BigCoin & BNA: The original OneCoin Ponzi points

In late 2014 OneCoin seemingly came out of nowhere.

In late 2014 OneCoin seemingly came out of nowhere.

Ruja Ignatova was an unknown outside of China and a select group of Europeans. Sebastian Greenwood was tied to the SiteTalk share-based Ponzi scheme.

As far as the cryptocurrency space went, the OneCoin concept was presented as being entirely new.

Turns out it isn’t.

OneCoin is little more than a third attempt at the Ponzi points model, tweaked for maximum financial destruction of its affiliate-base.

Our story begins in 2013 with BigCoin, a cryptocurrency you’ve never heard of.

Our story begins in 2013 with BigCoin, a cryptocurrency you’ve never heard of.

BigCoin was launched by John Ng and based out of Hong Kong. It was marketed with the usual MLM cryptocurrency pitch, “we’re gunna be the next bitcoin!”

At some point Prosper Ltd (also known as Prosper Inc) got involved which attached Sebastian Greenwood, Ronnie Skold (also from SiteTalk), Ruja Ignatova and Nigel Allen (fresh from scamming people in Brilliant Carbon) to BigCoin.

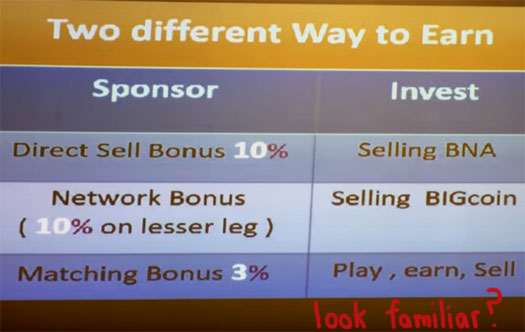

Prosper Ltd had its own fee structure within BigCoin, with downline members differentiated from the core BigCoin affiliate-base.

Like OneCoin, the problem with BigCoin was you couldn’t do anything with it. Like all Ponzi points, it had no value outside of the scheme you invested in to acquire them.

This prompted Prosper LTD to come up with an unregistered securities share offering.

No doubt inspired by SiteTalk’s endless promises of a public offering, Ruja Ignatova herself delivered the news at a BigCoin event in July, 2014.

Referred to as the “CryptoReal Investment Trust”, Ignatova explained

[0:51] The CryptoReal Investment Trust offers Propser members, who own tokens of BigCoin, to convert the tokens into shares of the CryptoReal Investment Trust.

[1:16] By taking the (BigCoin) tokens and converting them into shares, you convert your tokens from the virtual world into real assets.

The CryptoReal Investment Trust scheme launch was a disaster.

The internal value of BigCoin crashed and to this day CryptoReal Investment Trust shares remain “pending“.

By August 2014 BigCoin was on the verge of collapse, which prompted the company to create another cryptocurrency.

BNA was touted as the savior of BigCoin. Neither “currency” was open to the public, with trade restricted through BigCoin’s internal CoolsDAQ exchange.

Not surprisingly, BNA also crashed upon release.

After scamming who knows how much from a predominately Chinese affiliate-base, the BNA crash prompted the departure of core Prosper Ltd members.

Shortly thereafter, they began initiating plans to launch their own clone Ponzi points currency.

You know it today as OneCoin, run by the Prosper Ltd members who deflected from BigCoin.

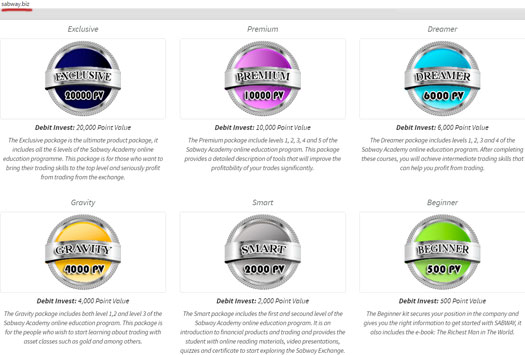

The prototype concept following the split from BigCoin was referred to as Sabway (“sabway.biz”):

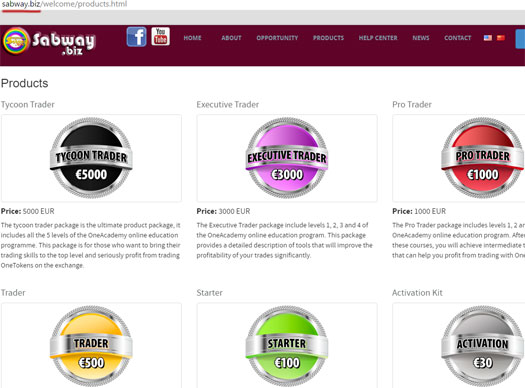

The Sabway website domain was privately registered on November 25th, 2014. Shortly after the initial prototype was revealed, it was modified to reflect the investment levels OneCoin would later launch with:

By that stage the “Sabway” brand had been abandoned. Prosper Ltd staff were cloning the OneCoin website onto the Sabway domain to tinker around with as needed.

