AiYellow jumps on crypto bandwagon with Yellow Trading Coin (YTC)

AiYellow’s hopping on the MLM crypto bandwagon is as cookie cutter as it gets.

AiYellow’s hopping on the MLM crypto bandwagon is as cookie cutter as it gets.

Before we get into that though, some history.

AiYellow launched in 2005. Although they’ve added bits and pieces to it over the years, the core business model has remained relatively unchanged.

AiYellow is centered around a useless business director (because y’know, the internet itself isn’t big enough itself).

The money side of things sees AiYellow affiliates sign up and pay fees for merchant licenses.

These codes can be sold to merchants (or more likely given away because nobody is paying for them).

Commissions are tied to affiliate recruitment, by way of initial signup fees and forced monthly spends.

Long story short, what have is a company full of affiliates buying merchant codes each month. That’s the main revenue spinner and what drives the compensation plan.

For the most part AiYellow had been limping along, until the company announced its YellowTradingCoin ICO last year.

YellowTradingCoin is an ERC-20 shit token. It serves no purpose other than AiYellow’s owners to suck even more money out of their affiliate base.

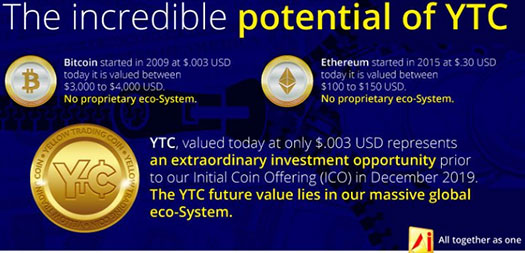

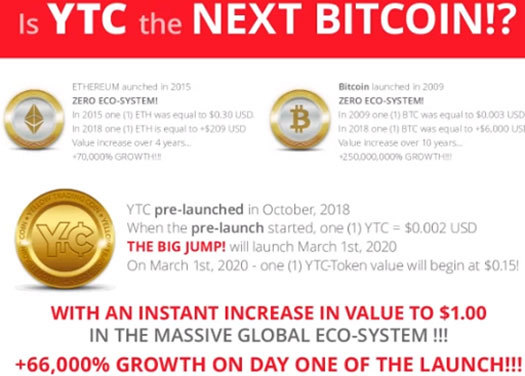

Investment in YTC is solicited on the usual comparisons to bitcoin and bullshit promises of lambo riches:

AiYellow themselves literally concede YTC is just a crypto cash grab;

The YTC Token is riding on the massive wave of Momentum created by the Blockchain revolution.

In reality AiYellow was a useless directory and nobody used. Adding a crypto shit token isn’t going to change anything.

Yet despite that, AiYellow maintains it’s an existing use case and is sure to drive up YTC’s value… when it publicly launches in March 2020.

Yes, you read that right. AiYellow is ICO’ing its YTC shit token for one whole year.

YTC was flogged to what’s left of the AiYellow affiliate-base for 2 cents a token. By March 2020 the company plans to go public at 15 cents a token.

No particular reason, it’s just an arbitrary value AiYellow has plucked out of thin air.

Until then affiliates can invest in YTC, however I believe they’re not allowed to sell for 75 days.

The cited reason for this is to “deter speculation as the value increases” (AiYellow arbitrarily sets the internal value of YTC as they see fit).

By now you should be intimately familiar with the MLM crypto scam model. But for those who aren’t;

After extracting as much as it can out of its affiliates, on or around March 2020 AiYellow will get listed on some dodgy public exchange.

Initially there’ll be a pump, during which AiYellow management will dump as much YTC as they can (AiYellow management generate YTC at little to no cost).

AiYellow affiliates will be told YTC is “going to the moon” and encouraged to invest more.

When that’s over the value dumps, leaving YTC bagholders to watch their coins dump to $0.

The fact of the matter is a business directory nobody uses isn’t going to prop YTC up. Even without the crypto nonsense AiYellow’s business directory is an outdated concept (even so in 2012, when we first reviewed the company).

Want proof?

When was the last time you used anything other than a search engine to find information on a company or product? Hell, when was the last time you went to a website to use their business directory?

Back in 2012 AiYellow was headed up by co-founders Martin Naka and Rick Cabo.

Curiously, the AiYellow YTC whitepaper cites Frank Varon as CEO of YellowTradingCoin.

Curiously, the AiYellow YTC whitepaper cites Frank Varon as CEO of YellowTradingCoin.

Not really sure how you can CEO of an ERC-20 token but alrighty then.

As per the “corporate team” section of AiYellow’s website, Martin Naka and Rick Cabo are still running the show.

Naka is cited as residing in Thailand and Cabo in the US (Los Angeles).

I don’t know if Varon is actually based out of the scam friendly jurisdiction Saint Marteen, but it should be obvious AiYellow has no physical presence there.

At the time of publication Alexa pegs Colombia (29%), Greece (18%), Thailand (10%), Venezuela (8%) and Brazil (8%) as the top sources of traffic to the AiYellow website.

Despite quite clearly marketing a passive investment opportunity, AiYellow provides no indication it has registered its securities offering in any jurisdiction.

