Dan Putnam continues securities fraud with Avasar

As part of what appears to be ongoing efforts to defraud consumers through securities fraud, Dan Putnam has launched Avasar.

As part of what appears to be ongoing efforts to defraud consumers through securities fraud, Dan Putnam has launched Avasar.

Through Avasar, Putnam is pitching consumers on passive monthly returns – purportedly paid from the profits of Amazon storefronts.

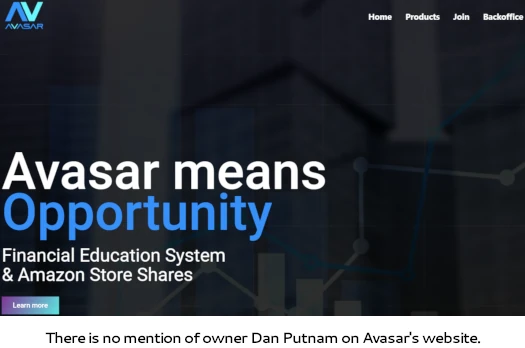

Avasar operates on the domain “avasar.com”, the private registration of which was last updated on August 5th, 2024.

There is no indication on the website that Avasar is owned by Putnam.

The only clue Putnam runs Avasar is the mention of Rubi AI:

BehindMLM first came across Rubi AI in August 2023, as part of Flex.

Launched as a standalone MLM opportunity, Flex enables members to steal and regurgitate copyrighted content.

Building on that, we now have Rubi AI attached to Avasar.

Avasar charges $39.95 a month for some basic services:

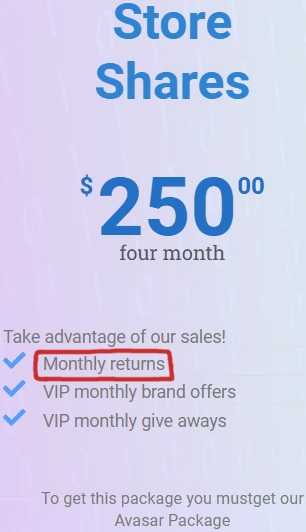

The passive returns “store shares” opportunity costs an additional $250 quarterly:

As above, taken directly from Avasar’s website, Avasar affiliates pay $250 a quarter on the promise of “monthly returns”. Said monthly returns are purportedly tied to Amazon storefronts.

We are one of the largest E-Commerce companies in the USA, headquartered in Salt Lake City, Utah, with extensive warehouses across the United States.

With decades of experience, we’ve achieved millions in sales and continue to lead the industry.

Imagine being part of our vast inventory and reaping substantial profits! We proudly stock renowned brands like Nike, Adidas, Reebok, and more, ensuring quality and prestige. Hurry—shares in our stores are extremely limited!

As per the Howey Test, Avasar’s “store shares” investment opportunity constitutes a securities offering.

Avasar affiliates are

- investing $250 with the company every quarter (an investment of money in a common enterprise);

- on the promise of “monthly returns” (with a reasonable expectation of profits); and

- “monthly returns” are purportedly paid out of the revenue of Avasar managed Amazon storefronts (derived from the efforts of others)

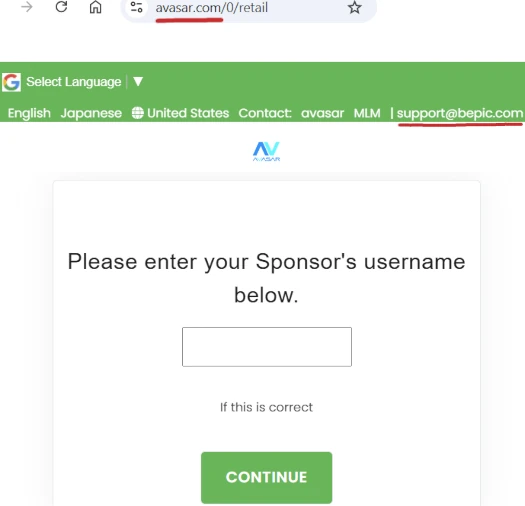

Clicking the “join” button on Avasar’s website redirects visitors to an Avasar skinned version of B-Epic’s website:

B-Epic is another MLM company owned by Putnam.

Pertinent to Putnam (right) continuing to commit securities fraud through Avasar, neither B-Epic, Avasar or Putnam are registered with the SEC.

Pertinent to Putnam (right) continuing to commit securities fraud through Avasar, neither B-Epic, Avasar or Putnam are registered with the SEC.

In December 2022 Putnam settled a $12 million securities fraud lawsuit filed by the SEC. The SEC’s filed 2020 lawsuit accused Putnam and two accomplices of defrauded consumers through three MLM crypto Ponzis.

In March 2024 BehindMLM noted Putnam seemingly violating his SEC fraud settlement through Aiscend.

Aiscend, another standalone MLM opportunity, sees Putnam pitch consumers on “hands-free trading with trade buddy”. In addition to not being registered with the SEC, Putnam and Aiscend aren’t registered with the CFTC either.

There isn’t a trading component to Avasar so only securities fraud applies.

Whether the SEC goes after Putnam for two additional documented unregistered securities offerings remains to be seen.