OneCoin was launched as version 2.0 of the BigCoin cryptocurrency. In place of the CoolsDAQ exchange OneCoin implemented xCoinx.

BigCoin itself appears to have survived the Prosper Ltd exodus by relaunching as BigCoin Bao.

BigCoin Bao points are still tradeable on the internal CoolsDAQ exchange. The value appears to still be set by BigCoin themselves, however trading volume has tanked.

I suspect it’s only being kept alive to appease the few diehard Chinese investors who refuse to let go.

For all intents and purposes, OneCoin is a clone of BigCoin…

…with one major exception.

The Prosper Ltd members running OneCoin (of which Ruja Ignatova is the only one publicly acknowledged), learnt the hard way that attempting to integrate Ponzi points outside of a Ponzi scheme inevitably results in a crash.

This is because outside of the Ponzi scheme the points are attached to, there is no demand. And with the value of the points artificially propped up by promises of riches to the Ponzi faithful, there never will be.

To (temporarily) address this, OneCoin came up with the concept of not going public until 80% of OneCoins had been generated by their script.

To put that into perspective, OneCoin has been generating points since late 2014. Last month they crossed the 30% point generation threshold.

80% of OneCoin points generated is years off… which gives the owners and top investors in the scheme plenty of time to fleece those who join after them.

One bump in the road was the announcement that upon 30% of points generated, OneCoin had hundreds of thousands of third-party merchants lined up and ready to accept OneCoin as a currency.

This is a copy of the idea behind BNA that BigCoin launched, which was also supposed to be spendable within a merchant network. Save for a few inhouse merchants created by BigCoin (think Coinvegas and OneCoin), the crash of BNA as they tried to go public meant merchant network integration never happened.

In order for merchants to accept Ponzi points, the points have to be released into the wild.

This means the creator of the points (OneCoin in this instance), are no longer able to arbitrarily set the value of the points.

Prosper Ltd know from their experience in BigCoin that releasing Ponzi points into the wild leads to a crash. Hence OneCoin have made no announcement about the promised merchants despite hitting 30% point generation weeks ago.

As more and more investors question why the company isn’t delivering on the merchant promise, the other end of the OneCoin candle has been set alight by its ever-increasing value.

The Ponzi paradox of arbitrarily setting the value of points on the sole condition the new value can’t be lower than the current value, means withdrawals today exceed actual funds invested yesterday.

OneCoin don’t assign daily values to their points, so “today” and “yesterday” can be extrapolated accordingly.

The current situation sees OneCoin’s early investors (Prosper Ltd members and Chinese BigCoin affiliates), putting in withdrawal requests at a rate far greater than the funds they initially and re-invested were valued.

This wouldn’t be a problem if genuine demand drove the price of OneCoin, but without it it’s up to OneCoin to honor withdrawal requests.

This classic symptom of a Ponzi collapse has been amalgamated into the excuse that there aren’t enough buyers on OneCoin’s xCoinx exchange to honor withdrawal requests.

What this really means is there aren’t funds in the kitty to pay everyone out. And so you have the current situation where 99.9% of OneCoin affiliate withdrawal requests are denied.

And that’s not going to change anytime soon, if only for the fact that OneCoin can’t payout funds it doesn’t have.

Whereas everything about OneCoin up until now has been appropriated from Prosper Ltd member experiences in BigCoin, unfortunately BigCoin never got this big.

Whereas everything about OneCoin up until now has been appropriated from Prosper Ltd member experiences in BigCoin, unfortunately BigCoin never got this big.

This is uncharted territory for OneCoin, hence the radio silence as they try to keep the ship afloat.

Unfortunately on top of everything else I’ve covered above, new icebergs have formed by way of a regulatory crackdown in OneCoin’s largest market.

Last month OneCoin was given the boot by their payment processor, China Union Pay. This means no more credit-card processing, with investors instead required to push money through less than reputable alternatives.

In a “mother of all ironies” turn of events, bitcoin has been introduced as a payment alternative. How apt that a Ponzi points faux cryptocurrency scheme find itself reliant on a legitimate cryptocurrency to survive – if for nothing else than the differences between the two that render one financial fraud and the other not.

