UGP Review: Union Green Power Boris CEO Ponzi

Union Green power, or UGP, fails to provide verifiable ownership or executive information on its website.

Union Green power, or UGP, fails to provide verifiable ownership or executive information on its website.

The only executive listed on UGP’s website is COO “Michael Warner”.

Outside of Union Green Power’s website and a FaceBook profile created in August 2025, Warner doesn’t exist. This makes him a prime Boris CEO candidate.

It should be noted that the Warner FaceBook profile creation coincides with Union Green Power’s website domain, “uniongreenpower.com”, being privately registered on July 31st, 2025.

According to its official Telegram channel, Union Green Power launched on November 1st, 2025.

While not always, Boris CEO MLM schemes are typically run by Russian scammers.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

Novae Money Review: Financial services rebrand + stock fraud

BehindMLM first reviewed Novae back in 2016. The company we reviewed no longer exists, with Novae rebranding as “Novae: The Credit and Money Company” early last year.

BehindMLM first reviewed Novae back in 2016. The company we reviewed no longer exists, with Novae rebranding as “Novae: The Credit and Money Company” early last year.

Novae’s name-change coincided with the company joining the DSA. To keep things simple we’ll continue to refer to the company as Novae Money.

At the request of a reader back in October, today we’re revisiting Novae for an updated review. [Continue reading…]

Exfusion Review: Tag Markets investment fraud

Exfusion operates from a subdomain “exfusion.ibportal.io”. The root domain, “ibportal.io”, was privately registered on October 19th, 2025.

Exfusion operates from a subdomain “exfusion.ibportal.io”. The root domain, “ibportal.io”, was privately registered on October 19th, 2025.

The “ibportal.io” root domain is disabled. A search for the domain reveals multiple Tag Markets associated schemes operating from it.

Beyond its “ibportal.io” subdomain, Exfusion is run through a shady Telegram group named @exfusioninternationalofficial.

Names we can attach through Exfusion marketing material are serial fraudsters.

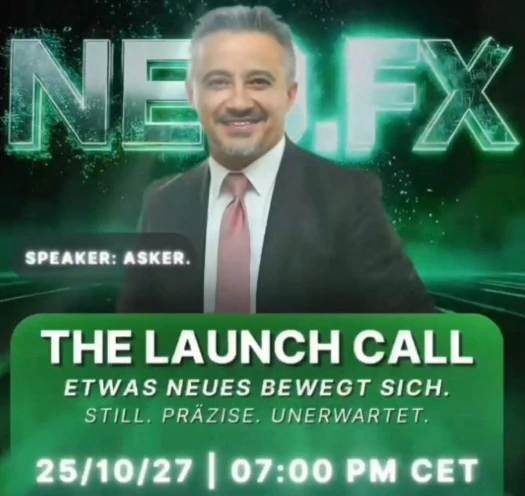

First we have Asker Sakinmaz:

Sakinmaz, from Turkey, first popped up on BehindMLM’s radar as CEO of the FlexKom pyramid scheme in 2013.

FlexKom was rebooted as Weeconomy in 2019. Weeconomy marked a transition to MLM related crypto fraud.

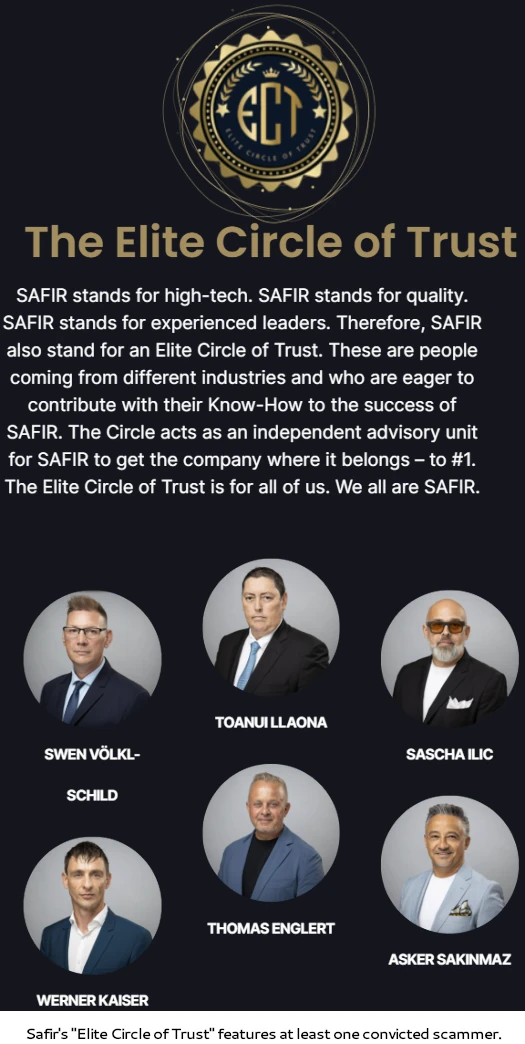

In his capacity as a FlexKom executive, Sakinmaz was convicted on fraud charges in Belgium in 2020. Sakinmaz, convicted in absentia, was sentenced to forty months in prison and an €18,000 EUR fine.

After Weeconomy collapsed, in 2021 Sakinmaz resurfaced as part of Safir International’s “circle of trust”.

