Local City Places launches $99 “units” securities fraud

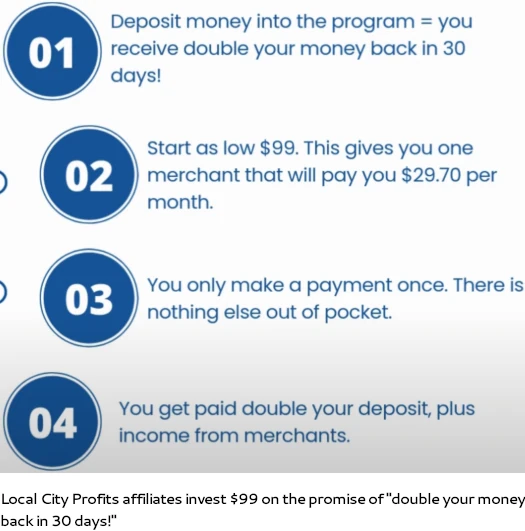

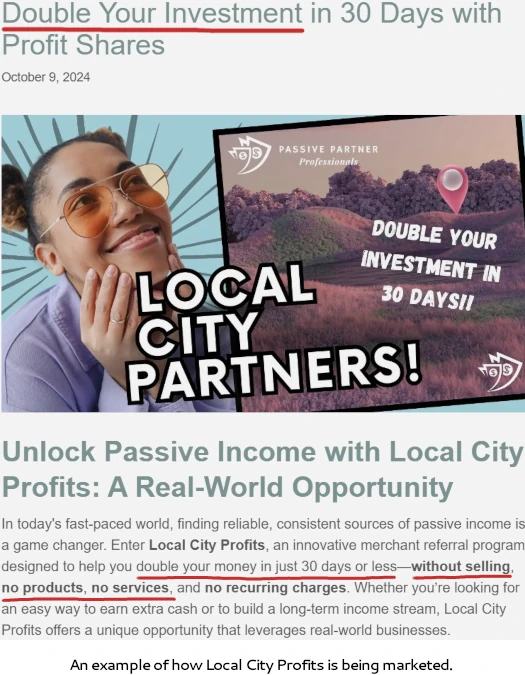

Local City Places has launched a $99 investment scheme promising “double your money back in 30 days!”

Local City Places has launched a $99 investment scheme promising “double your money back in 30 days!”

The new passive returns investment scheme follows Local City Places’ failed “business directory” scheme earlier this year.

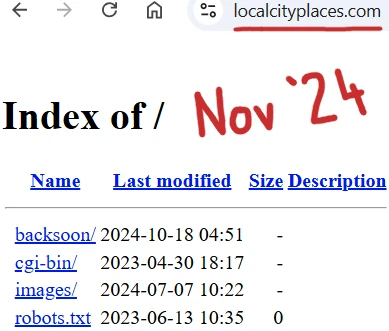

A visit to Local City Places’ website currently returns this:

In place of the collapsed MLM company we now have Local City Deals and Local City Profits.

Local City Deals still has Local City Places branding and appears to be an online voucher platform:

Local City Deals’ website appears to have been hastily put together and remains unfinished:

I could be wrong but I don’t think Local City Profits has its own website. It appears to be run from within Local City Deals.

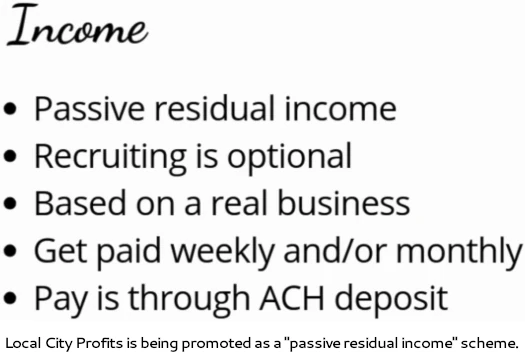

Local City Profits, aka Local City Partners, presents the ruse that investors are buying profits derived from merchants Local City Deals signs on.

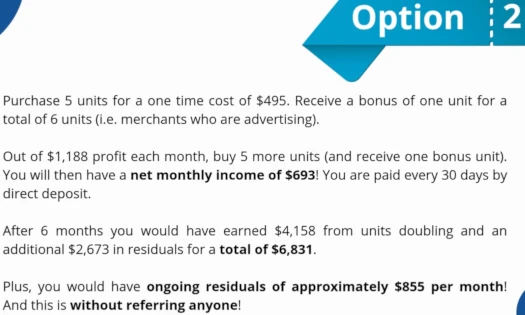

Local City Profits’ investments are pitched as $99 “units”, capped at twenty units a week ($1980). A bonus investment unit is also awarded per five units invested into.

Returns are paid as $29.70 a month. On top of that Local City Profits pays “double your money every 30 days”.

E.g. You invest $99 at the start of a month. Thirty days later Local City Profits pays you $198. At the end of the month you receive an additional $29.70.

Each month thereafter you continue to receive $29.70 on that unit.

Local City Profits promoters are encouraging potential investors to compound. In one example $855 a month plus $6831 within six months is pitched off an initial $495 investment.

