iGenius adds Blue Square Wealth to CoinPro fraud

The third iteration of iGenius’ CoinPro offering sees it partnering up with Blue Square Wealth, an SEC-registered US firm.

The third iteration of iGenius’ CoinPro offering sees it partnering up with Blue Square Wealth, an SEC-registered US firm.

iGenius launched CoinPro in mid 2024. The first CoinPro iteration was in partnership with UK firm CoinRule, through which “Cforce” automated trading was offered.

On the regulatory front, iGenius’ parent company is registered with the SEC. At the time of CoinPro’s launch, CoinRule’s website stated it was not registered with the SEC “or any other regulatory authority”.

BehindMLM additionally noted there was no disclosure of iGenius’ CoinPro offering or partnership in Investview’s SEC filings.

That iGenius was offering passive returns through trading also required it to be registered with the CFTC. Investview has never been registered with the CFTC.

By mid 2025 CoinRule had disappeared, with Investview announcing CoinPro was “powered by 3Commas” in July.

3Commas is an Estonian firm operated through 3C Trade Tech Ltd, a BVI shell company. 3Commas is run out of Estonia by co-founders Yuriy Sorokin (CEO), Mikhail Goryunov (Marketing Advisor), Egor Rzumovskii (CTO) and Andres Susi (CBDO).

On its website 3Commas offers consumers direct access to its automated crypto trading platform:

In addition to itself not being registered with the SEC and CFTC, 3Commas is also not registered with the Estonian Financial Supervision and Resolution Authority (FI).

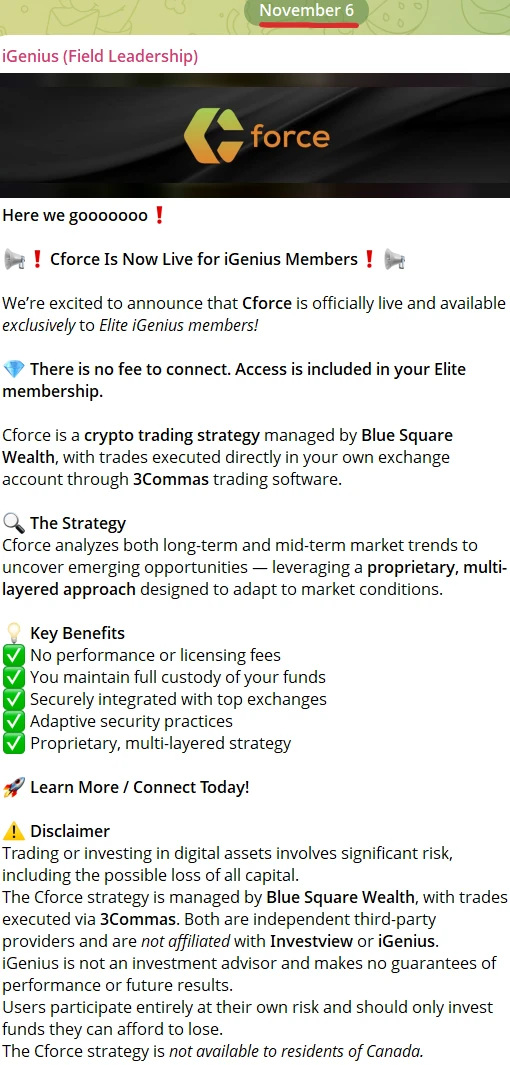

iGenius only named 3Commas as a CoinPro partner after CoinRule disappeared. As of November 6th, iGenius credits Blue Square Wealth as providing the “crypto trading strategy” behind Cforce.

Pursuant to the CoinPro securities and commodities fraud triangle that now exists, is this paragraph;

Cforce is a crypto trading strategy managed by Blue Square Wealth, with trades executed directly in your own exchange account through 3Commas trading software.

Before we get into specifics of the CoinPro securities and commodities fraud triangle though, who is Blue Square Wealth?

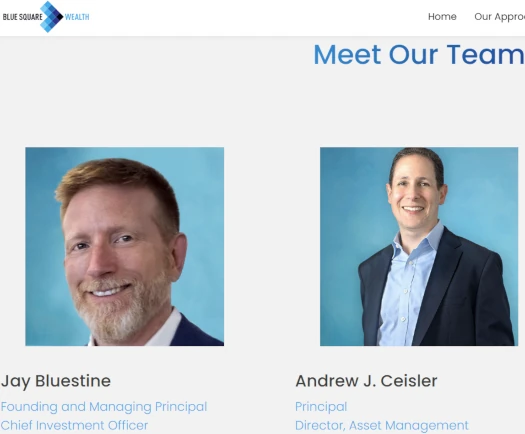

Blue Square Wealth is a US-firm based out of New York. The firm is headed up by founder Jay Bluestine.

