Start Options Review: A crypto mining & trading billion dollar company?

Start Options provide no information on their website about who owns or runs the business.

Start Options provide no information on their website about who owns or runs the business.

The Start Options website domain (“startoptions.com”) was initially registered in December, 2005. The domain registration details were recently updated on December 18th, 2017.

A residential condo address in Manilla, Philippines is provided on the Start Options website.

An official Start Options business presentation provides a corporate address in Auckland, New Zealand.

Further research however reveals this address actually belongs to a cafe.

As far as I can tell Start Options has no physical presence in either the Philippines or New Zealand.

The Start Options support email address contains the name “William Adelbert”.

No information about this individual exists in connection with Start Options, so it’s assumed to be a pseudonym.

Start Options current incarnation appears to have surfaced on or around May, 2017.

As of mid 2016, Start Options was a binary options investment scheme:

That opportunity appears to have collapsed around late October, 2016.

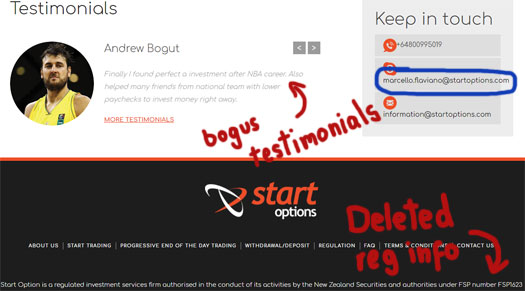

When the current Start Options website surfaced, the admin email was named “Marcello Flaviano”. A corresponding Twitter account was created on or around June, 2017.

Also featured on the original website was the following message on the website footer:

Start Option is a regulated investment services firm authorised in the conduct of its activities by the New Zealand Securities and authorities under FSP number FSP1623

The quoted FSP number corresponds to the 2005 incorporation of City Forex.

Corporate records reveal City Forex is owned by Sunil Kumar Cheruvattath.

Cheruvattath personally filed City Forex’s last Annual Confirmation FSP filing back in July, 2017.

Outside of a few additional New Zealand incorporations (City New Zealand Limited and Indokiwi Ventures Limited), I was unable to find anything further on Cheruvattath.

Either way, it appears Cheruvattath owns and operates Start Options.

The name sounds very Indian, however Cheruvattath could be operating from anywhere (likely Oceania or South East Asia).

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

Start Options Products

Start Options has no retailable products or services, with affiliates only able to market Start Options affiliate membership itself.

The Start Options Compensation Plan

Start Options affiliates invest bitcoin and/or USD on the promise of an advertised 25% to 60% monthly ROI.

An “aggressive trading” option also exists, promising a ROI of “up to 200%” a month.

- Rookie – invest 0.25 BTC or $1000 to $5499

- Freshman – invest 1 BTC or $5500 to $9999

- Sophomore – invest 2 BTC or $10,000 to $14,499

- Junior – invest 3 BTC or $14,500 to $24,999

- Senior – invest 5 BTC or $25,000 to $34,999

- Pro – invest 7.5 BTC or at least $35,000

The more a Start Options affiliate invests the higher their daily ROI percentage.

Start Options pay referral commissions via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

Start Options cap payable unilevel levels at four, with commissions paid out as a percentage of funds invested across these four levels:

- level 1 (personally recruited affiliates) – 30%

- level 2 – 20%

- level 3 – 10%

- level 4 – 5%

Joining Start Options

Start Options affiliate membership is free, however free affiliates can only earn referral commissions.

Full participation in the Start Options income opportunity requires a minimum 0.25 BTC or $1000 investment.

Conclusion

Start Options claims to be ‘one of the world’s fastest growing Progressive Bitcoin Mining & Crypto Currency Trading‘.

Additionally, Start Options claims

- 540,000 trading accounts have been opened with us

- Reliable execution: over 150 million orders filled to date

- Clients from 173 countries with billions deposited to date

At the time of publication Start Options has an Alexa traffic ranking of just under one million. Considering the current incarnation launched a few months ago (mid 2017), this casts pretty solid doubt over the company’s claims.

