Conti Review: Film investment “click a button” Ponzi

Conti fails to provide ownership or executive information on its website.

Conti fails to provide ownership or executive information on its website.

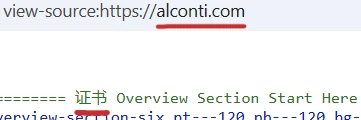

Conti operates from two known website domains:

- alconti.com – first registered in January 2020, private registration last updated on September 24th, 2023 (app funnel)

- conti.vip – registered with bogus details in July 2023, registration last updated on September 24th, 2024 (app)

In an attempt to appear legitimate, Conti provides a company certificate for Conti INTL-CULT LTD. Conti INTL-CULT LTD was registered in the UK on August 2nd, 2024.

Due to the ease with which scammers are able to incorporate shell companies with bogus details, for the purpose of MLM due-diligence these certificates are meaningless.

If we look at the source-code of Conti’s .COM website, we find Chinese:

This suggests whoever is running Conti has ties to China.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

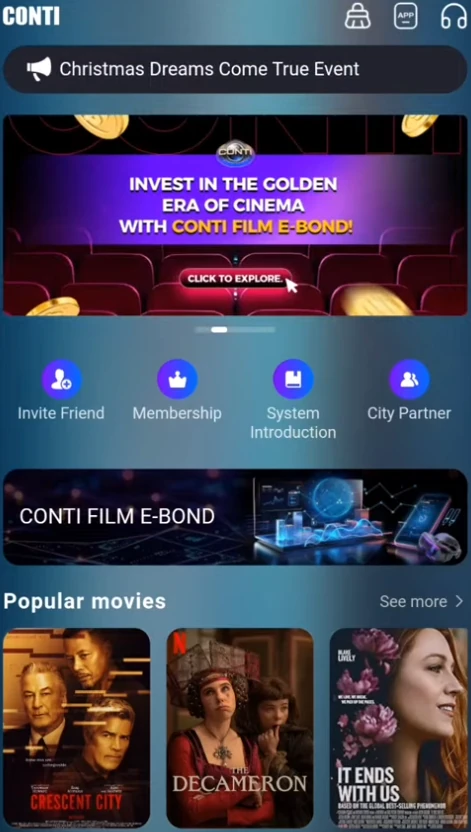

Conti’s Products

Conti has no retailable products or services.

Affiliates are only able to market Conti affiliate membership itself.

Conti’s Compensation Plan

Conti affiliates invest tether (USDT). This is done on the promise of advertised passive returns:

- VIP1 – invest 50 USDT and receive 2 USDT a day

- VIP2 – invest 200 USDT and receive 8 USDT a day

- VIP3 – invest 500 USDT and receive 20 USDT a day

- VIP4 – invest 1000 USDT and receive 40 USDT a day

- VIP5 – invest 3000 USDT and receive 120 USDT a day

- VIP6 – invest 6000 USDT and receive 240 USDT a day

- VIP7 – invest 10,000 USDT and receive 400 USDT a day

Conti pays referral commissions on invested USDT down three levels of recruitment (unilevel):

- level 1 (personally recruited affiliates) – 6%

- level 2 – 4%

- level 3 – 2%

Joining Conti

Conti affiliate membership is free.

Full participation in the attached income opportunity requires a minimum 50 USDT investment.

Conti Conclusion

Conti is yet another “click a button” app Ponzi scheme.

Conti’s “click a button” Ponzi ruse is film investment (dressed up as “Conti film e-bonds).

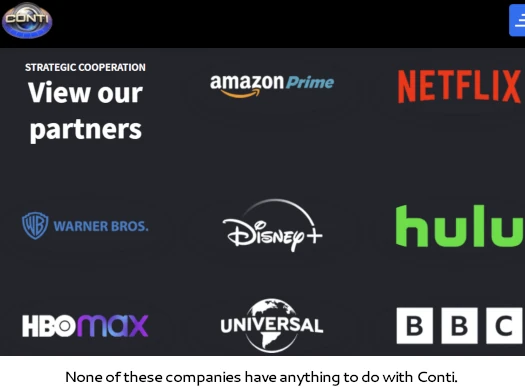

As part of its Ponzi ruse, Hollywood-Films misappropriates the name and branding of well-known film studios and streaming companies:

The presented ruse is Conti affiliates log in and click a button (the more invested the more the button needs to be clicked).

Clicking the button purportedly generates revenue via “score”, which is tied to some baloney about AI data. Said data is purportedly sold to Conti’s fictitious partners, with a percentage going to affiliate investors (who do nothing more than click a button in an app).

If that makes no sense it’s because it doesn’t. Clicking a button in an app has nothing to do with film investment or AI data.

In reality clicking a button inside Conti’s app does nothing. All Conti does is recycle newly invested funds to pay earlier investors.

Conti is part of a group of “click a button” app Ponzis that emerged in late 2021.

Examples of already collapsed “click a button” app Ponzis using the same film investment ruse include Pixar MOV, Hollywood-Films and Use.

Since 2021 BehindMLM has documented hundreds of “click a button” app Ponzis. Most of them last a few weeks to a few months before collapsing.

