Grokr Exchange Review: Trading signals “click a button” Ponzi

Grokr Exchange fails to provide ownership or executive information on its website.

Grokr Exchange fails to provide ownership or executive information on its website.

Grokr Exchange operates from six known website domains:

- grokrwaid.com – privately registered on April 19th, 2025

- grokr-lssc.com – privately registered on May 23rd, 2025

- grokrmail.com (domain disabled, used for support email) – privately registered on February 19th, 2025

- grokrx3wf.com (already abandoned) – privately registered on August 24th, 2025

- grokrex88.com (already abandoned) – privately registered on April 19th, 2025

- grokr88.com (already abandoned) – privately registered on April 30th, 2025

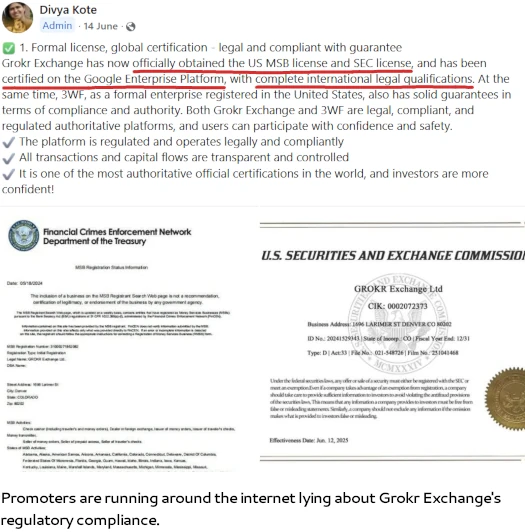

In an attempt to appear legitimate, Grokr Exchange touts SEC registration of Grokr Exchange Ltd.

Grokr Exchange Ltd. is a Colorado shell company, registered by “Ernest Dewey May Jr.” on May 13th, 2024.

The corporate address provided for Grokr Exchange Ltd. appears to be a random unrelated office block in Denver.

Ernest Dewey May Jr. appears to be a fictional identity used to register numerous suspicious looking companies.

We’ll revisit Grokr Exchange Ltd.’s purported SEC registration in the conclusion of this review

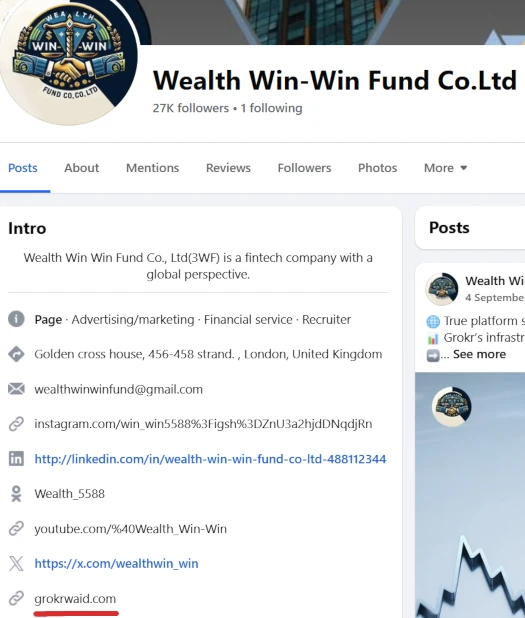

Grokr Exchange also goes by Wealth Win Win Fund, or 3WF:

Note the above official Wealth Win Win Fund FaceBook group is managed from Cambodia:

This is indicative of Chinese crime groups operating out of Cambodia (see review conclusion for more information).

![]()

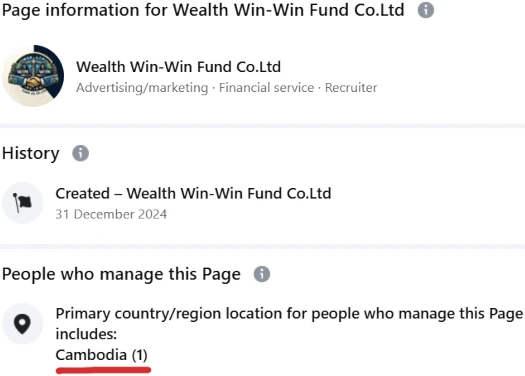

Further supporting this is Grokr Exchange’s web assets being hosted on Alibaba Cloud:

Grokr Exchange has already attracted the attention of financial regulators:

- Germany’s BaFin issued a Grokr Exchange securities fraud warning on June 11th, 2025

- Austria’s FMA issued a Grokr Exchange securities fraud warning on June 13th, 2025

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

Grokr Exchange’s Products

Grokr Exchange has no retailable products or services.

Promoters are only able to market Grokr Exchange promoter membership itself.

Grokr Exchange’s Compensation Plan

Grokr Exchange promoters invest USDT. This is done on the promise of a minimum 1.3% daily ROI.

Grokr Exchange pays referral commissions on invested USDT via a unilevel compensation structure:

Note Grokr Exchange hides referral commission rates from consumers.

Joining Grokr Exchange

Grokr Exchange promoter membership is free.

