Binaxx Review: Sann Rodrigues still pushing Ponzis in 2022

Binaxx provides no information on its website about who owns or runs the business.

Binaxx provides no information on its website about who owns or runs the business.

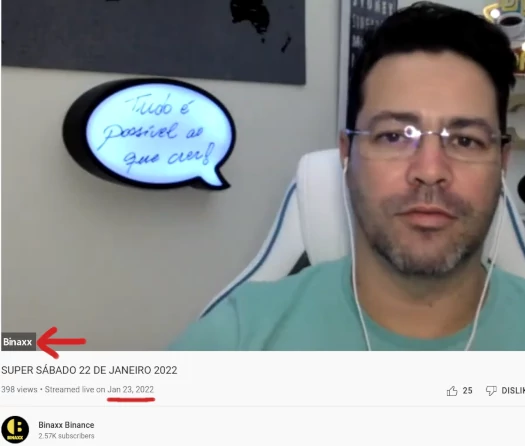

What its website does provide is links to its socials. Once of those accounts is Binaxx’s official YouTube channel, on which we see Sann Rodrigues hosting Binaxx corporate marketing videos.

Binaxx’s Zoom account name is “Binaxx”, signalling he’s representing corporate and not a promoter.

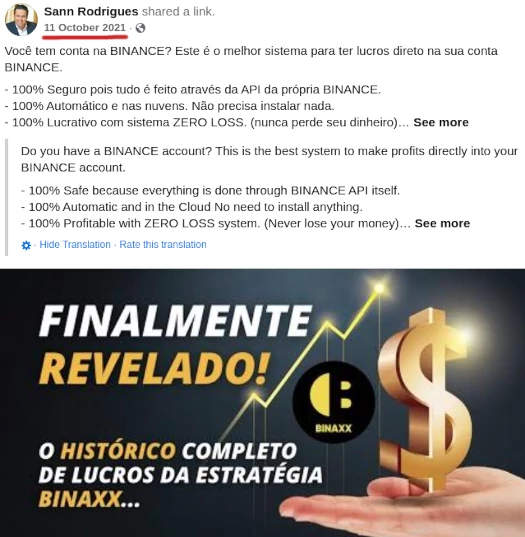

That said Rodrigues has been personally promoting Binaxx on social media since last October.

Binaxx’s website domain (“binaxx.com”), was privately registered on August 31st, 2021.

Rodrigues doesn’t clarify his exact role within Binaxx. He’s clearly either running it though, or working very closely with whoever is.

Rodrigues, full name Sanderley Rodrigues De Vasconcelos, is best known as the top promoter of TelexFree.

TelexFree was a $3.6 billion Ponzi scheme. Rodrigues himself pocketed over $3 million.

In 2017 Rodrigues settled TelexFree fraud charges with the SEC for $1.7 million.

The disgraced scammer is believed to have left the US to settle in Portugal.

Brazilian authorities have an open investigation into Rodrigues. In Feb 2020 it emerged Rodrigues managed to flee Brazil for the US with the aid of Federal Police.

At the time criminal proceedings against Rodrigues barred him from leaving the country.

As of July 2020, Brazilian authorities had made two arrests; one of the police officers involved and an attorney. Over $340,000 in cryptocurrency had also been seized.

After TelexFree, Rodrigues went on to promote iFreeX, BitinForex (Top10Cap) and Clube365.

These were all Ponzi schemes.

Clube365 popped up in early 2020. A visit to the scam’s website reveals Clube365’s website domain is for sale.

Read on for a full review of Binaxx’s MLM opportunity.

Binaxx’s Products

Binaxx has no retailable products or services.

Affiliates are only able to market Binaxx affiliate membership itself.

Binaxx’s Compensation Plan

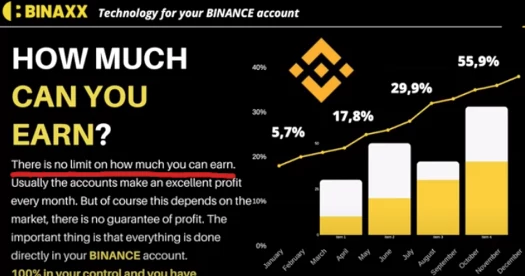

Binaxx affiliates invest tether (USDT) or bitcoin (BTC), on the promise of “no limit” passive returns.

Investment is tied to an annual fee, which determines how much in fees Binaxx charges on returns:

- C5 – $5 annual fee, min $150 USDT or 0.005 BTC and Binaxx charges a 50% ROI fee

- A10 – $10 annual fee, min $150 USDT or 0.005 BTC and Binaxx charges a 48% ROI fee

- A20 – $20 annual fee, min $150 USDT or 0.005 BTC and Binaxx charges a 40% ROI fee

- A30 – $30 annual fee, min $150 USDT or 0.005 BTC and Binaxx charges a 39% ROI fee

- A50 – $50 annual fee, min $150 USDT or 0.005 BTC and Binaxx charges a 38% ROI fee

- A70 – $70 annual fee, min $150 USDT or 0.005 BTC and Binaxx charges a 37% ROI fee

- A100 – $100 annual fee, min $150 USDT or 0.005 BTC and Binaxx charges a 36% ROI fee

- A200 – $200 annual fee, min $150 USDT or 0.005 BTC and Binaxx charges a 35% ROI fee