Oh and Chinese authorities have also arrested local OneCoin investors. That and the ongoing police investigation into the scheme hasn’t gone down to well.

To date OneCoin has failed to address the investigation or arrest of their Chinese investors.

Instead they’ve swept them under the carpet, with a reschedule of their planned Chinese event to the offshore jurisdiction of Macau.

The hope is a recently released glitzy video promo will distract people long enough for OneCoin to work out its next move.

Again, this is another BigCoin playbook (I swear they even use the same stock drama music on some videos):

Update 3rd August 2021 – As at the time of this update several BigCoin promo videos have been marked private.

As such I’ve had to remove the previously accessible YouTube links. /end update

I don’t expect the revelation that OneCoin is basically a clone of a twice failed Ponzi will have much of an impact on existing OneCoin investors. As long as the company has their money, they’re screwed into complacent silence.

Some will bark denials and others, eager to scam whoever at whatever cost, simply don’t care.

What I hope though is this research has been an education in the formation of OneCoin. It’s atypical that a Ponzi scheme run by unknowns would just materialize to the extent OneCoin has.

Now you know it’s just the continuation of scamming from a group of veterans that have been at it for years.

great research.

Cheers Niksam. I can’t take all the credit though, reader comments got the ball rolling…

You think they roll dice to see who gets to be “president” each time they relaunch?

Oz, this is so great. Thank you for the coherent research and flying it all together.

While having been following this for just over a year now, what you have put together brings a lot of clarity to many odds & ends pieces I knew about, but which were thrown around in disarray or lost outside of the cohesive context you have presented.

Thank you for your steadfast and brilliant journalism, and for providing the source information in nearly all cases. That is what makes a great journalist, and it is a pleasure every time I see you post a new story in this.

There is always meat on the bone, despite what the empty walnut headed villains like “Can Le’Beans” can’t see (or choose not to) through their rise colored multi leveled spectacles.

Kudos on typing through the bullshit and exposing this from nearly the day it all started!

You have continued to provide your readers with the juice and fuel to power the troops and arm the front line, as well as dissuade unsavvy newbs for falling for such schemes! Awesome, awesome work!

Only way to prove that it is a scam, is to see their coin production in dubai and sofia, unless you have proof that it is not done, you should not talk like you know it is a scam.

What are you talking about?

First, “coin production” is some computer in their office running a point generation script. There is no coin production outside of that.

Second, what does coin production have to do with using newly invested funds to pay off existing investors?

Bloody hell, the dumbass level of Ponzi pimps sometimes…

AWESOME job Oz. Can’t wait for your new article 🙂 Keep it up man!

Alright, how do you know the coin production is some script running in their computer office Oz?

Because it’s not publicly mineable. If they’re going to pretend to generate coins they have to be running a script that generates Ponzi points as per their set parameters.

That’s the only way they keep their “mining” schedule. Some understanding of cryptocurrency mining (specifically the imitatation of it) is required for any of this to make sense.

You don’t sound like you’re quite there yet so I suggest you go off and do some research.

you clearly dont know as much as you should, ”coin production” needs more and more better computers to mine more coins, they have 3 mining locations, in dubai, hongkong and sofia( you said in one computer, this clearly tells me you dont know how coins are being mined)

Secondly, 48% of investments are paid to investors(bonus for investing) and 52% of investments are used for better computers to mine more coins and manage bigger scripts.

Mining coins gets the coin price higher because it is harder to create coins, when 80% is mined it will go to open market and people can buy things with coins like any other bank..

Please stop! You’re killing me with laughter!

The way you describe mining of a “centralised cryptocurrency” is just hilarious. There’s no need for more and more better computers to mine coins in a centralised structure.

If there would be a centralised cryptocurrency in need for such a massive computer power it would be the stupidest thing ever invented. For example a car engine running with dead squirrels would be a smarter invention.

Seems like Ken (and others) sent their lackeys to do the dirty work for them… They can deny it all they want, but deep down inside these OCZombies know what they are up to.

Thank you OZ (and all) for the research and awesome teamwork shown during this process.

It, once again, just goes to show that no matter what happens there is a percentage of the ponzi believers that never let go – refuse to see what is right in front of their face.

Even when this thing collapses and people go to jail they will blame the regulators for unfairly bringing it down or they’ll blame sites like BehindMLM for spreading “lies” that caused the collapse.

We saw it with Zeek. Some people you just can’t reach. The ponzi pumpers bank on it.

@mr b

Yes, in a legitimate cryptocurrency.

OneCoin “mine” at a constant rate. There is no difficulty, they just their script to produce X coin points a day.

