BitConnect abandon US affiliates, BitConnectX ICO blocked

The next phase of revenue generation for the BitConnectX Ponzi scheme was to launch BitConnectX as an ICO.

The next phase of revenue generation for the BitConnectX Ponzi scheme was to launch BitConnectX as an ICO.

Making absolutely no sense considering BitConnect already operates the BCC cryptocurrency, BitConnectX is widely seen as a last-ditch cash grab.

Gullible affiliates are buying it though, with most investors willing to ignore warning signs and invest anyway.

An unexpected spanner in the works for the BitConnectX launch was the Texas Securities Board emergency cease and desist last week.

So far BitConnect has shown no interest in registering itself with US securities regulators, which would require the company to disclose evidence of external ROI revenue.

Instead BitConnect has stopped investment from Texas-based affiliates, although as far as I’m aware they’re still receiving daily ROI payouts (for now).

BitConnectX was scheduled to launch earlier today, with the company since delaying the launch timer featured on the BitConnectX website.

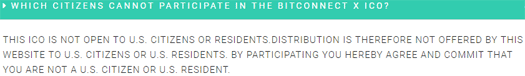

A FAQ for the ICO reveals that in the wake of the Texas cease and desist and likelihood of an SEC investigation, US residents are prohibited from investing in BitConnectX.

This is the strongest indication yet that BitConnect are operating fraudulently.

ICOs are not illegal in the US, however companies offering attached passive investment opportunities must register with the SEC in order to make the offering legal.

BitConnectX’s abrupt announcement is likely to dampen US investment into BitConnect vanilla. In the wake of the Texas cease and desist, many US BitConnect affiliates were looking toward BitConnectX as a sign that the company would continue to operate normally.

At the time of publication the US is easily the biggest source of traffic to both the BitConnect (20%) and BitConnectX (22%) websites.

There is also speculation that while BitConnect are advertising acceptance of BCC to invest in BitConnectX, that this will be short-lived – once again requiring affiliates to invest new bitcoin and litecoin to keep the scheme going.

Now with the US banned from investing in BitConnectX, the question is how much longer will US affiliates be able to invest and receive payments in BitConnect vanilla?

Since the Texas cease and desist the value of BCC has steadily declined. Seeing as upwards of 90% of BCC trading is done through the company’s internal exchange, typically when this happens BitConnect manipulate the price by suspending sell orders and injecting invested funds back into the exchange (internal buying).

This can be observed by sudden spikes in value on BCC charts. Strangely enough though this has yet to happen since the Texas cease and desist.

BCC’s current value is $350, down from $425 when the cease and desist was issued last Friday.

BitConnect are hoping to flog BCCX points to gullible investors for $5 each.

Hello OZ,

What are your sources for this information? I don’t see that on the bitconnectx website. Also where did you hear BCCX points would be $5 each? Sources please. Thanks.

BitConnectX FAQ: bitconnectx.co/faqs

Wow, you’re an idiot. Bitconnect declined because Bitcoin declined LMAO!

Their curves follow each other, because BCC is traded against BTC. This author is a moron.

No they don’t:

Stop watching garbage YouTube shill videos.

Bartholomew, looks like there is one moron in this chat, but it doesn’t appear to be the author. Sucks when you’re proved to be wrong eh?

I’ve funded several projects with residual income from BCC as recently as yesterday.

Have you or anyone you know been ripped off by your speculation? Not trying to get into a web battle I’m just asking…

Not sure what you’re getting at.

You boasting about personally stealing from BitConnect investors who joined after you doesn’t change the fact the company operates as a Ponzi scheme.

Lololol. Now BitConnect want $50 per BCCX point:

Totally not relying on BCCX investment to prolong BitConnect’s collapse.

Damn bro, I’m taking a risk like everyone else and you accuse me of stealing?? (Ozedit: Yep, because that’s what happens in a Ponzi scheme. If you want to rage against the government do it elsewhere.)

@JangoFett

Not interested in the “ebil gubmint somethingsomething so that justifies me stealing from people in a Ponzi scheme” defense.

Man up and own your thievery.

Its not a Ponzi scheme. 1 year later and counting, no one scammed etc.