Safir International was an MLM crypto Ponzi built around Zeniq Coin. The scam collapsed in 2023.

After Safir International Sakinmaz resurfaced as Director of Sales for the AiConnects MLM crypto Ponzi.

AiConnects’ website is still up but its social media was abandoned in October 2025.

Another name we can attach to Exfusion is Michael Baur:

As above, Baur is running official Exfusion and NeoFX marketing webinars.

In 2019 a BehindMLM reader tied Baur to the CMMT Revolution Ponzi scheme. In August 2022, another BehindMLM reader tied Baur to the collapsed PLC Ultima series of Ponzi schemes.

Baur resurfaced in 2024 to front the Skainet Systems Ponzi scheme.

Skainet Systems collapsed in June 2025. A short-lived Cermak reboot collapsed in July 2025.

Baur resurfaced in September 2025 as CMO of the Nexxano pyramid scheme. Nexxano’s website is still up but Baur is assumed to have ditched the scam and moved on with Exfusion.

On a December 9th Exfusion marketing presentation, Baur confirmed he resides in Dubai.

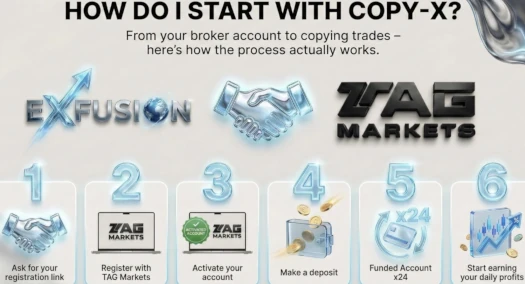

Exfusion marketing material cites partnership with Tag Markets:

This is because Exfusion is run on Tag Markets, an MLM investment fraud factory owned by Jared Esguerra:

On social media, Esguerra represents he works in “financial services” and is based out of Dubai;

In addition to Esguerra Tag Markets was co-founded by CEO Kevin Marin Valez, a “digital creator” and “business administrator” based out of Colombia.

As per the “Kevin Marin” marketing slide above, Tag Markets is represented to be operating from Columbia [sic] and Dubai.

Due to the proliferation of scams and failure to enforce securities fraud regulation, BehindMLM ranks Dubai as the MLM crime capital of the world.

BehindMLM’s guidelines for Dubai are:

- If someone lives in Dubai and approaches you about an MLM opportunity, they’re trying to scam you.

- If an MLM company is based out of or represents it has ties to Dubai, it’s a scam.

If you want to know specifically how this applies to Exfusion, read on for a full review. [Continue reading…]

Subhash Sharma’s MLM crypto Ponzi empire targeted in India

Indian authorities have taken steps to recover funds misappropriated through Subhash Sharma’s MLM crypto Ponzi empire.

Scams named as part of Sharma’s empire include Korvio, Voscrow, DGT, Hypenext, and A-Global. [Continue reading…]

Maxizone Touch MLM scam arrests in India

Indian authorities have arrested husband-and-wife directors of Maxizone Touch.

Indian authorities have arrested husband-and-wife directors of Maxizone Touch.

BehindMLM isn’t familiar with Maxizone Touch but the Enforcement Directorate cites it as an “MLM scam”.

Maxizone Touch operated from the domain “mymaxizone.com”, registered to Bhushan Singh on November 18th, 2024.

From Maxizone Touch’s official Instagram profile; [Continue reading…]

Meta Whale criminal investigation in Vietnam, arrest warrants

Vietnamese authorities have initiated a criminal investigation into Meta Whale.

Vietnamese authorities have initiated a criminal investigation into Meta Whale.

Arrest warrants have been issued against top promoters, following confirmation Meta Whale operates illegally. [Continue reading…]

Rodney Burton deemed a flight risk for a third time

A court has determined that HyperFund Ponzi promoter Rodney Burton is still a flight risk.

A court has determined that HyperFund Ponzi promoter Rodney Burton is still a flight risk.

The December 22nd ruling marks three instances of a court determining, no matter the conditions imposed, releasing Burton is too risky. [Continue reading…]

iGenius pivots from trading to… selling lab diamonds?

iGenius has revealed plans to sell lab diamonds in 2026.

iGenius has revealed plans to sell lab diamonds in 2026.

Top iGenius promoter Anthony Napolitano claims $25,000 to $30,000 commissions will be offered. Not everyone is happy about the pivot from trading to jewelry though. [Continue reading…]

EXW’s Manuel Batista arrested, detained in Dubai

EXW Ponzi fugitive Manuel Batista has been arrested and detained in Dubai.

EXW Ponzi fugitive Manuel Batista has been arrested and detained in Dubai.

Court records seen by BehindMLM reveal Batista was arrested in connection with a criminal case filed earlier this year. On December 12th, a Dubai court ordered Batista detained pending trial.

Beyond assaulting a woman, specifics of fraud charges laid against Batista in Dubai are unclear. [Continue reading…]

TexitCoin collapses, website disabled & socials abandoned

The TexitCoin MLM crypto Ponzi has collapsed.

The TexitCoin MLM crypto Ponzi has collapsed.

TexitCoin has been luring investors in on the promise of up to 900% over the past few months. In the lead up to the holiday season however, TexitCoin’s TXC shitcoin has collapsed. [Continue reading…]