BitNest collapses, desperate node Ponzi reboots

The BitNest Ponzi scheme has collapsed.

The BitNest Ponzi scheme has collapsed.

Instead of just disappearing with everyone’s money, over the past fortnight BitNest has launched no less than four reboots.

BitNest launched around mid 2024 after predecessor Yunis Loop collapsed. Both schemes are believed to be run by Chinese scammers.

The original BitNest Ponzi saw the scam sell “BitLoop” positions in USDT, offering up to 24% every 28 days.

On December 24th, BitNest advised it had terminated its original investment scheme;

Due to a temporary imbalance in the current liquidity structure, and the upcoming launch of the new BitNest version, there are logical conflicts between the old and new mechanisms during the transition period.

To avoid affecting more users or causing erroneous operations during the system upgrade, the platform has made the following decisions:

BitLoop (Lending and Leasing Market) has been temporarily closed.

“Temporary imbalance in the current liquidity structure” is crypto jargon for “Ponzi go boom”.

In the lead up to BitNest’s original Ponzi collapsing, “MEC node” investment positions were being pushed.

MEC node positions were targeted at BitNest’s top recruiters and cost up to 141,750 USDT per investment position.

On December 29th BitNest rolled out “BitNest Loop C”, a replacement for its original collapsed Ponzi scheme.

BitNest Loop C is an expanded participation method within the BitNest Loop system.

While maintaining complete consistency with the original system logic, matching mechanism, and profit structure, it provides users with the option to participate in circulation using USDC.

BitNest Loop C does not replace the original BitNest Loop, but rather extends its participation methods.

Apparently suckers handed over enough new money for BitNest to start up its original Ponzi on January 4th.

Starting today, affected BitLoop orders have gradually resumed normal settlement processes, and funds will be returned and credited according to established rules.

“Normal settlement processes” for BitNest is putting withdrawal requests in a “processing queue” to be “settled gradually”.

On January 6th, BitNest announced the launch of new “DAO Phase II” node investment positions.

The (fourth?) reboot in less than a fortnite sees BitNest commit to its Mellion (MEC) shit token. Mellion has its own website up at “mellion.io”, privately registered on September 1st, 2025.

MEC itself is just a low-effort BEP-20 token. BEP-20 tokens can be created in just a few minutes at little to no cost.

BitNest’s fourth reboot MEC node investment positions cost up to 157,889 USDT each.

Who is still dumping money into BitNest is unclear. What is clear is the scammers running BitNest seem keen to milk investors with new launches every few days.

Not expecting any of these BitNest reboots to go anywhere, we’ll check back in later this month for an update.

Update 31st January 2026 – Not much has happened since BitNest collapsed.

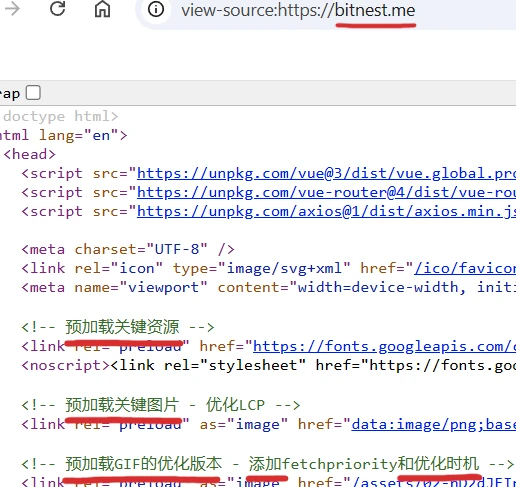

A clone website has been set up on the domain “bitnest.finance”, private registration last updated on January 14th, 2026. This is likely a safeguard in the event BitNest’s original domain is suspended due to fraud.

The MEC node investment exit-scam scheme appears to have already collapsed. This is from a January 30th update;

BitNest DAO will implement compliance segregation management at the governance level for USDT funds generated from MEC node sales.

This upgrade will be implemented in phases according to the established DAO governance process in the coming days, aiming to reduce potential exposure to Anti-Money Laundering (AML) and cross-jurisdictional tax compliance risks.

TL;DR: Good luck getting your money out.

Not expecting much but I’ll check back at the end of February for another round of “our Ponzi collapsed but we can’t be honest” nonsense.

Article updated with latest stalling from BitNest during their exit-scam.