DFRF Enterprises RICO lawsuit filed in Massachusetts

Over the past six months I’ve received numerous requests to review DFRF Enterprises.

Over the past six months I’ve received numerous requests to review DFRF Enterprises.

For the most part, these requests have been sent in from readers expressing concerns that friends and family members are investing thousands of dollars with the company.

These are by and large people who already lost large sums of money investing in TelexFree, Wings Network and other scams specifically targeting the Brazilian community in Massachusetts.

Upon perusing the DFRF Enterprises website, I ascertained that the scheme solicits investment from its affiliates, under the guise of asset and wealth management, asset finance, wealth structuring and investment banking.

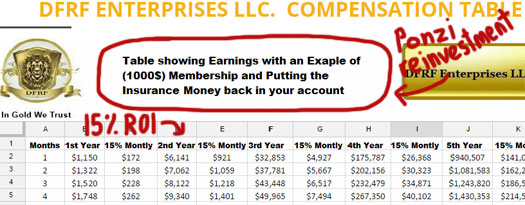

To encourage affiliates to invest funds, DFRF Enterprises openly advertise ROIs of 15% a month:

Quite obviously, DFRF Enterprises are simply shuffling new investor funds to pay off existing investors. Provide enough fluff about legitimate banking services and run a simple Ponzi on the backend.

So why isn’t there a review of DFRF Enterprises on BehindMLM?

Well the problem is the scheme only offers a single-level 10% referral commission. That’s a HYIP (high-yield investment program) and not MLM.

I have a busy enough time trying to keep up with the MLM industry. Expanding that coverage to HYIPs (which, unlike MLM opportunities, are universally scams) would put far too much on my plate.

That and the blog is called BehindMLM for a reason…

In any event, I’m covering a newly filed RICO lawsuit against DFRF Enterprises in an attempt to meet those concerned about the scam halfway.

If for nothing else than to bring greater awareness to those who have previously invested in the well-known Brazilian MLM scams over the past year, who now find themselves involved an even more nefarious scheme.

The lawsuit in question was filed by Evans J. Carter, in the Middlesex Superior Court of Massachusetts.

Carter, a lawyer based in the town of Farmingham, claims DFRF Enterprises is ‘yet another example of Framingham’s growing reputation as “the world headquarters” for pyramid schemes’.

DFRF Enterprises was launched in mid-2014, shortly after the SEC shut down TelexFree.

The scheme is owned and operated by Daniel Fernandes Rojo Filho (right), with the lawsuit alleging

The scheme is owned and operated by Daniel Fernandes Rojo Filho (right), with the lawsuit alleging

Filho has been in trouble before for operating another pyramid scheme in Florida that has since been shut down.

U.S. District Court records show a man with Filho’s name was among the defendants ordered to forfeit dozens of accounts containing millions of dollars, as well as luxury cars and hundreds of gold bars, in connection with a reported Ponzi scheme targeted by federal investigators in Florida in 2009.

Carter is representing two individuals, who claim to have invested $80,000 and $100,000 into DFRF, on the promise of an advertised 15% a month ROI.

In a DFRF promotional video on YouTube, Filho tells viewers they “can participate with a minimum deposit of $10,000”.

Unfortunately their lawsuit appears to have been filed, not because DFRF was a Ponzi scheme, but because they stopped paying Carter’s clients their promised 15% a month ROI.

According to the lawsuit, DFRF promised Carter’s clients, two Gloucester men who put $80,000 and $100,000 each into the company, annual returns of up to 15 percent on their investments.

“But DFRF’s business income was grossly inadequate to satisfy payments promised to members.”

Or in other words, the Ponzi scheme collapsed after affiliate investment slowed down. Whatever token legitimate business activity might have been taking place obviously couldn’t cover the Ponzi liabilities racked up.

The lawsuit alleges DFRF Enterprises took in “tens of millions of dollars” from investors in Massachusetts. It cites ‘nine counts, including fraud, unjust enrichment, civil conspiracy and violation of the federal RICO Act.’

