Bangor Bank denies partnership with TranzactCard

![]() Maine headquartered Bangor Bank has denied having a partnership with TranzactCard.

Maine headquartered Bangor Bank has denied having a partnership with TranzactCard.

The denial comes just days after TranzactCard corporate revealed Bangor Bank as their new US partner bank.

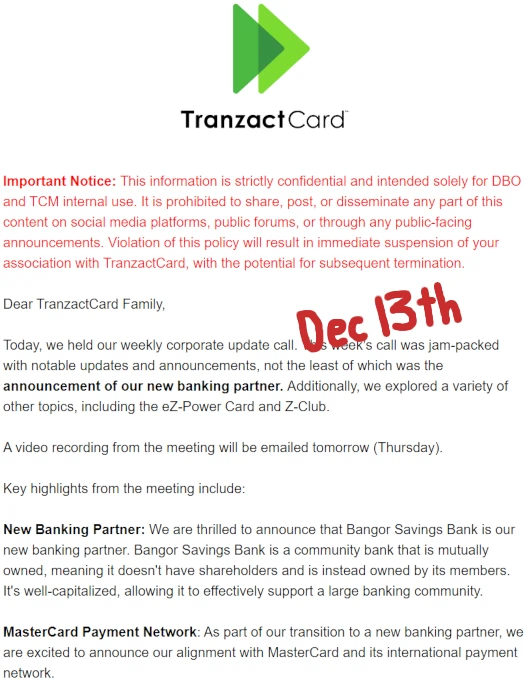

Following a “corporate update call” on Wednesday, TranzactCard sent out a “weekly update” later that same day.

The relevant part for this article is quoted below;

We are thrilled to announce that Bangor Savings Bank is our new banking partner.

Bangor Savings Bank is a community bank that is mutually owned, meaning it doesn’t have shareholders and is instead owned by its members.

It’s well-capitalized, allowing it to effectively support a large banking community.

As part of our transition to a new banking partner, we are excited to announce our alignment with MasterCard and its international payment network.

After verifying Bangor Bank was an actual bank, I took this at face value and added an update to our “TranzactCard loses US banking services” article.

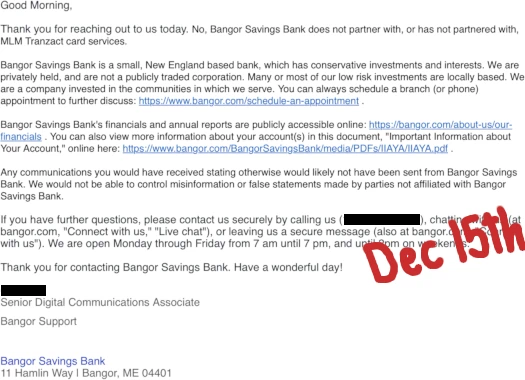

One BehindMLM reader went a step further. They reached out to Bangor Bank to enquire about the TranzactCard partnership.

Here’s the email they received back from a “Senior Digital Communications Associate” at Bangor Support.

Again, the relevant part for this article is quoted below;

Bangor Savings Bank does not partner with, or has not partnered with, MLM Tranzact card services.

Any communications you would have received stating otherwise would likely not have been sent from Bangor Savings Bank.

We would not be able to control misinformation or false statements made by parties not affiliated with Bangor Savings Bank.

Well, that’s kinda awkward.

It’s possible TranzactCard has completed an entire partnership proposal with Bangor Bank using inconspicuously named shell companies.

If so, now that the cat’s out of the bag that’s probably going to be terminated quick smart (making misrepresentations to banks is typically frowned upon).

Otherwise I can’t see why TranzactCard would take the risk in naming Bangor Bank, given anyone can just reach out to them to confirm.

As per TranzactCard’s weekly update;

With our new banking partner, the onboarding and customer identification process for all waitlist accounts will occur in a phased rollout starting next week, beginning with some of our field leaders who will test the functionality of the system.

Once this testing happens, we’ll then begin a phased onboarding for the entire TranzactCard community through a waitlist process.

Pending further updates, stay tuned…

Update 18th December 2023 – TranzactCard held an emergency webinar over the weekend. During the webinar TranzactCard walked back their Bangor Bank “partner bank” announcement.

TranzactCard now claims Bangor Bank is a “sponsor bank”. Distributors were instructed not to call Bangor Bank to verify.

These TranzactCard people have no shame. Or brains. Obviously someone was going to ask Bangor Bank to verify the statement!

I am sure most of your readers appreciate the importance of a bank partnership.

No bank = no transaction processing. Having a bank opens international banking as well.

The larger banks have gotten burned and may be a bit more careful in partnering with a sketching MLM (Epstein, yes, a sketchy MLM, no). Small banks are hungry for business partnership that create a flow of transactions.

I am not surprised at this info. OK over 25,000 TRANZACTCARD members have no bank to use their debit card but only with the promise to get “Z-BUCKS now presented for every 2 dollar spent you get 1 Z-bucks. (shame).