I think you should put a tiny amount on the platform to test out your “Ponzi” allegation, give it 3-6 months then come back with a comment. I actually dare you.

(Ozedit: Offtopic derail attempts removed)

Whether a Ponzi scheme pays you or not is neither here nor there. All Ponzi schemes pay out as long as new investors sign up and invest.

By the time a Ponzi scheme stops paying out it’s too late and you’ve lost your money.

Just because you’re comfortable with a fraudulent business model that sees you steal from people who join after you, don’t assume everyone else is.

the only reason you are here is because it IS a scam. you need to defend it with the hope of getting your money back. it’s the only reason any of you scammers need to come here.

If it was legit, it would stand on it’s own like a real business.

How does putting money in an alleged Ponzi prove or disprove it either way?

Is that like catching a cold makes one a “cold expert”?

Your logic appears to be severely impaired by existing Ponzi-speak.

This is not a ponzi scheme at all. I invested and have been receiving my payouts as promised.

I do not promote Bitconnect and I have no affiliates under me. The government always has to have their hands in our pockets and that is what the Texas cease and desist order is all about. And probably all states will follow Texas eventually.

A new currency and a new way for our government to get their share of it, that is the story.

People have invested, paid off their mortgages, quit their jobs and Paid their kids tuition in college.

We all know the risks and I think it should be up to us to decide if we want to take those risks. (Ozedit: Offtopic derail attempts removed)

I have no doubt those who invested to Charles Ponzi’s scheme and got returns were very certain that it was not a scam. They probably were sure of it!

And still it was a scam.

@Unreal

Whether you’re personally successful in stealing money from people who joined after you or not doesn’t change the fact BitConnect is a Ponzi scheme.

Whether you personally recruit the people you steal from or not doesn’t change the fact that you’re stealing from those who join BitConnect after you.

False, the Texas cease and desist pertains to BitConnect being engaged in securities fraud.

1. You cannot possibly speak for every BitConnect investor

2. Acknowledging you’re participating in a Ponzi scheme or not (which you don’t, so it’s a moot point), doesn’t justify financial fraud.

It’s amazing how many people do not understand what a Ponzi is. Please, people…Just Google it! Just because some of you are making money does not mean it is NOT a Ponzi scheme.

All that means is that you are collecting money that was ill-obtained through fraud, whether you realize this or not.

And that’s also how Ponzi’s work by definition: by paying earlier “investors” with money obtained from later “investors”.

Ponzis always pay people at first, but then it eventually collapses as the scheme runs out of money to pay everyone. Bernie Maddoff was able to do this for decades before his collapsed.

A real look at the numbers by Harry Markopolos (a financial fraud investigator), something no one did at the time, revealed that Bernie was indeed running a Ponzi scheme. This, even though his investors thought everything was fine because they were receiving regular statements showing that they made profits.

Hope that helps those of you who think nothing is wrong just because you got paid or are getting paid. You will see the truth soon enough, just like Maddoff’s “investors” learned the hard way as well.

Isn’t a Ponzi Scheme where someone takes investors’ money and pays out other investors?

As a BitConnect participant, when I make an investment, I can see the blockchain (which is a secure decentralized process) confirm that the money I have invested is in my wallet. If my money is never deducted (to pay off other investors), where is the “Ponzi” money coming from?

It comes from trading profit and seed capital raised by the sale and increase in the value of BCC. They don’t need our money to pay off other investors. Know too, that arbitrage, etc trading, if done well, can be very lucrative – especially if you have high amounts of capital.

(Ozedit: Offtopic derail attempts removed)

Yep.

Investing money in BitConnect isn’t the Ponzi scheme. You enter the Ponzi scheme when you park BCC with BitConnect and start collecting a ROI.

Don’t be a dumbass.

Please provide proof of your claims. BitConnect don’t, so good luck with that.

You’re not very descriptive when you say “park” BCC. Are you talking about the lending platform? Staking? Are you sure you understand how arbitrage trading works?

I don’t need to provide anything.. (Ozedit: Yeah, you do. Offtopic waffle removed.)

Of course I am. You park your BCC points with BitConnect and they use newly invested funds to pay you a ROI. Ponzi all the way.

Yup. What does that have to do with BitConnect though?