I’d be willing to bet that Carter’s clients had been previously involved in at least one of the Brazlian scams targeting the area this past year. If not TelexFree or Wings Network, then one of the others.

And I’d also be pretty confident in stating they knew exactly what DFRF Enterprises was when they invested…

Does excuse DFRF Enterprises fraud? No, of course not. But it does put a damper on the case.

I mean, if new suckers continued to jump on board and funded Carter’s clients promised 15% ROI, till they were in profit, would they have filed a RICO lawsuit then?

I doubt it.

What we have here is a mess of a community that, for reasons known only unto themselves, continue to plough millions of dollars into scam after scam after scam.

I really don’t know when the Brazilian community of Massachusetts are going to get it. Or maybe they do and just don’t care (unless they don’t get paid, in which case lawsuits like this get filed).

Carter meanwhile seems to be enjoying the business these scams bring to the area, with a Metro West Daily article claiming he ‘also represented alleged victims in’ TelexFree and Wings Network cases.

I’m guessing the idea here, only now that DFRF Enterprises has collapsed and there’s no money left, is to make enough noise to hopefully get regulators on board.

That though might be easier said than done.

Brian McNiff, a spokesman for Secretary of State William Galvin, whose office ordered the shutdowns of TelexFREE and Wings last year, said the office had nothing to say on DFRF on Monday.

Basically you’ve got a community who scam eachother. If Carter’s clients truly wished to know where their money went, it’s likely with their neighbors and/or members of their community who introduced them to the scam.

Obviously the kitty’s run dry or they’d still be getting paid.

Due to the single-level commission structure of DFRF’s business model, this probably isn’t a case I’m going to fall too closely.

My question to the Brazilian community of Massachusetts though is: “What’s it going to take for you to stop investing in all of these obvious scams?”

TelexFree, Wings Network, UniverTeam, GetEasy, iGetMania, iFreeX, VixConcept… the list goes on and on and on. And I’m sure before the year is out we’ll see even more scams surface that Brazilians in Massachusetts can’t wait to invest in fast enough.

Anyway, best of luck to Carter and his clients with their lawsuit. By the time a Ponzi scheme collapses your money is long-gone but if the Filho is still in Massachusetts, perhaps you might get some answers at least.

Update 25th May 2015 – On April 29th Plaintiffs Jose Silva and Carlos Santos filed a Notice of Voluntary Dismissal. Why the case was dropped is mystery.

this is the standard ‘no comment’ response govt offices/agencies give. they cannot disclose any investigation.

but, if the DFRF scam is all over the local media, i’m sure it will result in an investigation, if one is not already underway.

the amounts people have invested, are quite large, to make it a serious matter.

why is RICO being used instead of ponzi allegations?

-RICO [Racketeer Influenced and Corrupt Organizations Act], targets ‘organised crime’, where there are not just one or two perpetrators, but all the people who assisted also are included as defendants.

therefore, in this class action of two DFRF members we see that the defendants are listed as:

– securities fraud [ponzi], also falls under the ambit of RICO.

– since filho had previously been indicted for a pyramid scheme in 2009, and since a person who has committed “at least two acts of racketeering activity, within ten years” can attract RICO, this is a fit case for RICO

– RICO is apparently easier to prove, as it is based on ‘behavioral patterns’ rather than ‘criminal acts’ [dint exactly get this!]

– RICO brings a heavy duty 20 year sentence.

eg: Scott W. Rothstein, who ran a 1.2 billion ponzi scheme, was charged with RICO, and was sentenced in 2010, to 50 years [!!] in prison.

The lawsuit in question was filed by Evans J. Carter in the Middlesex Superior Court of Massachusetts. Its civil.

RICO is difficult to prove civilly but offsetting that is the prospect of the plaintiff(s) being awarded punitive as well as treble actual damages. Very likely Evans J. Carter took this on a contingency fee basis.

Criminal RICO is difficult to prosecute as well depending as it does on organizational “patterns of behavior.”