The TRANZACTCARD started out back in August 2023 as one for one. In other words you get equal 1 Z-Bucks for every dollar spent and now it is every 2 dollars spent you get 1 Z-Buck.

What TRANZACTCARD was trying to do is miniplate a small community bank to except 25,000 card members that will deposit $1.00 to average $1,000 or more into their bank.

Any bank manager would be up in arms with wide open and except that deal. But luckily Bangor Bank saw the smoke and decline to except them.

OK the trend continues to search for a bank. So what is wrong with some of the largest banks in the USA? OK, Well Fargo, Chase, America, Federal Credit Unions (why won’t they except TRANSACTCARD/).

Moving forward to the promise land with TRANSACTCARD. My debit card is still free without a monthly fee. (mmmmmm!)

Those 25,000 TRANSACTCARD have a choice, stay and face the extra monthly fees or in the movie (Chicken), just find a way to fly away from the coop.

I just read a TRANSACTCARD review from a customer. He said after joining he gets 2 Z-Bucks for every dollar spend. So, correct me if I am wrong that you get 1 Z-Bucks for 2 dollar spend.

Is the world going crazy! OK we are going into 2024 and my questions is: What is TRANSACTCARD OFFERING? Happy New Year, we will see next year 2024.

Bangor Savings Bank is a member owned institution … imagine 100,000 new members arriving from a sketchy MLM and electing Richard Smith Bank President, TranzActCard Nirvana, now they are the Bank!

Today they held an “all hands-on-deck TranzactCard field update.”

They announced that Ken Dohety, formerly of WorldVentures, is the new TranzactCard COO. Ken’s first action was to ask all DBOs to stop calling Bangor Savings Bank.

Bill Andreoli is no longer with the company, no reason was given for his departure.

Peter Rancie promises that the Z-Club will be launched “next year.” Updates are of course pending.

A “large number” of DBOs were accidentally removed from the database. Fixes are promised and a one month grace period has been added for people who lost rank due to the error.

Lots and lots of MLM waffle. Follow the “vision,” disregard all the failed promises above all, ignore people who ask uncomfortable questions.

@GlimDropper – are they still claiming that Bangor Savings Bank is their partner?

We should list the names of the so-called leaders behind this money grab.

They go from scam to scam with little to no consequences (to themselves) because the regulators don’t appear to be interested in pursuing the mid-level con artists of white-collar crime.

MONEY GAME HALL OF SHAME?

Andreoli is gone already?

I wonder if that ties into this Bangor Bank debacle…

Peter Rancie is now claiming that they have no bank “Partners”……… They only have bank/Program “Sponsors”…………..

“Bank Partners” has been banned from the “Servant Leaders” vocabulary………… LOL.

People is saying this Fake News…

Ok.. I’ll agree. But the Burden of Proof is on You who say it’s fake to Provide Proof that TranzactCard is Partners or is being Sponsored by Bancorp.

If you can’t then know that you fell for a scam.

Nothing wrong with it. We all been scammed at one time or another and now it’s just your turn.

Bangor Savings Bank is partnered with fintech PayWith Worldwide and may not have known of any deal between fintech PayWith Worldwide and TranzactCard.

Why wouldn’t TranzactCard just name PayWith Worldwide then?

Why would Bangor refer to this Tranzact thing as “MLM Tranzact Card services”?

How did the emailer refer to Tranzact?

Bangor could easily say they’ve not partnered with “MLM Tranzact Card services” when the company name is TranzactCard. In alot of business deals, details are important when asking questions.

Ask using wrong names, you’ll get the answer to that question rightly if that announcement is legal to announce at said given time.

^^ Grasping at straws.

I’m putting together the followup from TranzactCard. It pretty much leaves no room for doubt that they aren’t “partnered” with Bangor Bank.

That will be an interesting followup. This reply to an email looks made up to me actually.

Amazing grift. Looking forward to follow up posts on this.

Just chatted with Bangor savings. Tranzact DOES have a relationship with them.

So now they have a person in charge who helped WorldVentures go bankrupt? Multiple failed individuals at business in charge… Run!

TranzactCard does not have the experience, resources, risk-level, financial sophistication, management, or credibility to establish a direct sponsorship with any financial institution.

@william

Cool. Now what does “sponsor bank” mean? What are they sponsoring and for whom?

If there was a direct relationship Derek would have answered, “Yes.”

@OZ

YOU are the independent journalist that “researches”. How about doing some. 1 click and you find that the term is basically synonymous.

I say that in not reading the article, but wanted to share the link so you and others can get off the semantic wagon.

lithic.com/blog/bank-partners

Semantics matter when it comes to finance law. If Bangor Bank is a sponsor bank, who are the other players involved? Why is this information being hidden from consumers?

The onus isn’t on me or anyone else to decrypt TranzactCard’s false statements or resort to assumptions to interpret them.

The onus is on TranzactCard to provide accurate and non-misleading information to consumers (which they’ve so far failed to do as documented on BehindMLM).

