GSPartners’ G999 daily trade volume drops to $0

Daily trading volume for GSPartners’ G999 token has dropped to $0.

Daily trading volume for GSPartners’ G999 token has dropped to $0.

G999, created through an off-the-shelf shitcoin script, was part of the original fraudulent investment scheme deployed by GSPartners in 2021.

GSPartners’ original investment scheme saw affiliates invest tether (USDT) into G999 tokens.

G999 tokens are invested in via GSPartner’s GSTrade exchange, at a rate of “69 USDT for 4999 G999 coins”.

Within GSPartners affiliates also receive G999 when they sign up.

- sign up with a Brand Advantage Basic Package for 275 USDT annually and receive 3498 G999 tokens

- sign up with a Brand Advantage Premium Package and receive more G999 tokens than the Basic Package

Naturally it wasn’t long before earlier GSPartners investors, most of whom followed owner Josip Heit from Karatbars International, began cashing out.

That’s on top of GSPartners corporate cashing out too.

Combined, this activity drove down G999’s listed price on the dodgy exchanges it was listed on.

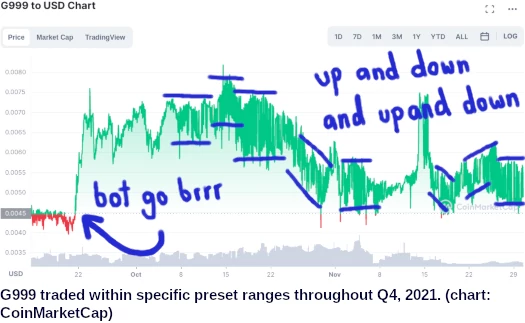

To prop up G999, GSPartners began deploying suspected wash-trading bots. This became more and more obvious as GSPartners recruitment declined.

Initially the bots were set to push a few hundred thousand between each other and peg G999 between a plottable range.

Over time the amount of volume traded between the bots declined. This coincided with GSPartners ditching G999 to focus on Lydian World and its spinoff tokens.

In mid 2022 GSPartners launched its metaverse certificates investment scheme. By the time the first US GSPartners fraud warning dropped in late 2023, daily G999 suspected wash trading was typically under $10,000 a day.

Between Canada, the US, South Africa, New Zealand the UK and Australia, over a dozen GSPartners regulatory fraud warnings have been issued.

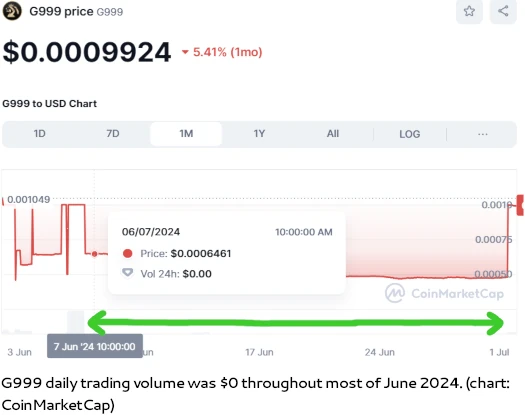

In March 2024, G999’s daily suspected wash trading volume dropped to $0.

Since then it’s most stayed at $0, climbing up to a few hundred on random days.

June 2024 was a particularly bad month for G999, throughout which all but three days trading volume was $0.

That amount climbed to $29.89 on July 1st but is expected to drop back down again.

GSPartners collapsed in December 2023, and with it all the marketing bullshit associated with G999. Investor losses have been realized, there’s no reason to keep up the facade.

Since G999 launched in 2021, the token’s trading value has dropped 84.17%.

The current iterations of GSPartners are Billionico and Auratus Gold, neither of which utilize G999.

Billionico started off as a suspected GSPartners backdoor for US and Canadian investors. It then became a weird culty membership scheme pitched at South Africans.

Billionico recruitment in South Africa is believed to have halted following a GSPartners related arrest in May.

Auratus Gold was a fake gold fraudulent investment scheme primarily pitched at Australians. The investment side of Auratus Gold collapsed on June 22nd.

Josip Heit (right) runs the GSPartners investment schemes through parent German company GSB Gold Standard Corporation. Heit spends most of his time hiding out in Dubai.

Josip Heit (right) runs the GSPartners investment schemes through parent German company GSB Gold Standard Corporation. Heit spends most of his time hiding out in Dubai.

Since the US fraud warnings dropped, Heit hasn’t made any public appearances. Heit’s limited known travel has been to countries without US extradition treaties.

The outcome of multiple federal investigations into GSB Gold Standard Corporation and Heit remain pending.

Oh no, I guess this is also your fault Oz.

You did mention it, but the blockchain don’t lie. Corporate dumped 2 billion G999 tokens.

https://behindmlm.com/companies/gspartners-corporate-dumped-2-billion-g999-tokens/

There’s been so many levels of GSPartners related fraud over the years it’s difficult for even me to recall them all.

That link will fit nicely with the “That’s on top of whatever GSPartners itself was cashing out too.” sentence. Thanks.

Video from March 23, 2024.

ibb.co/vzhMg1Z

youtube.com/watch?v=oH8SOk1jqow

So, I understood we have a (90 day) window as of October 1st to claim a refund! Who do we contact?

90 days from when the claim portal opens. It hasn’t opened yet.

If your state is on the settlement list then you don’t have to do anything till the portal opens. If it isn’t, you can contact your state securities regulator.