Parent company Blue Square Asset Management provides additional information, in a Form CRS on Blue Square Wealth’s website;

Blue Square Asset Management, LLC is registered with the Securities and Exchange Commission as an

investment adviser and, as such, we provide advisory services rather than brokerage services.

Here’s the problem – Blue Square Asset Management’s SEC registration as an investment adviser does not cover providing crypto trading strategies to iGenius’ CoinPro investors.

Who is an Investment Adviser?

A. Definition of Investment Adviser

Section 202(a)(11) of the Act defines an investment adviser as any person or firm that:

-for compensation;

-is engaged in the business of;

-providing advice to others or issuing reports or analyses regarding securities.

“Providing advice” is not the same as coming up with crypto trading strategies (signals), that are fed into 3Commas’ automated trading platform.

As it stands, Blue Square Asset Management, as Blue Square Wealth, providing crypto trading strategies that are fed into 3Commas’ automated trading platform is not covered by Blue Square Asset Management’s registration with the SEC as an investment adviser.

Furthermore, neither Blue Square Asset Management or Blue Square Wealth are registered with the CFTC.

Founder and Chief Investment Officer Jay Bluestine is registered with the CFTC, but this isn’t without its own due-diligence red flags:

- in 2018 Bluestine was terminated from Raymond James Financial Services for “introducing a client to an investment away from the firm without firm approval”

- in 2020 Bluestine was fined $5000 and suspended for ninety-days, for accepting $300,001 in undisclosed, undocumented and unapproved loans from a customer

Furthermore, Bluestine’s registration with the CTFC is also as an investment adviser. Bluestine’s was registration as a broker expired in 2018, upon being terminated from Raymond James for misconduct.

So be it either its SEC or CFTC registration, Blue Asset Management is not legally authorized to provide crypto trading strategies for use in iGenius’ unregistered trading scheme.

Blue Square Asset Management would likely fall back on “we just provide advice” if pushed on this but, as we’ve already established in iGenius’ November 6th announcement, Blue Square Wealth’s part in CoinPro extends well past that of an advisory role.

To summarize;

- Investview, through it’s MLM company iGenius, is charging consumers $1699.99 and then $224.99 a month for access to CoinPro

- through CoinPro, iGenius provides access to passive returns, generated through trading strategies Blue Square Wealth provides, which are fed into 3Commas’ automated trading platform

- 3Commas is not registered with the SEC or Estonian equivalent (FI)

- CoinRule and associated partnerships are not disclosed in Investview’s SEC filings (as of the last 10-Q filed on August 13th, 2025)

- despite generating passive returns for consumers through automated crypto trading, neither Investview, iGenius, Blue Square Asset Management, Blue Square Wealth or 3Commas are registered with the CFTC as a broker (Investview, iGenius, 3Commas), or as a Commodities Trading Advisor (Investview, iGenius, Blue Square Asset Management, Blue Square Wealth)

Whether Blue Square Asset Management discloses to the SEC that it has entered into a partnership with two companies running an unregistered trading opportunity remains to be seen.

iGenius attempts to shirk its legal obligations through the following disclaimer:

The Cforce strategy is managed by Blue Square Wealth, with trades executed via 3Commas. Both are independent third-party providers and are not affiliated with Investview or iGenius.

That last bit that I’ve bolded is pseudo-compliance baloney. Blue Square Wealth and 3Commas are obviously affiliated with iGenius through its unregistered CoinPro trading offering.

If we were to frame CoinPro as a conspiracy to commit securities fraud and/or commodities fraud, iGenius would be the ringleader and 3Commas and Blue Square Wealth its accomplices.

On iGenius’ part, there is simply no excuse for continuing to engage in fraud. Investview already settled Apex securities fraud charges with the SEC in January 2025. Prior to that, Investview was fined by the CFTC for Kuvera Global commodities fraud violations in 2018.

Yet here we are with another unregistered trading opportunity being marketed to consumers.

In the meantime, we’ll draw your attention to the last sentence in iGenius’ November 6th announcement;

The Cforce strategy is not available to residents of Canada.

This is the result of Investview finalizing an iGenius fraud settlement with Ontario and Quebec in or around August 2025. It’s possible this regulatory enforcement action is the reason CoinRule disappeared.

More to the point, iGenius excluding Canadian residents from CoinPro is evidence of the securities and commodities fraud taking place.

Canada’s financial laws are materially similar to the rest of the world. If you are offering passive returns through automated trading, either you are registered with the relevant financial regulators or you are operating illegally.

Thanks for looking into Blue Square. They don’t pass the smell test. Is it possible that they are part of the grift ecosystem?

Depends how broadly you define the grift ecosystem.

Bluestine reinvented himself as a crypto bro after his termination from Raymond James. I don’t think there was any connection to iGenius prior to CoinPro.