“Click a button” app Ponzis disappear by disabling both their websites and app. This tends to happen without notice, leaving the majority of investors with a loss (inevitable Ponzi math).

Organized crime interests from China operate scam factories behind “click a button” Ponzis from south-east Asian countries.

In September 2024, the US Department of Treasury sanctioned Cambodian politician Ly Yong Phat over ties to Chinese human trafficking scam factories.

Through various companies he owns, Phat is alleged to shelter Chinese scammers operating out of Cambodia.

Regardless of which country they operate from, the same group of Chinese scammers are believed to be behind the “click a button” app Ponzi plague.

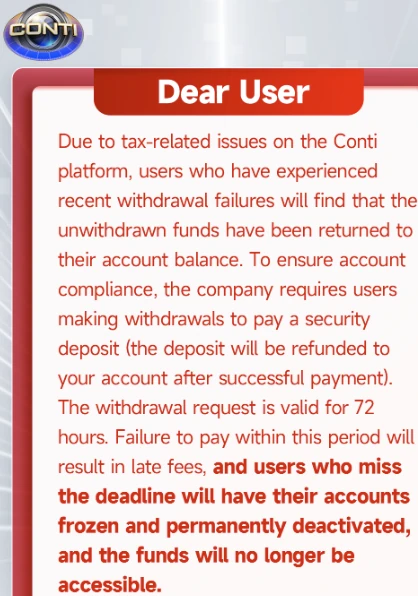

Update 6th October 2024 – Conti has collapsed. Investors are being fed baloney about taxes and are being asked to deposit more money.

This is a classic recovery scam, wherein a fee is charged on the promise of fund recovery.

Conti investors gullible enough to fall for the “scam within a scam” will lose said fee on top of their already lost Conti investment.

From the comments below, Conti appears to have hit Macedonia quite hard. Not that they’d be able to do anything about Chinese scammers, but I haven’t seen anything from Macedonian authorities yet.

Hat tip to Danny de Hek on this one:

youtube.com/live/3x-uDrGSuRI

This scheme is running rampant in North Macedonia. A ponzi like this has not hit the country since Cairos.

The mood around this one is different as the majority of people involved (aside from the dumbest of the dumb) know that this is a pyramid scheme but believe that they’re going to ride the wave and even attacking anyone who points the obvious so they “don’t ruin a good thing and let it ride, we know what we’re doing”.

Anyone with half a brain moved from this country over the past 150 years and what is left are the genetic rejects with a median IQ of 87 which REALLY shows with this ponzi scheme which couldn’t be dumber.

I thought only South Africa had a population this dumb, degenerate and cunning but North Macedonias are right up there and possibly surpassed South Africa given their population numbers.

When this thing inevitably fails in a couple of months everyone will start acting like “how could this have happened” with ZERO shame, self-reflection or sense of irony.

I usually take pity on dumb, poor, ugly and mentally retarded people (95% of North Macedonia), and I believe that it’s the government’s authorities job to protect them from their own stupidity, but this time around let them burn, right down to their ugly root.

BONUS: This ponzi has an App PUBLISHED on Google Play Store available for download: play.google.com/store/apps/details?id=com.ContiClip.ahdev

This is a first for me, a ponzi so brazen to actually publish their app on an app store, and Google has done NOTHING on the dozens of reports I have sent.

Update:

Google refuses to do anything about a blatant Ponzi scheme being distributed through their Google Play Store. The app has 100.000+ installs and is in the top 10 most downloaded apps in certain countries.

This is the response I got after filing a detailed report citing laws, writing a detailed explanation:

“please note that Google’s services host third-party content. Google is not a creator or mediator of that content. We encourage you to resolve any disputes directly with the individual who posted the content.”

Mind you even though I reported illegal content, the form is tailored mainly for copyright claims, and there’s absolutely no way to report an app for illegal activity.

Is Google complicit at this point?

Can someone get the Reddit bots to mass flag this app please? I had my account perma-banned.

A reader wrote in to ask about NorthStar, operating from “northstareval.com” (registered August 8th, 2024).

Support is the Meiqia chat bot so it’s the usual Chinese scammers. Looks to be a film investment ruse (dressed up as content licensing), but I can’t find any specifics.

Not sure if that means NorthStar has been abandoned or if it’s a Ponzi in waiting. Either way leaving a note here in case anyone else comes across it.

Conti Entertainment collapsed, payouts are halted and group chat admins start to disappear.

The scheme collapsed before Google pulled the app, the app is STILL up on the Google Play Store.

Thanks for the heads up. Will monitor for a bit before confirming.

I think it’s definitely joever for the Macedonians. No more magic button :'(

i.redd.it/7gmkmr9zy0td1.png

Confirmed, good ol’ “taxes” exit-scam. Been a while since we’ve seen one (2022):

https://behindmlm.com/companies/vccp-click-a-button-ponzi-collapses-pulls-taxes-exit-scam/

Macedonians must have come off particularly gullible and lost a lot of money for them to bother.

Added confirmation of Conti’s collapse and “taxes” exit-scam to the review.

We are feeling hopeless about the organization is stabilised in UK or not ..

Need Justice.