My Daily Choice dicloses 89,188 accounts breached

Following a brief disclosure and coverup back in February, My Daily Choice has now officially confirmed a data breach affecting 89,188 people.

Following a brief disclosure and coverup back in February, My Daily Choice has now officially confirmed a data breach affecting 89,188 people.

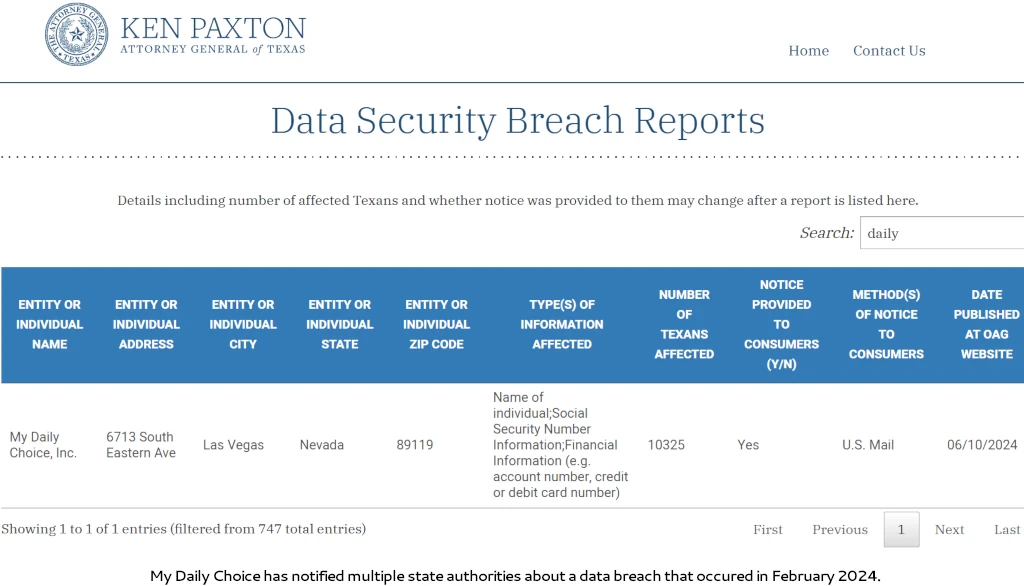

In Data Breach Notifications filed with various states (e.g. Maine, California and Texas (click below to enlarge)), My Daily Choice revealed the breach occurred on February 15th, 2024.

In notices sent out to breached account owners on June 5th, My Daily Choice co-founder and CEO Josh Zwagil (right) stated;

In notices sent out to breached account owners on June 5th, My Daily Choice co-founder and CEO Josh Zwagil (right) stated;

On or around February 15, 2024, MDC became aware of suspicious activity occurring within a third-party hosted environment in which we store company data.

We immediately launched an investigation, with assistance from our IT team and the third-party hosting vendor, to confirm the full nature and scope of the activity.

Our investigation determined that an unauthorized actor accessed, copied, and attempted to delete files stored within the third-party hosted environment on or about February 15, 2024.

My Daily Choice doesn’t name the third-party it was storing files on.

Details obtained through the breach include: account holder names, social security numbers and financial information (payment details).

Payment details include credit/debit card numbers and any provided security codes, access codes, passwords and PIN numbers.

As of June 5th My Daily Choice claims it “has no indication identity theft or fraud relating to this incident”.

For affected account holders, My Daily Choice states it is providing credit monitoring and “proactive fraud assistance”.

Single Bureau Credit Monitoring/Single Bureau Credit Report/Single Bureau Credit Score services at no charge.

Finally, we are providing you with proactive fraud assistance to help with any questions that you might have or in event that you become a victim of fraud.

These services will be provided by Cyberscout, a TransUnion company specializing in fraud assistance and remediation services.

Compromised My Daily Choice account holders are advised to continue “reviewing your account statements and monitoring your free credit reports for suspicious activity.”