Blahblahblah newly invested funds are used to pay off existing investors.

Mining and coins in OneCoin have nothing to do with ROI payouts.

Right. Just like the 30% hundreds of thousands of merchants who were ready to go. All aboard the bullshit train…

my bet is they are going to announce a partnership or merger of some sort to back the “currency” by some tangible asset, ala Gemcoin (Thus the coin production references).

but of course, they will be purchasing their own mines and facilities, which is why you can’t get your money back out at the moment, but be patient as they have negotiated the rights to the richest gold reserve in the world.

time will tell.

Beneath the surface quietly another one of these is building up called Ilgamos operated from Germany.

Only one article a few years old on this site. Perhaps they are the real deal to next challenge bitcoin. Any comments.

NICE JOB investigating the link between these companies Oz!!! What AMAZES me is that these brainwashed Onecoin reps can’t see the truth ….STILL!!!….

I guess some people just need to lose everything before they wake up. I just cant believe this woman Ruja has this kind of hold on people. HOW SAD!….

WONDERFUL JOB BEHINDMLM readers… at least we are trying !!

As we know, Ruja working for this Prosper to setup this close end fund, as a corporate consultant; Sebastian hire as “Product Manager” to design online product for Prosper.

After near one year as employee & consultant of Prosper, they think they can earn much more as billions if they open their own coin – which is Onecoin.

They start the network by Nigel Allan & Juha from Finland, Malaysia, and then China team bloom the market. Most of the earlier Oncoin China investors like me are from Carbon Brilliant. Which is Nigel’s army.

But after 6 months honey moon, our leader Nigel being cheating by Ruja, Sebastian & Juha – They don’t share the bonus as 001 to Nigel, then kick him out too.

No matter what, Ruja & Sebastian has zero loyalty, no matter to partner, owner or customers!

By the way, despite this Bigcoin, we can find many coins are from Sitetalk Families!

Leocoin – Dan Andersson (Ex-President of Sitetalk), Atif Karman (Pakinstan Leader of Sitetalk)

Octacoin / Crypto 888 – Gabor Venczel (Ex-Europe Biggest leader of Sitetalk)

ByExpress / Mobilecoin – Urban Turnsek (Ex-Europe 2nd Biggest leader of Sitetalk), Havard Michelsen (Product Director Sitetalk)

K Coin – May Chau (Ex-Hong Kong Big leader Sitetalk)

Onecoin – Frank Ricketts (Current CEO Sitetalk) Kenny Nordlund (Owner of Sitetalk)

U see how much they love Ponzi coins of Sitetalk Families!

Yes. Network marketers need to stop believing they are somehow involved in the REAL business world. Geesh

Pekka in Finland found this amazing gem!!

You feel you do not have achieved anything in life? What about if you would be e.g. “Businesswomen of the year” in Bulgaria? Or National Miss summer? You choose what title you want and contact Evgeni Minchev for details.

minchev.com/en/businesswoman.html

Is it just me or doesn´t the businesswomen of the year title sound familiar? Is it possible that Ruja have won it?

Evgeni Minchev – PR and organization of events

Rofessional PR services from the most celebrated in this area. Evgeni Minchev von Bul transformed his talent to communicate with the rich and famous in a…

Bombshell… game over….. i hope people get locked up for this disgusting fraud!

Are you kidding me!!!Please don’t tell me that they are using this stunt!!! Is Ruja really telling investors that they are going to purchase their own mines???

This is the same thing we were all told by the SCAM ARTISTS when I was involved in UFUN’S UTOKEN PONZI SCAM!!! After the arrests of top UFUN PONZI PIMPS they then decided to tell all of us sheep that they were buying their own mines…

check it out here… youtube.com/watch?v=3Asmk3hJT2I

They never did really purchase or mine anything!!! But it kept us all from asking questions!!!

Didn’t OneCoin already pull that bluff with the AurumCoin crap?

“Backed by real gold”… yeah, right.

Yes, they did the AurumCoin thing which never really started.

I’m still betting something similar is in the works though just in my readings over the past month. Nothing solid, just pure speculation at this point.

I only bring it up as a floating of ideas they will press at this point to keep money in the system and entice more people to pony in a little more dough.

well done.. CryptoQueen? A cryprocurrency expert? What a joke!

I just wonder one thing. These news first when onecoin is 18 months old? How did she hide it for so long! WOW!

Ponzi Participants are an interesting group.

OneCoin Pumpers post articles and graphs showing the reduced purchasing power of the US Dollar, and they won’t get any arguments from me on that topic.