If you want to crap on about BitConnect’s external revenue, you’ll need to provide evidence.

You and I know both know there isn’t any. Ponzi all the way.

Arbitrage, exactly same excuse Charles Ponzi used in his scam.

Now for the digital age. Tsk, tsk, tsk. Ponzi pimps recycle old scams, albeit now with cryptocurrencies instead of international reply coupons.

And you naive sheeple eat it up all the same.

Those of you saying Bitconnect is a ponzi scheme should present evidence to convince us.

I am hesitant of putting bigger amount in Bitconnect because I make more than what Bitconnect pays each day when I trade myself.

If they actually trade, making 30% a month will not be a big deal with such high capital. However, if the prices consistently increase, they would need more capital to keep returning higher gain not necessarily to pay former investors. This is because the money they pay you is actually your appreciating asset.

Those who shout ponzi should produce evidence. Otherwise, you had better keep your mouth shut.

Couldn’t care less about convincing you, but the evidence requested is zero evidence of BitConnect’s bot existing.

BitConnect claim they’re using some bot to generate ROI revenue, the onus is on them to provide evidence of the claim. You can’t otherwise prove a negative.

There’s only one reason BitConnect has failed to provide evidence of external ROI revenue since it launched over a year ago; because it’s a Ponzi scheme.

You of course already know this, so stop making excuses for financial fraud.

Assuming that it’s a ponzi without evidence doesn’t help anything. It could be a ponzi but don’t act like you know because you don’t.

The evidence is BitConnect failing to provide evidence of external revenue to pay affiliate ROIs for almost a year. BitConnect as a company claim to have a trading bot, they need to provide evidence it exists.

Failure to register the BitConnect securities offering with regulators in their largest market is also evidence of BitConnect engaging in financial fraud.

If you have to ask people to prove a negative to defend your Ponzi scheme, you’ve already lost.

Ponzi or pyramid, it’s fraud until it proves otherwise.

“IT” being the entity which is dealing with the general public without the required registration or proof of its’ claims.

Today’s Crypto Platform Dear John Letter comes from Bitconnect:

There are unconfirmed social media reports of bitconnect’s website not currently being available.

Paid out balances in BCC … price is plumetting . Brings whole new method to exiting.

What a crazy crash. Next usi-tech will pay out in tech coins lol.

Wow.. BCC is at 35 dollars . down 85% last 24 and over 90% of what they valued the coin for those getting anything n return…

WOWSIE!!

Kaboom!

Behold the sustainability of ponzi point altcoins:

BitConnect (BCC) $31.63 USD (-87.65%)

coinmarketcap.com/currencies/bitconnect/

21$ Now. So fast.

But but but guys, they fully refunded everyone. So if you “lent” them $1000 you get 3 BCC – which is worth $60?

Surely we will see a class action lawsuit in the coming weeks?

Against whom ???

A phony company with a virtual address in the UK ???

Really? People paid into such a dodgy company? Incredible.

I had doubts about BCC. I trusted a friend and did not do my own research, got influenced by the mob rule and desperate need to get some extra cash to pay off debt, I invested my tax savings.

I used Fiat currency, bought BiTCoin exchanged it for BCC and lent it.

Without warning, I wake up to find the value of my lend in my BCC Wallet not in the BTC or $US Lend wallet. My heart sank.

They had given me back my investment in a coin that had no value except to trade against the BTC on their exchange, which was down. Who was buying BCC, no one.

If the people behind BitConnect had any balls, they would have given back the BitCoin or the equivalent in $US to withdraw. That would have the most honest and honourable thing to do.

However, with a 24 hour clock and international investors lending. When the decision was made, more than half the people were asleep only to wake to find the $360 per coin worth $20 on the other exchanges if .. you could withdraw.

It took me 14 hours to get my BCC off the site and into another exchange which by that time I had lost all and still owe my tax man.

My fault, I did it. I am responsible. Live and learn.

The Dark World that wants to screw the authorities, need the authorities when there is no justice in the dark world of crypto.

However I do believe that who ever is behind BitConnect and BitConnectX, they have no heart or soul for their lenders and traders and only for their own well hidden bank vaults.

Remember, Karma is a bitch when it bites. They will fail. What goes around comes around. Believe me, I have experienced.