- A300 – $300 annual fee, min $150 USDT or 0.005 BTC and Binaxx charges a 34% ROI fee

- X5 – $500 annual fee, min $500 USDT or 0.015 BTC and Binaxx charges a 33% ROI fee

- X6 – $600 annual fee, min $300 USDT or 0.075 BTC and Binaxx charges a 30% ROI fee

- X7 – $700 annual fee, min $5000 USDT or 0.15 BTC and Binaxx charges a 27% ROI fee

- X8 – $800 annual fee, min $10,000 USDT or 0.25 BTC and Binaxx charges a 25% ROI fee

- X10 – $1000 annual fee, min $20,000 or 0.5 BTC and Binaxx charges a 20% ROI fee

Referral Commissions

Binaxx pays referral commissions on initial fee payments, as well as ROI fees imposed on downline affiliates.

Referral commissions are tracked via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

Binaxx appears to cap payable unilevel team levels at thirty.

Referral commission rates and how many levels commissions are paid on, are determined by how much a Binaxx affiliate pays in fees.

- C5 tier affiliates don’t earn referral commissions

- A10 tier affiliates earn 10% on level 1 annual fees (personally recruited affiliates)

- A20 tier affiliates earn 15% on annual fees and 10% on ROI fees, paid across levels 1 to 3

- A30 tier affiliates earn 20% on annual fees and 14% on ROI fees, paid across levels 1 to 5

- A50 tier affiliates earn 25% on annual fees and 17% on ROI fees, paid across levels 1 to 7

- A70 tier affiliates earn 25% on annual fees and 20% on ROI fees, paid across levels 1 to 10

- A100 tier affiliates earn 30% on annual fees and 21% on ROI fees, paid across levels 1 to 12

- A200 tier affiliates earn 30% on annual fees and 22.5% on ROI fees, paid across levels 1 to 15

- A300 tier affiliates earn 30% on annual fees and 25% on ROI fees, paid across levels 1 to 20

- X5 and higher tier affiliates earn 30% on annual and ROI fees, paid across all available 30 levels

The MLM side of Binaxx is a bit unclear.

I believe 30% of fees paid are paid out in commissions regardless of tier. This means that higher tier affiliates are able to collect the difference on commissions paid to lesser tier affiliates.

E.g. if someone in your downline is an A30, they earn 20% and 14%. If you were an A200, you earn 30% and 22.5%.

Assuming there’s nobody at a higher tier between you and your A30 downline, you’d earn the 10%/12.5% difference on any commissions they earn.

An affiliate or affiliates higher than A200 upline, would collect the difference on ROI fees paid until the full 30% is paid out (at A200 the full 30% on annual fees paid has already been paid out to you).

Earnings Caps

Binaxx has a 300% earnings cap, however it’s unclear what this specifically applies to.

Given returns are supposed to be unlimited, I believe the 300% earnings cap applies to commissions earned.

This would either be a periodic cap (daily/weekly/monthly), or a subscription based cap.

I’m not sure which of these the earnings cap is and Binaxx don’t specify.

If it’s the latter (which I believe is more likely), then the concept of these being “annual fee” only really applies to those not recruiting.

Joining Binaxx

Binaxx affiliate membership is $5 to $1000 annually.

The more an affiliate pays in fees, the less they are charged in ROI fees and the more they are able to earn.

It is unclear whether membership fees need to be paid again when the 300% earnings cap is reached.

Binaxx Conclusion

Having gotten nowhere with basic crypto Ponzi schemes, Sann Rodrigues is back with a “lulz can’t touch our money!” Ponzi scheme.

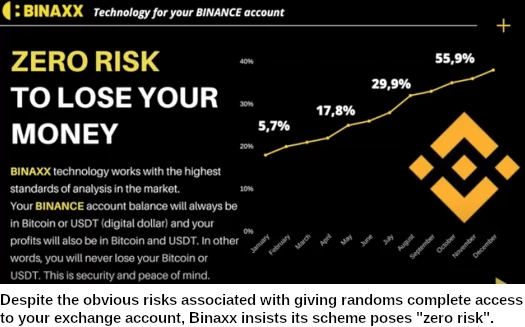

These schemes market heavily on the premise that they can’t directly access funds held in a third-party exchange account.

The reality is they don’t need to. Affiliates give Binaxx complete control of their funds through a bot.

The bot is programmed by Binaxx and does whatever they program it to do. This can be changed on a whim.

“Lulz can’t touch our money!” Ponzi schemes shuffle money between accounts through the bot. This takes place via trades but isn’t actual profitable trading.

When affiliate recruitment dries up, a “lulz can’t touch our money!” scam collapses and affiliate accounts are drained.

Any number of excuses are created to cover this up. iQuandex called it “technical error”. Digital Profit called it a “rare black swan market condition”.

The end-result was the same. Admins of the scams made off with affiliate’s money.

On the regulatory front MLM companies offering passive investment schemes need to be registered.

Neither Binaxx or Sann Rodrigues are registered to offer securities in any jurisdiction.

Rodrigues was explicitly banned from committing further acts of securities fraud as part of his TelexFree settlement.

At time of publication Alexa ranks Binaxx’s website at 8 million. This is climbing, suggesting recruitment is growing.

When it stops, refer back to iQuandex and Digital Profit for how Binaxx will end.