However, this is their hair-brained solution:

OneCoin (bottom-line, cut through the crap) Presentation:

“Trust me. Let’s take your savings and send it to this lady in Romania and your troubles will be over.”

Wait! There’s more…..

“Hmmmmmm. Of course, for helping you……I get 10% of whatever you send. My upline gets some too. Plus, we all get overrides on anyone you can convince to do the same.”

Proof? You want proof, eh?

“If you need more convincing, here’s an ad that was purchased with some of the money sent by a lot of friends of mine. See, that’s the owners picture on the cover.”

Insert personal (or borrowed) testimonial here:

“Are you greedy enough to let your emotions make the decision for you? Let’s do a screen share so I can show you I made $1,700,000 already. Seriously! This represents a 500% Annual Rate of Return. Try getting that down at your Broken Bank with your worthless fiat currency”

Now, gimme your money sucka!

They have some news about the Macau event + new debit card through UnionPay called One Net UPI Card (not Mastercard or Visa, etc…). The fee for a new card is 100 euros.

where is the evidence that Ruja was a partner of prosper inc?

I am thinking about joining onecoin.

This is what happens when you don’t read the article… (it’s in the video footage of her announcing the shares)

He obviously can’t read BECAUSE HE MUST NOT HAVE ANY BRAIN CELLS IN HIS HEAD.

Less than a month away. Does anyone know where they plan on having there major, life-changing, currency disrupting event?

I know it is in London, but have they announce a venue to hold it in?

My guess would be the O2 arena, but even that only holds 20 thousand. OneCoin is so great they will need so much more room that that.

Look at the pictures of the overwhealming crowds at the Macau (Oh, that’s right there are no pictures) but this is a GLOBAL event.

@Rockfish

I’ve seen flyers for both Wembley Arena and Excel Stadium (lol. “Excel” – how appropriate), but both venues show no evidence thereof, nor are receptionists at those listings aware of anything Onecoin related. Both venues webpages neither acknowledge this.

The thought is that those with tickets will be notified LAST MINUTE (how legitimate and par for the course).

Will be keeping eyes on this though. They can’t hide forever (or they may just pull a no-show and take long plane flights somewhere in the opposite direction?)

Thanks Oz for you research. I have only invested €46,750 so my brother benefits. If it wasn’t for you I would have invested more.

I stared Level 1 of the education and it’s actually really good.

@Sheikh

You can thank these authors:

Investopedia – Free Content (All Levels – Significant amount)

Technical Analysis for Dummies (Level 1 & 3)

The Collapse of the Dollar and How to Profit from It By James Turk, John Rubino €10 (Level 1)

Rich Dad’s Guide to Investing in Gold and Silver by Michael Maloney (Level 1).

How does the stock market work? by Pauline Estola (Level 1 First Paragraph)

Commodities For Dummies by Amine Bouchentouf (Level 1 p42)

AND THAT IS JUST FOR LEVEL ONE

@TimTayshun

I have read that the so-called Education Packages contained information that was not “original content”

Just to confirm, are you saying the Level 1 Education Package that OneCoin sells to Investors is actually “borrowed” from other sources and NOT original content?

@MLM Broken Model

Yes sir. I assume that you are jesting that you didn’t already know (or at least assume) this, but just in case:

Thanks to Ben Zmith, HERE are several images of a few OneAcademy (Onecoin) Training Packages compared with the original copyright content available online:

drive.google.com/file/d/0B4CyzrtK43UvY09KY19XeXBQMG8/view

SOURCE: “The OneCoin Ponzi Scam” engineereddigital.com/onecoinscam.com/tag/ponzi/index.html#plagiarism

@ TimTayshun Thanks for posting the proof that those so-called Education Packages are nothing more than poorly re-written (and stolen) content.

So, OneCoin Promoters like Ken Labine, Tom McMurrain, John Reilly, Kevin Foster, Joseph Piper, Greg Knox, Jason Richard Mangan, Sarah McGee, Stan Harris, Carl Wilt and others are stuck “between a rock and a hard place”

Attention OneCoin Pumpers: If I failed to include you in this most auspicious list, feel free to add your name.

Do they fess-up and acknowledge the truth now, or wait until the end and feign ignorance.

It will be interesting to see who takes advantage of the “first-movers advantage.”

What to do……..what to do?

Hi

Firstly

(Ozedit: Offtopic derail attempts removed)

I download this video above and i need people will know the truth. that it is why i made it public 🙂

Sebastian he was work and programmer on Sitetalk since 2009, then he left and work anotherthing or he join direclty BIGcoin, then he bring Ruja..