Full participation in the attached income opportunity requires a minimum undisclosed USDT investment.

Grokr Exchange Conclusion

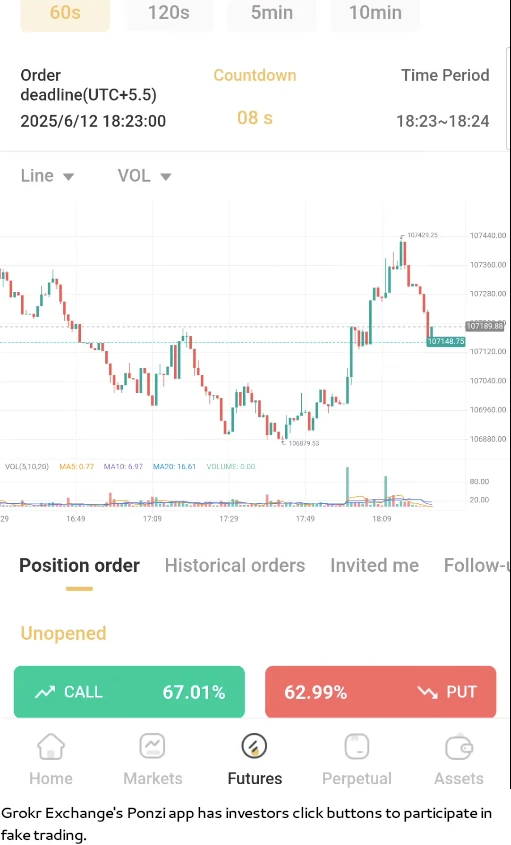

Grokr Exchange is yet another “click a button” app Ponzi scheme.

Grokr Exchange’s website is full of made-up marketing baloney, including claims like Grokr Exchange being “the world’s leading blockchain asset financial services provider”.

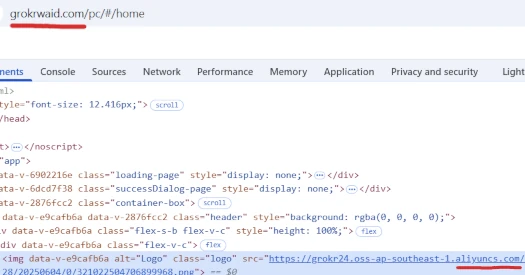

Grokr Exchange’s actual investment scheme is a run-of-the-mill trading signals ruse:

Trading signals are fed to investors through Wealth Win-Win Fund. Typically dodgy Telegram and/or BonChat groups are used.

However signals are provided, Grokr Exchange promoters take the provided signals and feed them back into Grokr Exchange’s Ponzi app. This requires “clicking buttons”, hence the term “click a button” app Ponzi.

The usual set up is the more is invested the more fake trading signal buttons have to be clicked in the app.

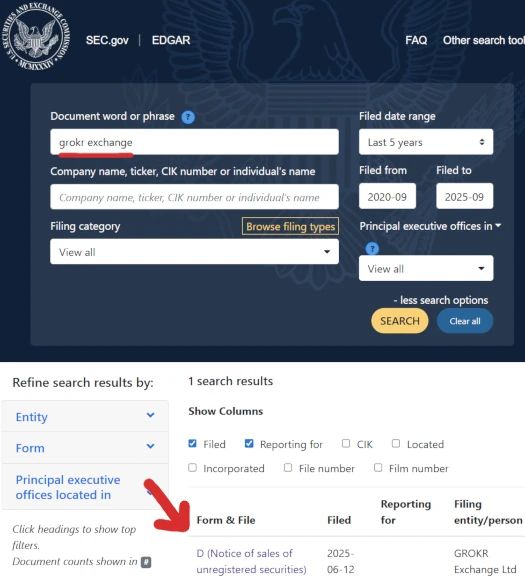

On Grokr Exchange being registered with the SEC, the Colorado shell company is registered but there is only one Form D filing:

A Form D is used to notify the SEC of an exempt securities offering. Grokr Exchange’s Ponzi scheme does not qualify for an securities registration exemption.

“Click a button” app Ponzis like Grokr Exchange easily satisfy the Howey Test.

Grokr Exchange promoters invest USDT (an investment of money), into Grokr Exchange’s app (a common enterprise), on the promise of passive returns (an expectation of profits), purportedly derived through trading (derived via the efforts of others).

In brackets above are prongs of the Howey Test, which is used to establish whether an investment contract exists. Not surprisingly, Grokr Exchange’s investment scheme satisfies all prongs of the Howey Test.

Under the Securities and Exchange Act, Grokr Exchange is required to register its securities offering with the SEC. Instead of doing that, the scammers behind it have created a Colorado shell company and filed a false Form D.

This is fraud in and of itself, notwithstanding Grokr Exchange offering unregistered securities (illegal in every country with a regulated financial market). Refer back to the German and Austrian Grokr Exchange securities fraud warnings.

In addition to being required to register with the SEC and periodically file audited financial reports, Grokr Exchange generating revenue via trading requires it to register with the CFTC (FINRA).