Attached to Local City Profits’ investment scheme is a seven-level deep MLM compensation plan.

Local City Profits pays referral commissions on recruited affiliate investment via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

Local City Profits caps payable unilevel team levels at six.

Referral commissions on unit investment is paid across these six levels as follows:

- level 1 (personally recruited affiliates) – 10%

- levels 2 to 5 – 5%

- levels 6 and 7 – 2.5%

With nothing marketed or sold to retail customers, the MLM side of Local City Profits is a pyramid scheme.

Local City Places, Local City Deals, Local City Profits and Local City Partners are all owned and run by Troy Warren.

Warren (right) is US resident based out of Arizona.

Warren (right) is US resident based out of Arizona.

As documented by Ivan Penn for the St. Petersburg Times (now Tampa Bay Times) in 2009, Warren has a long history of marketing and ecommerce related fraud.

• A lawsuit by MasterCard International in 1991 that accused Warren and more than a dozen other defendants of taking millions from consumers through false offers of low-rate credit cards under a company they ran, called Listworld. The case was settled and dismissed.

Listworld filed bankruptcy and reached a settlement with the Federal Trade Commission, which shut the operation down for deceptive practices.

• A bankruptcy filing that left Warren with a judgment for $1.9 million that he was declared responsible for in an order in 2006.

• An order by the Arizona Corporation Commission that Warren pay $20,000 in restitution to investors for selling stock he did not register for a charitable Internet business, FreeFundRaisingPrograms.com Inc.

• The Better Business Bureau gave Warren an “F” for his failed SearchBigDaddy.com Internet products and services business because of complaints, failure to respond to complaints and lack of business background.

Warren also has been sued at least five times for failing to pay state and federal taxes in the tens of thousands of dollars, from the early 1990s to 2005.

As per the Howey Test, Local City Profits’ passive returns investment scheme constitutes an investment contract.

The Howey Test is four criteria an asset must meet to qualify as an “investment contract.”

If the asset is an “investment of money in a common enterprise, with a reasonable expectation of profits to be derived from the efforts of others” it is considered a security.

In Local City Profits, affiliate investors invest $99 or more into Local City Profits (a common enterprise). This is done on the promise of 200% within 30 days and $29.70 a month thereafter (a reasonable expectation of profits).

Said profits are represented to be derived from the business activities of Local City Deals (the efforts of others).

Being an investment contract, Local City Profits’ passive returns investment scheme is a securities offering that must be registered with the SEC.

A search of the SEC’s public EDGAR database reveals neither Local City Deals, Local City Profits, Local City Partners or Troy Warren are registered with the SEC.

Offering unregistered securities to US residents constitutes securities fraud.

Beyond that, Local City Profits’ passive returns investment scheme fails the Ponzi logic test.

We can ascertain from the migration from Local City Places to Local City Deals that Warren’s business is unsustainable. Whatever merchants exist aren’t enough to keep the company afloat.

SimilarWeb tracked just ~3000 monthly visits to Local City Deals’ website as of September 2024, so there’s not much going on there either.

Even if we buy into the “profits are from merchants” baloney though, if that was the case why does Local City Profits need your money then?

Apparently all Warren needs is $99 to pump out $227 within a month and then $29.70 each following month.

Logically is that were the case, surely you’d just quietly run the business, compound 200% each month and retire as the world’s richest person within a few years?

As it stands, the only verifiable source of revenue entering Local City Profits is new investment. Using new investment to fund ROI withdrawals, even partially, would make Local City Profits a Ponzi scheme.

As with all MLM Ponzi schemes, once affiliate recruitment dries up so too will new investment.

This will starve Local City Profits of ROI revenue, eventually prompting a collapse.

The math behind Ponzi schemes guarantees that when they collapse, the majority of participants lose money.

I have friends that want me to invest in that. Troy blocked me on FB for asking questions. So that made it a hard pass for me.

Troy warren is a lifetime scumbag scammer!!! Avoid at all costs.

A business friend approached me with this scam. I told him that if Troy Warren was legit and as rich as he claims, he wouldn’t need to get $99 for “units” from people. My friend said “he has the money but he wants to help others build residual income.” I told him if he really believes that, sorry for your loss.

Kenneth. sounds like your friend is part of the scam! Anyone who says good things about Troy is part of the problem.

I totally agree. I should say business acquaintance. I don’t make friends with scammers. I thought he was smarter than this. He comes from a background in e-commerce like I do.

I’m involved now and they’re only way he communicates is a one way telegram group that constantly reassures people that invest are going to get paid even though they’ve already been overdue a few weeks for payment. Any solid Proof of returns??

Proof of returns don’t matter when nobody is getting paid. I would have thought this was obvious.

Travis – The one way Telegram group is set up that way for a reason; so nobody can say anything and tell the truth about this total scam.

6 mos. Of working the Merchants side, and never received a dime for my efforts.

I wish I had done more research before I invested in 11/25. The person who signed me up was also clueless.

I invested the 1,980 and I’m trying to decide if it’s worth it to take him to small claims court since I’m not in AZ. Why is he not in jail?