Mr. John he saw what they want to do badthing or they want to copy the idea .. I put this video from Juni 2014 i was been there.

my Qestion was How they was on event Juni 2014 then start Onecoin on September 2014 ?

who made this text .. he/she crazy why … write about they look the same. is correct to write about BIGboy and Mc-donalds they are the same.

he / she most write … that they try to copy us . but who will survive ?

he/she not write about that

they have 121miljard Onecoin and no project

we have only 1 milljard and we have 23 project

Best

Wesam Shaya

Because Ignatova and the gang left BigCoin and went on to start their own Ponzi scheme.

More profit that way.

OneCoin copied BigCoin. OneCoin = BigCoin v2.0

Thanks mr. OZ

my another Q is du you have been on both ( Onecoin and BIGcoin) ?

If yes can you write who is best and why ?

if the answer is No so how you can write about something you did know all the truth, cause you will never know all the skill without joining

i can talk.. cause iam on both, cause we have get token from OPN, but i work with BIGcoin almost 3 years ago, everything is going better and better.

also i will use BIGcoin on my salong .. just waiting to my accounter to know better how i will pay tax etc..

/ Wesam

Hello Wesam!

I have a rookie account in Onecoin and I have all the skills to know that it’s a ponzi scam. So how can you claim that it is not a ponzi? Where’s your evidence?

So, Bigcoin is a virtual currency that still can not be used after over three years it has existed? Wow, that’s really amazing.

@Wesam

Both are Ponzi schemes, there is no “best”.

Because understanding a compensation plan has nothing to do with joining a company.

That you are were in OPN and are BigCoin and OneCoin only reveals you are a scammer. It does nothing for your credibility in reviewing their respective business models.

I see the letters BNA throughout this article and other artilce as well, but no one seems to says what it means.. Is it a company? What does it stand for??

Even the title of the article says BigCoin & BNA!!! Thanks for your help! I Appreciate you!

I think they just referred to it as BNA from memory. Not sure if it actually stood for anything in particular.

I have been following this OC ponzi for a while and has surprised me how these crooks have been able to stretch it for so long.

I just have a question. How they were able to recruit a person like newly appointed Pablo Munoz with a seemly career in direct sales companies. Is he blind or what?

Who would jump to a ship just minutes before collision to a huge iceberg?

Hi Vladimir,

about your answer ” I have been following this OC ponzi for a while and has surprised me how these crooks have been able to stretch it for so long.”

actually it is so much different between some one follow and some one who are already on it( joind) as mr OZ wrote.

i told all my friend on europe that it is Onecoin are ponzi cause i meet her Juni 2014.

cause i was member on OPN so i went to one event they told us they will make only 1.000.000.000 or 21.000.000.000 onecoin as i remeber and no more.

Actually i warned my friend, some of them they joined with big package because they saw and search there is many video on youtube etc.

For me i told them she worked to us and on juni 2014 so how she can left and open a new currency after 3 month only?

i was sure 100% that it is ponzi very simple no any one can make copy and they win.

how the price can be the same when we all get dubble coin? imagine 121.000.000.000 onecoin if the price will be 1usd dollar so the currency will worth 121.000.000.000 usd is that possible?

is that right? people who buy big packge they get onecoin less price and who buy small package get so higher?

why the price cost almost 7euro when no one can sell?

all i know them they need to make 10-20 order to be able sell only 1 onecoin now all they are sad.

why not me and i had joind BIGcoin more than 3 years?

There is no justice. people like us who joind OPN since 2012 instead we lanuch IPO 2016. they give us only onecoin who are not worth 10% as we pay when we joind opn 2012

so iam sure Onecoin is finito.

but BIGcoin is different my friend

why you think negative? BIGcoin alomst 4 years with no problem as onecoin they get from the first a few month.

mr OZ , Onecapita and Vladimir what you wrote i see you never join currency like ONecoin or OPN or Leo, BIgcoin otherwise give some prov and not only text..

iam not on gramma but i know what i do and with who i work only text with our prove is nothing.

(Ozedit: Offtopic waffle removed)

@Wesam

So you’re “100% sure” OneCoin is a Ponzi scheme but BigCoin, which is what OneCoin is based off and pretty much uses the same business model, isn’t?

Get out of here…

An Alexa ranking of 3 million plus is not enough to sustain a Ponzi scheme. BigCoin collapsed years ago. You’re late to the party son.

Everything you need to identify a scam is in its business model. You don’t need to join a scam to identify one.

Thanks for replay me OZ.

Firstly Iam not the God to say 100% Iam sure or not, It is my feeling.