IF the State acts at all in this situation its far more likely Filho will be charged with wire/mail fraud, etc. like all the other two bit scammers out there. (much simpler prosecution)

maybe caselaw shows RICO is difficult to prove, but here’s what wiki says:

RICO application on ponzi schemes, seems to be the flavor of the season in massachusetts.

a class action under RICO is currently ongoing in the 5 million ‘cabot ponzi scheme’, in which the wells fargo bank and US bank are named as defendants.

Secretary of State, William Galvin, has concurrently filed a civil case, for securities fraud, against the ‘cabot ponzi scheme’

so as the DFRF case develops, we can expect to see state action, alongside the class action.

we see that, payment processors are very readily blamed, for not being vigilant. but because banks are ‘respectable’ institutions, people are averse to blaming them, for greed and negligence.

if one or two banks get a heavy kick, half the bank based ponzi’s will disappear too.

we should be equally cruel to both banks and payment processors.

Not what I hear….

The combined effect of compulsory Suspicious Activity Reports and the Bank Secrecy Act means we (the public) will never know how many ponzis HAVE been reported and how many prosecutions have been initiated because of the authorities being made aware by the banks automatic filing of SARs

It should be noted it can take upward of six months for a financial institutions’ SAR/S making it through the system and becoming a full blown investigation, which means, in terms of the average pseudo MLM / get-rich-quick or HYIP ponzi scheme, they can be long gone along with the money before prosecutors come knocking.

these numbers are damning, and beg the question, that why two current ponzi class actions,in massachusetts, have been filed under RICO? do those lawyers know something, we don’t?

going back in history, the ninth circuit court, in omnitrition, had found sufficient cause for RICO to be invoked . but that case never went to its logical end, so who knows what may have happened?

the general complaint against RICO, is that it is vague, and difficult to tie up. well, we have two live cases to watch now!

thanx for the info, and relative to the cabot and DFRF ponzi’s, the banks who have been named as co defendants under RICO, can just show their SAR’s reports to the judge, and go home free.

Its not clear what the wiki article is getting at, because private civil suits alleging RICO violations (like the one brought by the Carter plaintiffs) are by no means “easy to prove in court.”

Filho denies all charges.

framingham.wickedlocal.com/article/20150225/NEWS/150227531

Who said anything about MLM? This was a single-level Ponzi scheme from the get-go.

Complete with the usual Ponzi smoke and mirrors:

So uh… maybe someone can ask Filho why DFRF has taken thousands of dollars from investors and is apparently now struggling to pay them advertised ROIs?

Yeah, but you were still guilty of running a scam. Innocent people don’t ‘forfeit dozens of accounts containing millions of dollars, as well as luxury cars and hundreds of gold bars‘ to regulatory agencies.

This guy’s obviously full of shit. Sounds like regulators need to bring down the hammer on him again.

huahuahua Are you surprised with that? So far, I only can say… There more … just read me.. there’s more. We are contacting some important people about this issue and we can say for sure. There’s more. Daniel = Jail if justice really work for scammers and liars!!

who are those 75 john does, who have been named defendants in the RICO class action.

maybe they were agents who were getting commissions for bringing investors in, and hence formed the single level ponzi scheme commissions? you know, like a sales team which works purely on commissions, and not any salary basis.

not at all. i don’t know what it is with ponzi/pyramid scamsters and ‘mines’, but they always seem to be invested in gold, marble, coal, diamond, bitcoin, mines!

I’d say upline affiliate leaders. The Brazilian community in Massachusetts who keep participating in these scams one after another must be pretty familiar with eachother by now.

Below the fifth paragraph in the story above, Oz shows a DFRF graphic.

An affidavit filed by a Task Force investigator in the Evolution Market Group/Finanzas Forex case in 2010 shows a flow chart on EMG/Finanzas that is similar to what DFRF is publishing now.

Find the affidavit here — and see Page 7. Some folks may want to read the entire document:

NOLINK: emg-ffxremission.com/hc/en-us/articles/201546804-Affidavit

I’ll note that members of the same Task Force that took down the $119 million AdSurfDaily Ponzi scheme in 2008 also took down EMG/Finanzas. The lead investigator in the ASD case had experience in narcotics investigations.