That means that in addition to pyramid fraud, AiYellow, its corporate stafff and affiliate promoters are also committing securities fraud.

Simply put; If regulators don’t step in between now and March 2020, the vast majority of AiYellow YTC investors will lose money in yet another MLM altcoin exit-scam.

Firstly. The language used here is not professional.

Secondly. This sounds like sour grapes.

Please have the decency when you want to run a Company down for personal gain, make sure of your facts! Defamation is a serious matter.

So we can all agree AiYello’s Yellow Trading Coin is a desperate MLM crypto Ponzi cash grab…

…hey wait a minute. This language is unprofessional. That’s it, I’m outraged!

Defamation no doubt is a serious matter. Might want to check your definition of defamation though.

Reporting the fact that AiYellow’s Yellow Trading Coin is a MLM crypto Ponzi scam isn’t defamatory.

Good day

Has there been any new information or development of YTC? Where would I be able to get more information if this is a scam or not?

This is being highly promoted in South African market and would like to get more information if anyone can help.

A crypto Ponzi is a crypto Ponzi.

Sounds like the only developments are the recruitment of gullible South African investors.

Hi.

I’ve been caught in this shit scam. Lanora Rodgers please tell me where I can get my investment back at least. nevermind the “actual” value accoring to you lot scammers.

I whish all scammers ……. just disapear with the same pain they caused others.

You can’t, that’s not how a Ponzi scheme works. Sorry for your loss.

Did anybody sell any tokens in South Africa since the launce

when can I sell my YTC please?

Who’s going to buy them?

You invested in worthless Ponzi points. Sorry for your loss.

Technically, the coins remain in my “Account.” The idea is to create a marketplace whereby you trade the coins for goods.

In South Africa there is no one particularly interested in propping up #GDC Co-op’s marketplace platform. My hope of recovery hangs balanced on Europe developing THEIR market.

The Brokers are now being bashed for not selling the concept properly, but we were all attending webinars hosted by the GM’s in South Africa.

I have proof that the coin was still marketed as tradeable thru LUNO as late as mid January 2020. We were all asked to open LUNO accounts.

I have recorded one of the General Manager’s webinars in which she mentions the Luno account as a requirement and another training video on YouTube published by a GM confirming linking your wallet to Bitcoin, Eth as a means to trade your coins.

This was blocked for viewing after we brought it to GDC Co-ops notice. All in all, just a very disappointing outcome.

Pyramid scheme goes shit token Ponzi. Nobody outside of the scheme will ever care about the token and that’s why you’re left bagholding.

Is there no organization who can help people who invested in ytc?

If this is really a scam how do this people sleep at night?

how many old and poor people lost money by investing money.Cleary someone is making money by taking money.

I also invested money into ytc and waited for the biggg jumppp!!!! Everyone thought by 1 March 2020 they would be able to sell there coins, but that was never the case.

From ytc to luno to gdc and still nothing. The once marketing the coins should be kept reliable for the losses of poor peoples money.

They told Noone that they would have to do marketing and advertising to sell coins. Another big lie…….

What, you thought you’d just magically arrive at lambo town?

Sell the coins to who? Nobody outside of Ponzi points schemes cares about them.

You got taken for a ride, same as any other Ponzi scheme. The operators sleep very well, with your money.

I see they busy burning ytc coins again, telling investors that there value will increase…..

How many people can honestly say ‘I sold my coins’???? Anyone?

If this YTC is so fantastic like they proclaim it is. Why not give us the opportunity to sell in exchange for bitcoin??? Why cant we sell these so call amazing tokens?

Apparently they a market place where you can exchange about 10% of price of item on there market place website, then cash for the other 90%…

all their websites are so pathetic it’s a joke… such a waste of money and the brokers all encourage us to hold on to the tokens. It’s just a massive scam where I believe the brokers are making money but not us.

Why wont they register there erc20 tokens on etherscan. ???? Sort your shit out yellow trading coin… do it now.

Caz I Fully agree with you.. I personally made peace with the fact that I lost money in this scam.

The coins you buy is definitely from your broker, that why it’s so easy to say “but we manage to sell coins” seriously??? What about the so call investors?? What are they selling??

This YTC coin or yellow trading coin. Is the biggest scam…. why cant you exchange the coin for ethereum as you guys boasted.

Is it an erc20 token? You boast it has gone live and public but there is zero information on etherscan.

Arrest the lot of these thief’s including the brokers who refuse to help anyone cash out. Scammers. Thieves. Fakers

This is one of the biggest bullshit scams i have ever been caught with. And all the brokers just disapeared!

Reported them to the SEC. so many red flags. Why do they say we can sell our coins on there closed platform?

Why wont the brokers sell our coins when they sign up new members? They said we can exchange them for zoidpay but now i heard we cannot.

Your bullshit stories are going to get the lit of you in jail. Sooner the better. Brokers included.

I also have my doubts about this coin. Big promises in the beginning, but no proof in the pudding.

I think this coin will disappear very soon. Got me caught for a big PUzzzzzzzzzzzzzzzzzzzzzzzz!

Lanora Rogers I’m pretty sure you are eating your words now, you were a big advocate for this scam.