Why Caus I have also shares on Sweden

When any company make split the price most be half on the original price

Second

If they told us from the beginning that they will have only 21.000.000 and not more

So how they could change or increase it to 121.000.000.000 Onecoin

To prove my words

Do you think if some told us that Bitcoin it can be Minning to 1.000.000.000 Bitcoin

Do you think the price will be 800$ or it can go down to 0.0006$

Cause How I will trust this currency if the algorithm can be change all times?

On BIGcoin

We starts with 1.000.000.000 and it still only 1.000.000.000

(Ozedit: Offtopic derail attempts removed)

How you feel about BigCoin’s Ponzi business model is neither here nor there. It is what it is.

None of which has anything to do with BigCoin running a Ponzi points scheme.

You’re delving into the cryptocurrency facade. That’s a separate issue on top of the Ponzi scheme backend.

wrong. try again

@whip @wesam – actually, I believe what he means to say is sound in that if (for the sake of simplicity: a “stock”) “splits,” the price (value) should be “halved.”

I’ve been reading a lot of “translated” text in multiple languages and I think his point is that whenever, say, Onecoin tokens split, the value of the coin should decrease, not stay stable, which holds absolute logic, but is still an obscurity of economics in the scenario at hand (ie., Onecoin scam is a convoluted cluster-#$%# to begin with and makes no economic sense at all).

Yes, I agree, that’s how a real stock market works and I also think that @Wesam Shaya tried to explain that.

For me this is new and probably relevant info, so I really want to understand what you mean.

For example, you invested $10,000 in OPN in the past. When OPN joined OneLife/OneCoin, did they give you a OneCoin account for free, with a “value” of (less than) $1,000 (10% of $10,000)?

@MikeR @Wesam- please articulate the amount you “invested” in OPN as/ or BigCoin.

Grin my understanding, you still have credence to BigCoin.

You must have lost money in OPN, BigCoin,SiteTalk, etc. Can you state exactly what5your holdings in each interest are? At this time?

@whip

What you mean ( wrong try again )?

Who you make my words with different color? I am new on behindmlm 🙂

I see @timtayshun he understand me correct. The price of Onecoin was almost 8€ when the total of Onecoin was 21miljard

Why we get Dubbel of Onecoin when they told us it will be 121 miljard Onecoin ?

Logically if my Onecoin on that day cost 7€ … Why people will invest more?

The price will never reach 1€. Why?

Cause if it will cost 1€ the total market will be 121miljard Euro. Do you believe on it??

If Iam old invester why shall I get only Dubbel of Onecoin. And who are new buy big package and he get his Onecoin around 0,7€?

Who buy very basic package it will cost him 8€.

Thanks @MikeR

I wrote with I know and with what it happen with my shares on Sweden. When the price reach 40$ as example.

The do Dubbel of shares and price will be halv. Sometimes as Funger print.

When the price reach 300kr. The dived to 3 and price return to 100kr.

This is good cause people will buy again.

Why? If the price will be 1000$. You can buy only one. But if the price is only 10$ you can buy may be 300 shares.

On Sweden I have a hair dresses salong ,, the kapital of my salong bought shares like Mavshack.

I saw the price was 8kr before. Then before a few weeks the price was 0.24kr.

Here I do not know if the price was down, not good for company or they make split.

However I bought 250.000 shares. Later if I want to repair my salong I can sell them ::-)

you have absolutely no idea what happens in a real business world. and since there is no ‘onecoin’, a split of nothing is nothing.

@MikeR

Ok. We invest around 8000€ with 4 gold package on OPN from the first month on 2012

Instead to get shares on IPO 2016.

We get only Onecoin may be worth 250€, I was not happy at all.

They told us also you need to pay 500€ to active your account and get Dubbel of Onecoin.

So when we paid again 500€ ( cause I did not want to lost my money ) I saw total coin and worth is was less than 600€ !!!

But I invested 8000€ before and 500€ later ,, how mine worth only 600€ and need to wait to 2018 so I can sell it … horrible.

Now there Is a website but no work and you can not sell. Actually I told from before they will not survive.

I have a good eduction on computer so I can good mathematics. Impossible they will reach 1€

So how the price is 7€ now ??? And why if no one can sell.

@MikeR

I saw all who are here are new or they do not know about what they talk or they not work with this currency or mlm at all.

Ok , I am not good on English grammars but I can not say I lost 8000€ on OPN.

Cause I do not know how much I earn or lost on Sitetalk. We are member since December 2009 on Sitetalk.

We have earned and spend but I have learned a lot. So we can not say we lost. The loser is only who invest and not do anything or who not learned.

i can say. Onecoin will not survives.