I’ll also note that some of the EMG/Finanzas cash was tied to a narcotics investigation and that person ASD members said was supplying debit cards to ASD is listed by INTERPOL as a fugitive implicated in a money-laundering scheme involving the offloading of drug profits at ATMs in Medellin, Colombia.

EMG/Finanzas was an almost unbelievably insidious scheme, with members effectively told they had to steal their way out of the “program.” They also were told the “program” helped provide money to kidnapping victims.

Finally, I’d note that at least one investigator assigned to the TelexFree case has experience in narcotics investigations. It’s the sort of experience that can be valuable when large sums of money are directed at a scheme that may have created black markets and conduits through which larges sums of money could be laundered.

One thing EMG/Finanzas, DRFF and TelexFree all have in common is a nexus that involves the New England region and the region of Orlando, Fla.

Robert Hodgins, the reported debit-card supplier to ASD, was indicted in Connecticut (New England region) and once reportedly attended as ASD event in the Orlando region.

For a while, a mysterious figure identified as “Juan Hernandez” became a purported executive at ASD. Like Andy Bowdoin, “Juan” took the 5th.

Unlike Andy Bowdoin, “Juan” appears to have disappeared.

PPBlog

Where? The gold mine they claim it’s not operational and Accedium Insurance had problems in Malta -> they 100% granted return lol ponzi. We looking for it

of course it wont be operational! if there was any truth in filho’s statement that DFRF, was invested in mines or gold reserves, he would have plonked the papers down before the press.

i challenge him to make this argument, in DFRF’s reply to the class action suit. or he can just try saying this to the secretary of state galvin, and see where it gets him !

Ah. I wonder the day to see that. Same old scam, youtube videos, pdf, and papers. Things is, this scam is well done, much beyond geteasy Tiago jerka*****.

5 years 337.747% (wft roi!!!) <- this is not a joke this is trolling with stupid pyramid members.

Oz and PP, Do you have any email?

I have some news about DFRF but I preffer to share in private.

This website has a “Contact” button in the upper right corner.

PPblog seems to have a similar system in the top menu.

Update – March 5, 2015 – Silva et al v. DFRF Enterprises, LLC et al, not sure about the entire case but here goes.

pacermonitor.com/public/case/7700938/Silva_et_al_v_DFRF_Enterprises,_LLC_et_al

Had a look on Pacer, the original complaint filed by Jose Silver and Carlos Santos is attached as an exhibit (#1) in the first doc on the docket. It’s 85 pages long and was filed back in January.

Looking at the description of it in the bank’s request to be removed from the case, a bunch of DFRF investors (likely ex-TelexFree investors) are upset the scheme collapsed and are trying to get a class-action lawsuit going for $10 mill.

Filho is named as a defendant, along with 16 other named defendants and 75 John Does.

Can’t say I have any sympathy for them. How moronic do you have to be to keep jumping on board the Brazilian/Portuguese Ponzi schemes?

Anyway, they’re trying to sue the banks too which, if the banks are to be believed, isn’t going to work due civil procedure rules.

I’d much rather see Filho pursued by regulators, as this class-action reeks of “Waah we didn’t get to rip off people who joined after us, give us our money back!”.

aw, how will non pacer people see the docs. can people with access to pacer publish these docs?

good morning everyone. I personally can say know the ceo of dfrf personally and I shared with him and I feel a serious and honest perso.

I have also seen signs that say 15 % and that is not desert is up to 15%. Thank you and blessing.

“Serious and honest” people don’t run Ponzi schemes.

Regardless of what you’ve seen, DFRF is being advertised as a 15% a month ROI Ponzi scheme. You invest and are then paid out of subsequently invested funds.

Oz You are awesome!

I’m one of the people who contacted you about this with concerns for friends. They are quikting jobs to “work” ft with this!!!

You are correct, most participated I Telexfree, but left with other suckers money. I think the idea is, “if I get out early who cares!”

