Former EU commissioner fronts QuickX Ponzi scheme

John Dalli is a former EU Commissioner for health. He’s also Malta’s former Minister of Finance and Economy.

John Dalli is a former EU Commissioner for health. He’s also Malta’s former Minister of Finance and Economy.

In what isn’t much of a surprise, Dalli is one of the faces promoting the QuickX Ponzi scheme.

Dalli (right) resigned as health commissioner back in 2012, following an anti-fraud investigation into tobacco related bribery.

Dalli (right) resigned as health commissioner back in 2012, following an anti-fraud investigation into tobacco related bribery.

That case is ongoing, with Dalli pleading not guilty last month.

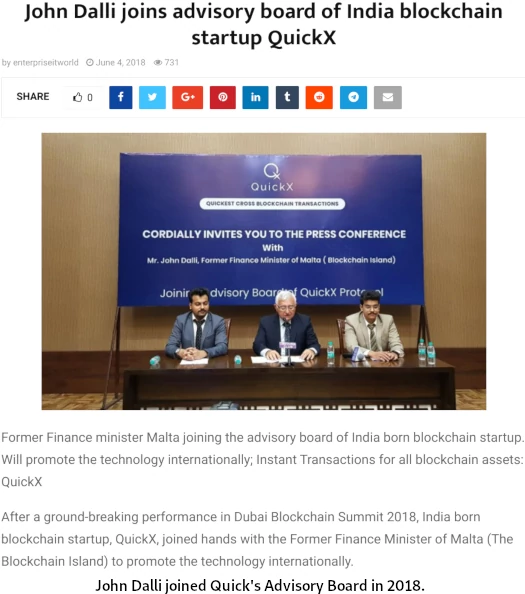

In 2018 Dalli was appointed to QuickX’s Advisory Board.

QuickX is an crypto Ponzi scheme run from India by Kshitij and Vaibhav Adhlakha.

BehindMLM first came across QuickX through Crypto Advice in 2019.

Crypto Advice was a Ponzi scheme built around QuickX’s QCX token.

The scam was fronted by Boris CEO Jordan Lucas…

…but believed to be operated from India by the Adhlakha brothers.

Possibly tying in to Dalli, Crypto Advice was set up as a Maltese shell company.

In 2021 BehindMLM reviewed Riseoo, another MLM crypto Ponzi confirmed to be run by the Adhlakha brothers.

Crypto Advice has collapsed and its website is long gone. Riseoo’s website is still up but recruitment has collapsed outside of Algeria.

No longer tracked on any public exchange by CoinMarketCap, QCX token also appears to have collapsed.

QuickX’s former FaceBook page has been deleted. The QuickX Twitter profile was abandoned in December 2021.

Again, tying into Dalli, QuickX operates through the Maltese shell company QuickX Limited. The Maltese address used to register QuickX belongs to Dalli.

Registered in 2018, QuickX Limited to date has failed to file any annual or financial reports.

Dalli’s ties to QuickX was recently reported on by The Shift News. A November 6th report also reveals the Malta Financial Services Authority recently issued a QuickX securities fraud warning.

The Shift News has been trying to get the MFSA to take action on QuickX and Dalli since early 2021.

The Shift has been working on the story for months. Questions were sent to the MFSA in January 2021, but the only reply received was that the Authority was looking into the case.

More than a year later, the MFSA has issued a warning when things had gone too far, and a number of people had suffered due to the regulator’s lack of action.

This is an all too familiar story.

Prior to getting involved in crypto fraud, Dalli was tied to

an operation scamming Christian believers out of their savings by persuading them to put their money into her nonexistent scheme to ‘support small-time gold-miners in Thailand’.

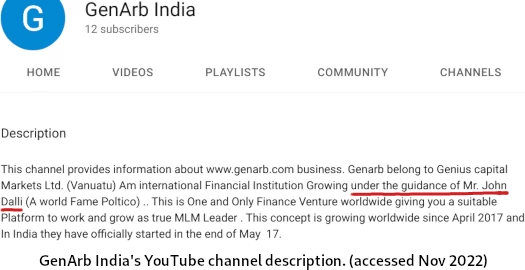

Dalli’s first crypto fraud scheme was Genius Capital Markets (Gen Arb), a collapsed Ponzi scheme Dalli heaped praise on in 2017.

In line with the state of MLM related securities fraud regulation across Europe, Dalli’s first QuickX marketing speech saw him speak on

how cryptocurrencies will allow people to shift money around without being “spied upon” by law enforcement.

QuickX itself stated in a press-release that

Dalli’s presence on the QuickX advisory board, according to the company, “…cannot be understated as it could allow the start-up to obtain unequalled access to government regulators – minimising regulatory uncertainty for the company”.

“At this time you’ll be hard-pressed to find token sales that have been green-lighted by an establishment player.

This is what makes QuickX’s token sale [ICO] so unique, as it has the backing of Malta’s former finance minister John Dalli.”

Other than MFSA’s “after the fact” warning, Maltese authorities have taken no action against QuickX, Dalli or the Adhlakha brothers.

BehindMLM has long lamented on the failure of European authorities to effectively combat MLM related securities fraud.

An ex-Finance Minister and former EU Commissioner openly defrauding consumers through Ponzi schemes, while not surprising, reflects extremely poorly on Maltese authorities.

I’m impressed by this informations that help me keep my community from scammers that has make thousands loose interest in online assets.

It baffles me how regulators can be so damned slow to take action and at least issue warnings. How the hell long does it take to review these obvious, blatant financial fraud schemes? Are they just trying to make their job look harder?

It’s not difficult:

Are they publicly offering a security? (Yes)

Have they registered their security offering? (No)

There, done: obvious securities fraud is obvious. Issue a damned warning, at the very least.

Oh, and don’t cower in fear at some law firm and retract it later, like the Brits did with OneCoin (one of the biggest and most obvious Ponzi schemes in history).