Also LeoCoin. They give me also free bronze package 550£ on Leocoin but ther was no coin.

They have only education The. They make Leocoin.

OneCoi and Leocoin only try the copy our idea on BIGcoin.

BIGcoin is best for me now. We have more than 4 years with no bad article.

All who wrote they do not know what they talk about. Only they thing so and so like many talk bad about Amway or MaryKey … etc.

We need prov after 4 years we still working good and we can sell not like Onecoin there xcoinx is close for more than 2 month .. why?

about sitetalk. We are on the stock but All member who are invest and not get money or learned are loser

Why? Cause the shares most cost 1.8€ not like now only 0.003€.

Logically if you invest 1000€ is not matter if the price cost 2€ or 0.0004€ if you are lar day pickup more than 1000€. Are you agree ?

I have learned from Sitetalk, Unaico , Opn, Leo and Onecoin.

So I learned so much. While other just write and write

After 4 years on BIGcoin Iam very well and we reach a Rolex Awards

On Sitetalk we have enough of shares,, it they need to focus to build Sitetalk not promote.

Only people for more Ponzi Onecoin. Otherwise our shares will not cost 0.0000001€ on sitetalk.

It can return to 0.5€ if they make faster and more easy to upload pic etc

BIGcoin is best for me now.

Most important is our Founder drive safe and slowly and he have very good experience and most important is my leader who help me to reach this level on BIGcoin

We are legally on Hongkong. If you like to know more and learn you need to join.

Ponzi What It is mean? For me like Onecoin.

Why? Cause it can not work when the total coin is 121 miljard and the price is already 7€. So nverv will reach the 2€.

Others like Leocoin I can not say Ponzi.

It I have feeling it will not works. I never trust the leader like Atif kamran

but BIGcoin.

We have good investor and money is on China and HK not on Egypt and Pakistan. We are legally on HK. We have Goode leader and best Founder.

If I have understood correctly you are from Sweden, or live there?

If you can write in Swedish I recommend writing your message first in Swedish and then putting it through Google Translate. It could make your text easier to understand.

@Whip

With my respect you wrote but it is Zero information!!

I wrote many detailes.

(Ozedit: Offtopic derail attempts removed)

What you understand from what I wrote already?

As I wrote from the beginning Onecoin is nothing. They are Ponzi.

They quite from china then they try to survive by merge with Sitetalk. Sitetalk they could not continue that it is why they accepted to merge with Onecoin.

Now is bad for them both.

We are first opportunity who connect Internet currency with mlm. Others came after us and they tried to copy us. It they not success.

@Wesam

WTF are you rambling on about?

You most definitely got ripped off for thousands of EUR in OPN. Whether you acknowledge that in pursuit of Ponzi riches is irrelevant.

BigCoin is the same Ponzi points model as OneCoin. It’s illegal in Hong Kong.

The “crypto” side of the business is just as dead. Whatever money you’re making is by ripping off gullible Chinese victims into the scheme.

BigCoin never made it big globally, hence it’s small potatoes on regulatory radars.

Thats right OZ.. Wesam is just BLABBING it up.. without the ability to use Google Translate so it makes you wonder his intelligence.

BigCoin and Onecoin are in the same Boat.. A sinking/sunk one!!

“I need more people to join this scam under me so I can get my money back.”

@ Whip.

I dont understand your comment. I was letting Wesam that I cant understand his statements.

Can you explain your response??

Thanks.

you asked if anyone could understand him. I posted my interpretation.

Again a new BigCoin! This time without scams?

Do not the people responsible at Air Asia know that there was already a fraudulent BigCoin?

NOLINK://share-your-photo.com/e3153e2be3

Is Sebastian Greenwood a sex offender too? I found this comment below a video with him presenting BigCoin. I won’t quote the entire text, but it is present in the screenshot.

share-your-photo.com/15a2b5018f

share-your-photo.com/c65a05f28e

youtube.com/watch?v=rjAo4TkP7r4

That’s some dark Ponzi fan-fiction.

The video I mentioned in comment #66 with Karl Sebastian Greenwood as promoter of BigCoin on Wesam Shaya’s channel is no longer listed, but is still available!

ibb.co/yQrN5hZ

youtube.com/watch?v=rjAo4TkP7r4

Here again the comment quoted above under this video, because the portal share-your-photo.com no longer exists:

ibb.co/tCrYWJJ

How much did Sebastian Greenwood pay Wesam Shaya to have the video delisted? The video with Ruja Ignatova on another channel of Wesam Shaya is still listed!

ibb.co/dtpL11R

youtube.com/watch?v=WFPtj8qsItE