Failing to do so is illegal as per the FTC Act and Commodities Act.

One could even make the argument that in withholding crucial due-diligence information from consumers, Bangor Bank is violating US law.

It appears that a “sponsor bank” processes credit card transactions:

It appears that a “partner bank” allows the fintech to offer a range of businesses services. It short, it seems that TranzactCard has Bangor Bank to process credit cards.

Is it a direct relationship between the two or is there a third-party intermediary though. This sort of stuff should be in a public disclaimer as was disclosed with the original banking channels.

Hey Oz, I wouldn’t be too quick to say that Bangor is violating US law for transparency if their deal is not complete and they have not actually issued any cards or done any transactions for Tranzact.

Reporting the truth is being objective about the truth. You have done a remarkable job on pointing out several truths that were hidden from the public because these type of MLM companies lack regulation which includes the sexual abuse and drugging you wrote about in another article and how company culture played into that occuring.

That being said, there is always the possibility that some small bank will want that business because that is how they make money as well.

If Tranzact actually does pull this off and gets up and running as a platform, good for them. That would still not change the legitimate and ethical questions that you have raised about the industry ethos and corporate culture that seems to go with these things which has created alot of value for people in helping them make informed decisions for whatever they choose and for that I applaud you.

I hope Tranzact actually does work out for the people invested so heavily and emotionally into this. However, you get what you pay for, so the quality of the product may or may not be what they claim or what people are expecting but that remains to be seen.

I fully agree that claims of ‘influencers’ as Richard Smith was videotaped saying preemptively was and are manipulation fabrications to create FOMO for a product that may never even fully materialize.

At the end of the day, people will spend their money however they want to….

Someone posted a purported chat log of Bangor Bank stating they were TranzactCard’s sponsor bank.

Good question. The source I found quickly provides a bit more, for example:

The source also say the bank is responsible for vetting the fintech company because “…ultimately, they assume the risk for each of the fintech’s transactions and customers.”

According to this source a “direct relationship” fits the partnership label.

Source: tallied.io/university-credit-card/sponsor-banks-101-how-do-they-work

The phrase “you get what you pay for” does not apply in instances of misleading product AND/OR earnings claims. The MLM industry if rife both.

Other phrases like “a fool and their money are soon parted” or “you pay your money and you take your chances” or “buyer beware,” also do not apply when the decision to buy (or join an MLM) is based on deceptive marketing.

Community Banks are not exempt and TranzactCard will be a challenge for Sponsor Bank Bangor Savings. TranzactCard’s beneficial owner is on the Utah White Collar Crime Offender Registry.

TranzactCard’s CEO started his own United States Bankers Association to game potential TranzactCard members.

TranzactCard ridiculously claims to return $1 for each $1 spent in debit card swipes. TranzactCard’s DBOs make outrageous claims such as being a bank.

TranzactCard’s prior sponsor bank terminated the relationship. Not to mention TranzactCard’s principal source of income, Multi Level Marketing member fees. The outcome will be entertaining.

“Banking is Hard” – Peter Rancie

americanbar.org/groups/business_law/resources/business-law-today/2023-july/guardrails-for-bank-fintech-partnerships/#:~:text=The%20Final%20Guidance%20lays%20out,an%20ongoing%20basis%2C%20and%2C%20if

@Oz…

So is this the arguement you are making with this piece? Please clarify. (Ozedit: derails removed)

That was clearly a remark in response to Scarecrow. Stop fishing.

Disclosure failures that prevent consumers from making informed decisions are part of US law (FTC Act, the Securities Act and the Commodities Act).

@BillKeep…You misunderstood the context of what I was saying by “You get what you pay for” and I fully agree that the MLM industry is rife with misleading product and/or earning claims.

It is applicable from the context that if what you think you are purchasing was not well researched and you didn’t objectively weigh all considerations, then what purchased is a delusion.

To use an analogy, there are warning signs all over cigarettes, yet that doesn’t people from purchasing them and using that product. This is a FREE country, and what comes from that freedom is the right to make good well informed decisions or ill-informed choices.

What I meant with “You get what you pay for” is that you might be buying a delusion according to some people’s opinions, or you might have just purchased the pot of gold at the end of the rainbow.

Whatever your opinion when you lay down your own money for what you personally find valuable is just that, a personal, hopefully adult decision.

If you want to go down that rabbit hole, TranzactCard today is bears absolutely no resemblance to what was announced a few months ago.

Consumers can’t even make delusional decisions when the goalposts move every other week and information is intentionally hidden from them.

@Oz.. you cut out a paragraph of the rest of my post. No fishing here. Straight up objective question.

Have you contacted Tranzact as Bangor has stated and is there a lack of due-dilligence on your own part in researching this piece? (Ozedit: strawman derails removed)

Whether I have or haven’t is irrelevant to TranzactCard and Bangor Bank failing to provide consumers with enough information to make an informed decision about TranzactCard’s MLM opportunity.

This is a legal requirement and your first and last warning on strawman arguments.