The Last Network collapses, VOW “hackers!” exit-scam

![]() The Last Network Ponzi scheme has collapsed.

The Last Network Ponzi scheme has collapsed.

On August 14th VOW claimed “a bot” had improperly acquired and sold $2 billion worth of VOW tokens.

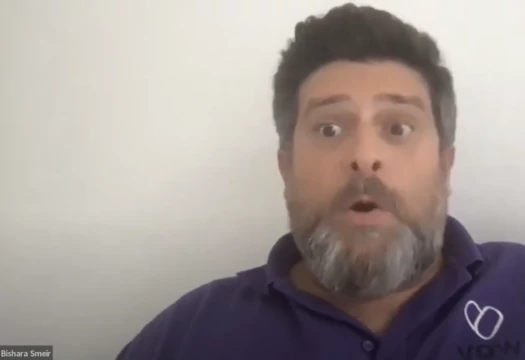

The Last Network is the MLM side of Bishara Smeir’s MLM crypto Ponzi scheme.

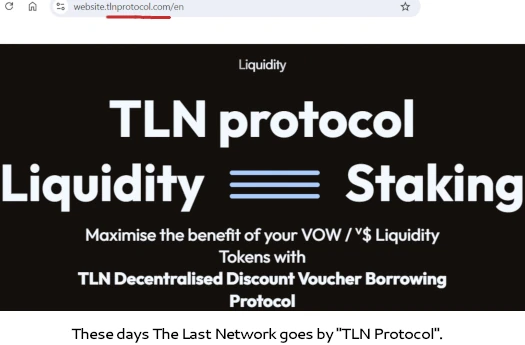

A visit to The Last Networks’ website domain today reveals the scheme was rebranded as “TLN protocol” at some point.

The underlying Ponzi scheme however is the same, invest in VOW tokens and withdraw subsequently invested cryptocurrency through the “staking” Ponzi model.

Referring to its collapse as a “market incident”, VOW’s exit-scam saw the company come up with “USD rate setter” baloney.

The USD rate was amended and 1m VOW was sent to the contract to test that everything was working as expected. This created, as expected v$100m, which is subsequently to be burned.

This time gap of making this change, testing, and reverting was around 15-30 seconds.

During this process, an unexpected event occurred where a bot acquired around 20 million VOW tokens from Uniswap and sent them to the contract resulting in nearly v$2 billion being created.

The bot subsequently then sold the $2 billion v$ into the Uniswap pool.

VOW’s exit-scam saw VOW’s public trading value plummet from ~33 cents to $0.0028 in less than half an hour.

VOW is currently sitting at 7.4 cents.

Instead of just being honest about The Last Network and VOW collapsing, the companies are stringing investors along with hopes of recovery.

This situation has caused a temporary disruption, and we understand the concerns this raises within the community.

We want to assure you that we are fully committed to address this immediately and are actively working to resolve market conditions.

$VOW means more to us all than any selfish exploiter can usurp. Fundamentals are still the same, and the massive support of our ecosystem and liquidity providers is evident, needed, and will see us prevail.

Certik, often misidentified as a financial regulator equivalent by crypto bros, published an “incident summary” pertaining to VOW’s exit-scam on August 14th.

Certik cited the same “USD rate setter” baloney VOW came up with;

On 13 August 2024, VOW token was exploited for around $1.2 million.

The usdRateSetter address in the VOW contract temporarily changed the exchange rate (usdRate) between VOW and vUSD from 1 to 100. A malicious actor exploited the new usdRate to obtain vUSD at 100 times the correct amount.

This was not the first time the usdRateSetter had temporarily modified the usdRate. On 22 November 2023 and 1 March 2024 the usdRate was also temporarily changed to 150 and 200 respectively. However, these previous changes were not exploited.

As opposed to be an instantaneous bot attack, as represented by VOW, Certik asserts “the attack contract was deployed 110 days prior to the incident”.

In other words, “somebody” planned The Last Network’s and VOW’s exit-scam back in November 2023.

The usdRateSetter had performed similar operations on 1 March 2024, changing the usdRate to 200, then to 5, and finally to 1, suggesting that the attacker was monitoring for future changes to the usdRate and immediately executed the attack once the opportunity arose.

In total they drained approximately 175 ETH, 595k USDT and 5.8M VOW.

Coinciding with its collapse, The Last Network website traffic has been in decline throughout 2024. VOW website traffic is too low to measure.

As of July 2024 SimilarWeb tracked just ~19,800 monthly The Last Network website visits, down 12% month on month.

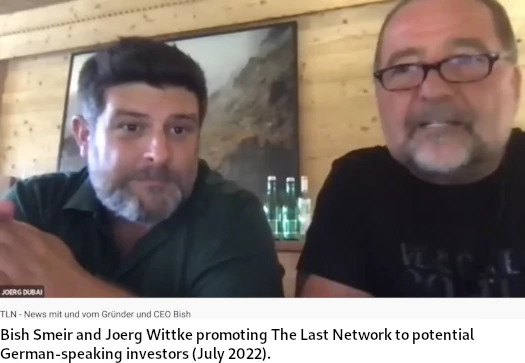

The majority of The Last Network’s website traffic is centralized across Germany (71%) and Austria (21%). New suckers in the UK appear to have been recruited just before The Last Network’s collapse.

The Last Network promotion being centralized to Germany and Austria can likely be credited to Joerg D. Wittke.

Bish Smeir represents he is based out of Scotland in the UK. Jeorg Wittke, a German national and serial promoter of Ponzi schemes, hides in Dubai.

The timeline for completion of The Last Network’s and VOW’s exit-scam is unknown. At time of publication both company’s websites remain online.

Great info, could you please investigate the Embr group that partnered with them as well?

Embr doesn’t appear to have anything to do with MLM.

They just partnered with them and dropped their crytpo token and had their holders exchange their embr tokens for VOW! Yes they’re involved!

Literally killed their bsc contract and forced their holders to adopt vow token! It seems to me that they are involved! This happened just 2 weeks before the exploit!

Read what I wrote again.

2 be fair 2 Fatman Scoob, his £20 subway season book card that was sold in Scotland was shithot.

The decent sales guys made good money, his 1/4 per cent on all cards sold made manboobs a lot of money and the punter got the best deals ever and loads of free subs over the whole year. And the subway franchises were rammed with punters and their tills were chaching all day long.

The tubster also had Tiger Tiger and Pizza Hut cards too. They sold like hotcakes too.

I did watch that VOW nonsense on YouTube and came to the conclusion that it is a sex cult club for nutters. And if they ain’t all in prison then they should be. Bunch of TJ Hooker casuals!!!