I’m getting to know some “friends” better now.

Thank you for getting out of the way to research. I enjoy your blog very much.

Please keep updating to avoid any error again like with Finanzas Forez.

There are several misrepresentations by the purported ANJALI, et al.

As many of you know, we predicted the collapse of Telexfree and declared the fund would be dry by mid-May 2014. They filed Chapt 11 and had about one month left in the accounts.

We have investigated DFRF, Inc and would first note that DFRF Daniel has never been charged with running ANY PONZI SCHEME, rather he accepted funds with a gentleman from Portugal that were purportedly laundered money for a drug cartel…and he won the case!!!

To charge another in an open forum with unsupported allegations of criminal activity can make the FALSE ACCUSER liable for Defamation Per Se.

If one thinks they can evade by using acronyms, believe me, the owner of the site can be forced to produce tracking information via subpoena deuces teacum and give the damaged party opportunity to sue the accuser for damages…and then pursue the party for decades to recover damages.

I would recommend that ANJALI, et al, seriously consider the consequences and report accurate and documented allegations only!!!

Billionaires can chase you a very long time to recover damages!!! And I would recommend it as there is simply way too much “false witness” allegations published as if they are fact!!!

one more time: there is a lot misinformation here. Oz the west way to do is go straight to the information.

Miley awesome, I don’t think so?

OZ do you have something to offer me (Ozedit: No, I don’t. Offtopic derail attempts removed.)

Filho had a Ponzi scheme lawsuit filed against him and didn’t “win” anything.

justice.gov/sites/default/files/usao-mdfl/legacy/2011/09/04/EMG%20amended%20complaint.pdf

Assets were frozen and seized. They settled and Filho had to return the money he stole from victims.

And what does waffling on in support of scammers and denying reality make someone?

Oh right, a moron.

Daniel Filho is a serial scammer and has a recorded history of operating a pyramid scheme. Now he’s back with a Ponzi scheme.

Facts are facts.

Done and done. 15% monthly ROIs from an admin with a prior history of being involved in Ponzi/pyramid schemes?

Scam.

upload the documents that show which mines DFRF has invested in, showing clearly how it generates enough income from there, to pay investors in DFRF, 15% returns per month.

don’t just come with empty threats, everybody knows the law, show proof that DFRF is NOT a ponzi, or SCRAM.

Read docs under #1

archive.org/2/items/gov.uscourts.mad.168113/gov.uscourts.mad.168113.docket.html

daniel uses documents that do not belong to them. he did not pay for mining rights in Brazil and nowhere in the world.

he took possession of documents when making purchase agreement of mineral rights Camarinhas (gold mine in Brazil). But he did not pay. the contract was not fulfilled.

He will be charged very soon so as well. He used the project, the mineral rights, as it were, fraudulently, to leverage money to the insurance company, which is a fraud too.

Has anyone noticed the Rico claim in Boston has been dismissed???

Anjali, We will be compiling real data for all of us to analyze. It is a year now and he must produce Prospectus as a baseline for the public offering process.

Let’s get these public documents and analyze them.

I do know that at 9.3 tons processed monthly in 4 different processing centers with production costs from $745/troy oz to $860/troy oz the numbers made sense six months ago.

As soon as we have compiled them I will share them, win, lose or draw!!! You can accept, reject or question the same. GAJ

Any new updates on dfr? I heard he went to court 1/11/16.

As per the case docket (January 8th, 2016):

today is 6/25/16 there have been court dates in last few months for dfrf enterprises. have you heard of the outcome of these hearings.

I understand billions were confiscated when Daniel was arrested and nobody knows what became of the money, also Daniel doesn’t want to be released from prison because of his safety. is any of this true? please answer.

@geraldo

You can keep up to date here – https://behindmlm.com/category/companies/dfrf-enterprises/

Next date is a pretrial conference on June 29th.

Filho requested not to be released from prison (protective custody or some such from memory). Why hasn’t officially been explained.

Dunno about the billions seized, DFRF didn’t get that big.