The investment opportunity however is pretty clear to identify.

If you like to you can purchase another harvester. You can accumulate rewards and acquire more harvesters. That creates a little compounding effect.

Now if you have a couple of harvesters working you get more rewards. You can do that same thing again if you want to.

You can acquire more harvesters and those harvesters will grow and grow.

So I sign up as a Tranont affiliate, invest in a harvester position and receive a daily ROI – paid in TranontCoin. Where’s the fraud?

To establish that we first need to identify an investment contract. In the US this is done via the Howey Test.

As per the Howey Test;

An investment contract exists if there is an “investment of money in a common enterprise with a reasonable expectation of profits to be derived from the efforts of others.”

In Tranont we have affiliates investing in harvesters, which are sold by Tranont (the common enterprise). This is done “with a reasonable expectation of profits” (cashing out TranontCoin paid as a daily return).

To qualify to receive a daily TranontCoin ROI, affiliates only have to invest in a harvester position. Thus satisfying TranontCoin returns are derived “from the efforts of others”.

As it stands Lorne Berry has represented Tranont harvester positions are virtual investment positions. Whether there’s any hardware sent out to affiliates is unclear.

In any event, the investment contract still exists either way. I’ve covered the non-hardware scenario above. If hardware is sent out, it’s sold and must be plugged into Tranont to generate returns.

As receiver of funds invested in the positions and operator of the network the hardware is connected, Tranont is still the common-enterprise.

This is different to buying hardware and mining whatever cryptocurrency yourself – as there’s no common-enterprise involved.

So now that we’ve established an investment contract as per the Howey Test, why does that matter?

The Howey Test determines what qualifies as an “investment contract” and would therefore be subject to U.S. securities laws.

Securities in the US are regulated by the SEC. Tranont is based out of Utah in the US, is run by US-based executives and at time of publication, Alexa attributes 83% of traffic to Tranont’s website to the US.

Neither Tranont, Lorne Berry, Russ Losee or Scott Bland are registered with the SEC. You can verify this yourself by searching the SEC’s Edgar database.

By failing to register its TranontCoin harvester investment scheme with the SEC, Tranont is at a minimum committing securities fraud.

MLM crypto schemes committing securities fraud lend themselves to operating as a Ponzi scheme. In Tranont this would see funds invested in harvester positions and/or directly into TranontCoin, used to pay TranontCoin withdrawals in fiat.

Lorne Berry didn’t go into specifics of where funding for TranontCoin withdrawals will come from. I’m assuming Tranont isn’t going to admit to running a Ponzi scheme though, meaning they’ll claim to have an external revenue source to pay TranontCoin withdrawals with.

That’s fine, but the only way to verify external revenue being used to pay withdrawals is filing periodic audited financial reports with the SEC.

Tranont intends to launch its TranontCoin scheme on “the first day of summer”. Being based out of Utah, presumably this means sometime in June.

As it stands TranontCoin is a poorly thought out unregistered investment scheme. It will make Lorne Berry and other early investors a boatload of money. Tranont’s shady third-party partner will also take their cut.

This will come at the expense of Tranont’s affiliates, who for the most part are unlikely to be crypto literate (Berry’s presentation was definitely from a “OK so you know nothing about crypto” viewpoint).

If the TranontCoin harvester investment scheme goes ahead, things will then get even more messy as TranontCoin is further integrated.

Ironically across two Tranont reviews published on BehindMLM, I’ve cited Tranont’s already complicated compensation plan. That doesn’t look to be getting remedied anytime soon.

It’s important to remember that Tranont creates TranontCoin out of thin air. TranontCoin that Tranont might eventually pay bonuses and commissions with is literally generated on demand, at little to no cost.

That’s more money in the company’s pocket, again at the expense of Tranont affiliates.

On the backend withdrawals are only possible as long as there’s money to pay out. Which is being drained by the ever-increasing harvester investment scheme.

This is obviously not a sustainable business model. I won’t go into internal/external exchanges and exit-scams yet as I think that’s premature.

Pending specific costs and commissions of Tranont’s harvester investment scheme being made public, we’ll keep you posted.

In the meantime if you’re in Tranont or thinking of joining Tranont to participate in the TranontCoin scheme, I wouldn’t be investing anything until you’ve verified registration with the SEC and full disclosure via audited financial filings.

A lot hinges on who Tranont’s blockchain bro partner is, so I wouldn’t commit to anything without full disclosure on that either.

Failing which, this isn’t going to end well for any number of reasons. The most prominent of which will be “Ponzi go boom!”, or the SEC steps in and shuts Tranont down.

Update 22nd January 2023 – This article originally contained a YouTube link to the cited Tranont webinar.

Sometime in the last week the webinar video has been marked private. As such I’ve now disabled the previously accessible link.

As a general update, Tranont never mentioned TranontCoin again after April 2022.

You probably meant:

Have a great weekend, Oz!

OMG I remember editing that. I initially wrote literate and when I read it back must have missed “unlikely” or it didn’t trigger or whatever.

I specifically remember changing it thinking “whew, caught that one!”. Argh!

Thanks, and have a great weekend yourself!

This article is terrible.

The webinar is too vague to already deem this a scam.

If they want to pay their reps dollars and funny money, then so what ?

The reps are not gonna turn away free funny money.

It’s too early to call this a scam.

I would delete this article and wait a few months before embarrassing yourself with writing reviews so quickly.

LoL the Howie Test sounds cute.

The word “scam” doesn’t appear anywhere in this article.

What is identified is securities fraud, with exit-scam analysis deemed to be premature.

So what indeed. Way to deflect the identified securities fraud.

Whether you think securities fraud is cute or not is neither here nor there.

1. This isn’t a review.

2. I stand by my research. Tranont’s harvester positions pay a passive return and thus constitute a securities offering.

Tranont is not registered with the SEC, thus constituting securities fraud.

Cant see any scenario where “Henry Jamiroquai” could sound any stupider.

Hilarious…in a sad way.

Thanks for this article. I am in tranont and have benefited a lot from their products I use and I look forward to using them for years to come. I’m also deep into crypto and have been buying for 5 years.

Hearing they were releasing a coin of their own was intriguing and troubling. I have asked for actual information regarding the purpose and utility of this coin from the company and my upline and haven’t received any official info yet.

I anxiously await and hope to at least advise them of extra caution if anything.

I would expect they are doing their homework, but assumptions are dangerous. Especially in crypto.

A rug pull would devastate the company and the product supply I’ve come to rely on.

Oz, this opportunity has started flooding UK Facebook groups this week, since they are due to launch soon here.

I have already picked up their health goods do not have Food Standards Agency Approval.

Whilst there is no UK website yet, which will need to include GDPR, FCA and ICO references.

Their reps have said they will have a UK based warehouse.

With the freedom of articling and expression this author has the right to the words written, however in defence of the company Tranont and their choice to develop their own coin, is purely a choice and new opportunity for Tranont.

Nothing in your article points out any direct laws or breaking of laws or that this is viable reason to label the company as a scam.

Each and every corporation now and in the future will look for new opportunities and endeavours. Articles purely written on hearsay, gossip and personal opinion does not reflect Tranont accurately in any way.

I personally am an Independent Tranont associate and can say with confidence, Tranont products work.The compensation plans are beneficial alongside the health products.

Tranont is a success and definitely separates itself from competitors with its products and people.

Article’s written to purely bring down quality of a company, purely because the company itself wants to extend into other financial endeavours is purely unjust.

Securities fraud is illegal.

That’s nice. Perhaps you can tell us what happened to Tranont’s announced “first day of summer” 2022 launch?