In any event, Start Options utilizes the clichéd ruse of forex trading, cryptocurrency trading and mining to explain ROI revenue.

The forex side of the business appears to be an extension of the failed binary options model. Crypto mining and trading is likely an attempt to cash in on the recent explosion of cryptocurrency fraud.

I say fraud because Start Options provide no evidence whatsoever that forex trading, cryptocurrency trading or mining is used to fund affiliate ROI payments.

In some of the affiliate marketing videos I’ve seen there are apparently some trading reports provided to affiliates, but nothing that comes close to a dollar for dollar audited accounting of affiliate ROI revenue.

Although since removed from the Start Options website, back in May the company billed itself as an “automated bitcoin trading program”.

Start Options is obviously offering a passive investment opportunity, which requires registration with securities regulators in any jurisdiction they operate in.

As I write this Alexa cite the US as the largest source of traffic to the Start Options website (25%).

A search of the SEC’s Edgar database turns up nothing for Start Option, City Forex or Sunil Kumar Cheruvattath.

This means Start Options is illegally offering unregistered securities to US residents.

Rather than address the unregistered offering of securities, Start Options attempts to reframe regulatory non-compliance as a cryptocurrency issue.

Due to Bitcoin and Crypto Currencies being a decentralized and deregulated currency we are not required to be regulated, but we are insured by insurance company and we insure each account with us for up to 100% of the initial investment.

Regardless of how a securities offering is set up, it needs to be registered with the appropriate authorities. This obviously includes passive bitcoin and cryptocurrency offerings.

At the end of the day the only verifiable source of revenue entering Start Options is new affiliate investment.

Using newly invested funds to pay off existing investors makes Start Options a Ponzi scheme. Recruitment commissions also add an additional pyramid layer to scheme.

As with all Ponzi schemes, once new affiliate recruitment dries up so too will new funds entering the scheme.

This will starve Start Options of ROI revenue, eventually prompting a collapse.

Considering the use of bitcoin and lengths Sunil Kumar Cheruvattath has gone to ensure his name doesn’t directly appear in connection to Start Options, victim fund recovery is extremely unlikely.

Update 21st March 2018 – Promotion of the Bitcoiin pump and dump altcoin has revealed Start Options likely has ties to Chinese scammers.

Update 6th February 2021 – Start Options was part of Kristijan Krstic’s $70 million dollar+ Ponzi empire.

Krstic was arrested in Serbia on behalf of US authorities in mid 2020.

Dir Team, how do you check your facts???

Gerrit

Rookie – invest 0.25 BTC or $1000 to $5499

Freshman – invest 1 BTC or $5500 to $9999

Sophomore – invest 2 BTC or $10,000 to $14,499

Junior – invest 3 BTC or $14,500 to $24,999

Senior – invest 5 BTC or $25,000 to $34,999

Pro – invest 7.5 BTC or at least $35,000

These new ponzis love to copy the failed Gladiacoin scam model. 7 levels of entry up to a huge loss of 7.5 BTC. Another rip off.

Check facts? I personally research every company I review. If I can’t verify facts I either state so or don’t publish.

Uh, why not name the insurance company and publish the insurance contract ?

What kind of insurance company insures a simili- edge fund ???

There is a guy pimping this like nobody’s business on FaceBook. I’ve seen him promoting these scams for 5 years now, including Zeek.

How do these weasles get away with it over and over? They should be held legally accountable for it, even if the owner can’t be found.

@M

The small-time crooks don’t make enough to pop on the radar.

The major ones usually burn out, leaving only a select few that manage to profit handsomely from scam to scam.

Cryptocurrency has made successes of many otherwise failed or failing scammers unfortunately. Hopefully regulators can turn that around in 2018.

Another great analysis of an obvious ponzi. There are many youtubers pushing this scam on the clueless. Shame it’s going to end badly for them.