Grokr Exchange has not registered with the CFTC. This constitutes additional commodities fraud.

Despite claiming to have trading signals capable of generating a minimum 1% a day, for some reason Grokr Exchange can’t execute trades on their own. Instead they inexplicably opt for the ruse of sharing trading profits with randoms over the internet.

If that business model makes no sense it’s because it doesn’t. Why get randoms to click a button in a dodgy app when you could just execute the trades yourself?

In reality clicking a button inside Grokr Exchange’s app does nothing. All Grokr Exchange does is recycle newly invested funds to pay earlier investors.

Grokr Exchange is part of a group of “click a button” app Ponzis that have emerged since late 2021.

Examples of already collapsed “click a button” Ponzis using the same trading signals ruse include MTS Foundation, QTCPCoin and Finopta.

Since 2021 BehindMLM has documented hundreds of “click a button” app Ponzis. Most of them last a few weeks to a few months before collapsing.

“Click a button” app Ponzis disappear by disabling both their websites and app. This tends to happen without notice, leaving the majority of investors with a loss (inevitable Ponzi math).

In the lead up to a collapse, “click a button” Ponzi investors also tend to find their accounts locked. This typically coincides with a withdrawal request.

As part of a collapse, “click a button” Ponzi scammers often initiate recovery scams. This sees the scammers demand investors pay a fee to access funds and/or re enable withdrawals.

If any payments are made withdrawals remain disabled or the scammers cease communication.

Organized crime interests from China operate scam factories behind “click a button” Ponzis from south-east Asian countries.

In September 2024, the US Department of Treasury sanctioned Cambodian politician Ly Yong Phat over ties to Chinese human trafficking scam factories.

Through various companies he owns, Phat is alleged to shelter Chinese scammers operating out of Cambodia.

Myanmar claims to have deported over 50,000 Chinese scam factory scammers since October 2023. With “click a button” app scams continuing to feature on BehindMLM though, it is clearly not enough.

In late January 2025, Chinese ministry representatives visited Thailand. The stated aim of the visit was to tackle organized Chinese crime gangs operating from Myanmar.

In early February 2025, Thailand announced it had cut power, internet access and petrol supplies to Chinese scam factories operating across its border with Myanmar.

As of February 20th, Thai and Chinese authorities claim ten thousand trafficked hostages had been freed from Myanmar compounds.

Also on February 20th, five Chinese crime bosses were nabbed in a wider raid of four hundred and fifty arrests in the Philippines.

On March 19th it was reported that, despite the recent raids and arrests, “up to 100,000 people” are still working in Chinese Myanmar scam factories.

As of April 2025 and in response to a crackdown across Asia, newly opened Chinese scam factories have been reported in Nigeria, Angola and Brazil.

Myawaddy is an area in Myanmar along the Thai border. Myawaddy is under the control of the Karen National Army (KNA).

The KNA, led by warlord Chit Thu (right) and sons Saw Htoo Eh Moo and Saw Chit Chit, protect and profit from organized Chinese criminals running “click a button” Ponzi scam factories.

On May 5th the US imposed sanctions on Chit Thu (right).

On May 5th the US imposed sanctions on Chit Thu (right).

The Treasury said the warlord, Saw Chit Thu, is a central figure in a network of illicit and highly lucrative cyberscam operations targeting Americans.

The move puts financial sanctions on Saw Chit Thu, the Karen National Army that he heads, and his two sons, Saw Htoo Eh Moo and Saw Chit Chit, the department said in a statement, freezing any U.S. assets they may hold and generally barring Americans from doing business with them.

Britain and the European Union have already imposed sanctions on Saw Chit Thu.

A May 25th report cites Myanmar and Loas as having “towering scam economies”. Cambodia however is reported to be a hotspot for Chinese criminal activity.

Cambodia is likely the absolute global epicentre of next-gen transnational fraud in 2025 and is certainly the country most primed for explosive growth going forward.

Cambodia is becoming the centre of an exploding global scam economy driven primarily by Chinese organised crime.

Chinese gangs are reported to operate in Cambodia under the protection of unnamed local politicians.

In June 2025, Amnesty International claimed Cambodia’s government was

“deliberately ignoring” abuses by cybercrime gangs who have trafficked people from across the world, including children, into slavery at brutal scam compounds.

The London-based group said in a report that it had identified 53 scam centres and dozens more suspected sites across the country, including the Southeast Asian nation’s capital, Phnom Penh.

The prison-like compounds were ringed by high fences with razor wire, guarded by armed men and staffed by trafficking victims forced to defraud people across the globe, it said, with those inside subjected to punishments including shocks from electric batons, confinement in dark rooms and beatings.

In July 2025 Cambodia arrested over 1000 cybercrime suspects. Twenty-seven of those arrested were members of Chinese criminal gangs.

Regardless of which country they operate from, ultimately the same group of Chinese scammers are believed to be behind the “click a button” app Ponzi plague.

Update 24th January 2026 – Grokr appears to have collapsed. As at the time of this update Grokr’s previously working website domains have been disabled (infinite loading screen).