The other scary thing…

Referral commissions….

30% 1st Level Direct

20% 2nd Level

10% 3rd Level

5% 4th Level

65 percent???

How are earth are they going to pay out such returns when they’re paying 65 percent upfront to the upline??

Well they dont let withdrawals until 60 days on level 2, 90 days on level 3, etc. only referral comission on level 1 is available for immediate withdraw.

Are any of you in this program Start Options, do you have any 1st hand proof of all the negative comments?

I thought about getting into it cause my friend is in this and making very good returns. They also really have mining farms they have had since 2010 that they back there program up with. get back to me.

You don’t need to join a scam to identify one.

Enough proof to certify Start Options being a scam is documented in the review.

Says who, the person trying to recruit you to earn referral commissions…? Did you ask them for proof or does due-diligence only go one-way?

Like how admin on this joke of a review site just deleted my comment that proved that start options is the real deal.

The person running reviews on this site has no proof and doesnt want to be wrong so he deletes my comments saying anything positive.

I do have pictures of people in our group that have toured there facilities standing in front of there buildings of mining equipment and offices with a big sign over my friends head to the public advertising who they are.

They are very transparent, the only company that publicly puts the owners name out there.

I nuked your bullshit comment because it was recruitment spam. Fuck that right off.

No proof of what exactly? To date Start Options has provided no evidence of external revenue or it being a “billion dollar company”.

You can’t prove a negative, so it’s up to the person making claims to provide evidence to back them up. *crickets*

And what exactly does that “prove”? Your buddies no doubt saw some pretty machinery and were fed a bunch of porky pies.

Where is the audited third-party accounting showing Start Options are using external revenue to pay affiliates?

Was it one of those temporary banners they tie on with a bit of rope? Seen a few of those over the years.

Yet there’s no disclosure on the Start Options website and instead of naming the owners, you’re dancing around it. Yeah, “transparency”.

Yap. This is another ponzi. They did the same in binary options where affiliates referred the uninformed suckers who lost 99% of the time.

Run the other way people.

Wonder if the above commenters believe you now?

After start options forced those mining bitcoin to transfer earnings to B2G? Then refuse to alkow it to be cahed out….

I bought into this B2g fiasco as my first venture ever into cryptocurrency and boy did I learn a lot and fast.

I could say a lot more but I’m certain anyone who got in knows by now it was an elaborate SCAM. I’ll check here first before investing in anything.

RUN. Start Options is a scam. They offered a dbl coin offer on B2G, I sent my coins to John DeMarr (Private Investigator in Ca, he was my upline facilitating this offer).

I sent him an email, changed my mind. They opened an account and put my coins in that scam offer (AFTER) I cancelled.

John said he will help me and never did. Never returned my text or emails after that. Dont do business with him.

They sent me nasty notices that I couldnt cancel. I thought ok 45 day contract, saw my acct growing everyday and got excited (only on paper) the day of withdrawal 6-9-18 I get a notice “Due to High Volumes of withdrawal unable to process within 48 hrs Please be patient!!

Its now 60 days past the withdrawal date and I keep getting the same response.

I see them posting a new Buy 2 get 1 free offer. Hoe the hell they gonna pay them when they cant pay me. Scam Scam Scam.

Stay away from Start Options now owned by Russian Venture Company that doesnt want to be known. Lady who said that hey were transparent, your on something… I have ALL my documents to prove this.

BEWARE HIGHJACKERS, WILL TAKE YOUR $ and lock it up, NO ACCESS!!!!!!!!!! #%!^&

I think you’ll find you invested with scammers from the get go. Anything to get your money.

MOMI NELSON or others effected by Start Options or the affiliate scam companies, Bitcoiin B2G, Dragon Mining, Thorex, Btctraderonline, bitcointradingworld, and several others, please reach out by email to Joseph Rotunda and let him know you’ve been scammed.

He is particularly looking for people that live in the state of Texas, but interested to hear from all.